This first analysis nevertheless enables us to identify some major trends, based on a set of accounts whose turnover is equivalent on average to 76% of that of the companies whose accounts were collected by the Banque de France in 2019. In total, the companies surveyed count 9.4 million employees.

The vast majority of companies have maintained their cash position at the cost of increased debt

Between the end of December 2019 and the end of March 2021, non-financial corporations’ gross debt rose by EUR 224 billion, and their cash position by EUR 215 billion. Their net debt therefore increased by only EUR 9 billion. However, these aggregate data do not enable us to specify how the changes in debt and cash position are broken down between companies.

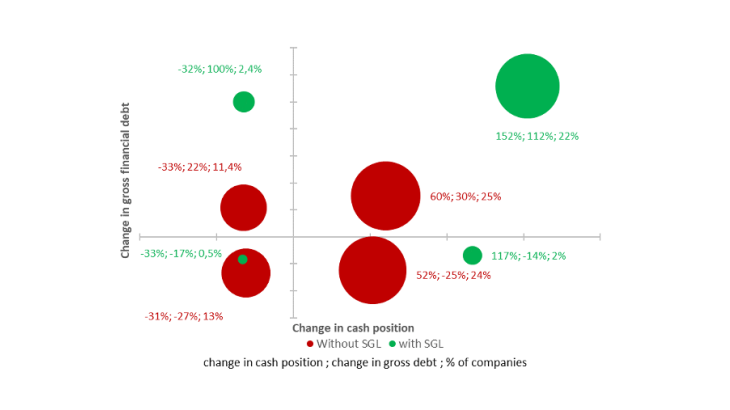

De facto, thanks to debt financing, facilitated by the State-guaranteed loan (SGL) scheme, a majority of companies have been able to maintain or improve their cash position despite declining sales: for 73% of the companies studied, their cash position has remained stable or increased (Chart 1). The SGL scheme has largely contributed to this situation: 27% of the companies surveyed have used it. These companies are both more likely to show a stable or increasing cash position (over 89%) and to record a greater increase in their cash position than those that have not had recourse to this scheme.

Deferred tax and social security debt is not included in the financial debt studied here, although it can be spread out over several years under the exceptional settlement plan scheme. Indeed, not only is it difficult to isolate precisely in the balance sheet, but also including it would not alter the conclusions. Thus, the medium-term financial debt of the companies studied represents an average of 6.1 years of cash flow on the basis of the balance sheets impacted by the crisis, i.e. a 6-month increase compared to the balance sheets published before the crisis; if we add the tax and social security debt registered in the 2019 and 2020 balance sheets, the increase in debt expressed in terms of the number of months of cash flow is the same: + 6 months.

The rating system to identify potentially vulnerable but economically viable companies

Despite this increase in the cash position of most companies, 14% of the companies studied record both a rise in debt and a decrease in their cash position: they are in the "sensitive" quadrant, in the upper left-hand corner of Chart 1.

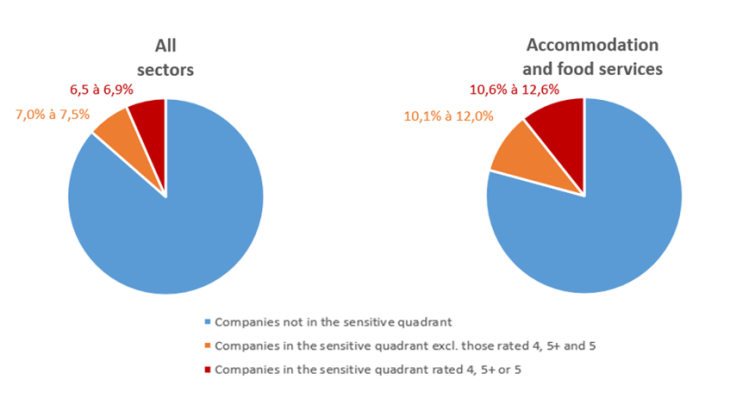

These companies should therefore be closely monitored, sector by sector, even if the approach should nevertheless be qualified: on the one hand, some companies in the other quadrants may require close monitoring; on the other, some companies in this quadrant may be in good financial health. Thanks to the Banque de France rating system, it is possible to identify potentially vulnerable but economically viable companies in the "sensitive" quadrant, which could face difficulties when the government support measures are lifted.

After excluding the best-rated companies before the crisis (3++ to 4+), i.e. those which were in a sufficiently favourable situation to cope with the shock, and the worst-rated companies (6 to P), i.e. the very fragile ones even before the crisis, we estimate that around 6 to 7% of rated companies will need to be closely monitored. This proportion is higher in certain sectors; it reaches 10 to 13% in the accommodation and food services sector, which is logically the most impacted by the crisis (Chart 3).