- Home

- Publications et statistiques

- Publications

- Crypto-assets: 2022 confirmed already id...

Post n°310. In 2022, the crypto-asset market underwent a sharp fall in valuation. After previously attracting a number of retail investors who were searching for high yields in 2021, the market revealed its instability. The expansion and high volatility of the crypto-asset market has resulted in greater risks and losses for crypto players and investors alike.

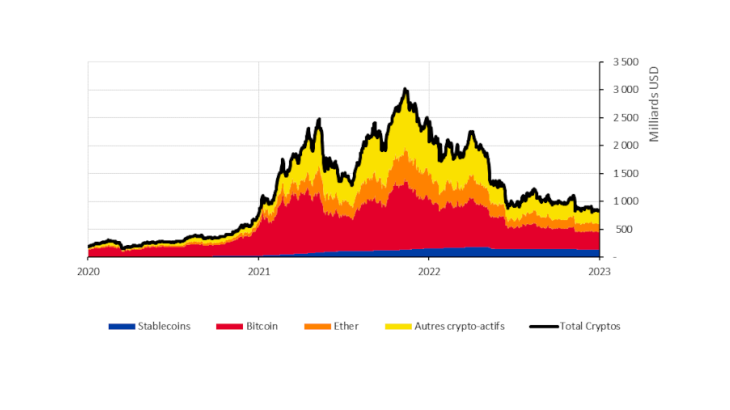

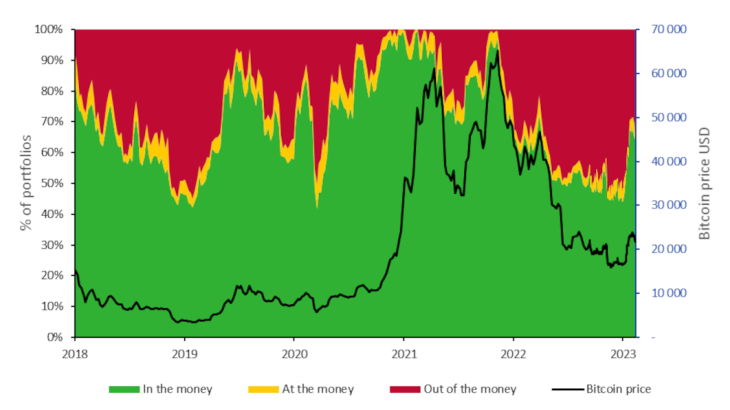

Crypto-assets hit a peak market valuation of USD 2,933 billion in 2021 before suffering a 60% drop in 2022. Bitcoin, the leading crypto-asset, lost 66% of its value over the year resulting in major unrealised and realised losses for 50% of its investors at the end of 2022 (Chart 2). Crypto-assets include unbacked assets such as Bitcoin and Ether, “stablecoins" such as Tether and USDCoin, digital securities referred to as NFTs and crypto-based derivatives. During 2022, the estimated market capitalisation of stablecoins remained relatively stable, meaning that their share of the crypto-asset market rose sharply from 7% to almost 20% over the same period.

Notes: Data as of 12 February 2023. Whether it is "in the money" (an unrealised gain) or "out of the money" (an unrealised loss) can be determined based on a bitcoin’s purchase price and current price.

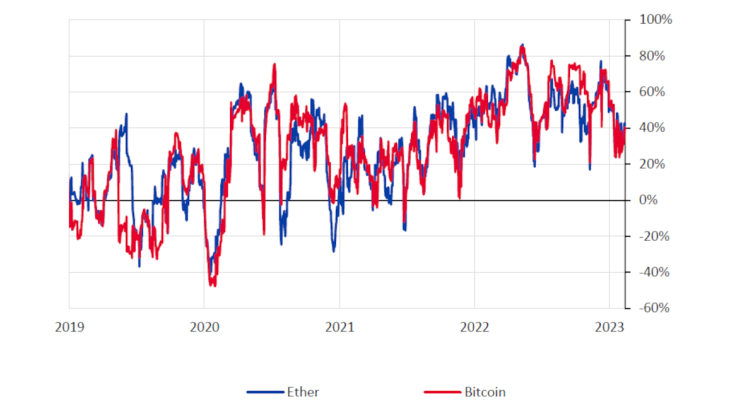

A number of factors were behind the slump in the market. Rising interest rates reduced the attractiveness of crypto-assets, as they had previously been buoyed by investors searching for higher yield. Also, as crypto-assets were initially presented as being uncorrelated with traditional financial markets, they attracted certain investors looking to diversify their portfolios. However, the correlation between crypto-assets and the main US equity indices (Nasdaq, S&P500) has increased significantly since March 2022, reaching a peak of 85% in May 2022 (Chart 3). This is mainly due to the growing participation of institutional investors in the market (BCE, 2022) and a strong correlation with the share price of technology companies such as Tesla and MicroStrategy that invest in and influence the crypto ecosystem.

Lastly, bankruptcies during the year and cyber-incidents on crypto platforms, which have increased fourfold since 2020 (Crystal Blockchain), have compounded the loss of investor confidence, leading to a gradual withdrawal of investments from online trading platforms.

A highly interconnected market

The dramatic collapses of 2022 exposed the complex interconnections within the crypto ecosystem and the lack of transparency and control of crypto players. The risks associated with the sector have increased in parallel with the growing number of players and the escalating complexity of the services, which include not only investments in crypto-assets but also lending services and leveraged products. Some trading platforms offer crypto-derivatives for speculative purposes with a leverage of over 100:1 (BCE, 2022).

The crypto-asset ecosystem is highly interconnected. A reduction in the price of a crypto-asset can create a domino effect that immediately impacts several market players. The collapse of Terra and stETH (an Ether-derived asset) directly affected the specialised hedge fund Three Arrows Capital, which had taken directional positions in these crypto-assets. Three Arrows Capital defaulted on debts owed to 27 companies including the Celsius and Voyager Digital platforms, which subsequently filed for bankruptcy in July 2022.

In a case of market manipulation, the algorithmic stablecoin Terra lost its US dollar peg in May 2022. This resulted in the collapse of the entire Terra ecosystem, which represented more than USD 70 billion, and prompted a 30% fall in the total crypto-asset market valuation and a brief de-peg between Tether and the US dollar.

The collapse of the FTX platform in November 2022 deepened the decline in the crypto-asset market, which lost more than 20% of its market valuation in two days. FTX Trading Ltd. played several roles on the crypto-asset market, as both a trading platform and issuer of its own unbacked crypto-asset, FTT. It formed part of a conglomerate of companies including a crypto-asset hedge fund called Alameda Research. At the beginning of November 2022, specialised media reports revealed that Alameda Research fund held 73% of FTT reserves, which prompted the CEO of Binance, a competing platform, to publicly announce the sale of all its FTT tokens due to their illiquidity. This announcement preceded the collapse of FTT and the halt of crypto-withdrawals by the FTX platform. Following the revelation of its financial position, FTX Trading Ltd., the company that comprised FTX US and Alameda Research, filed for bankruptcy. The bankruptcy spilled over onto other sector players, such as the BlockFi platform, which also filed for bankruptcy on 28 November 2022, after borrowing USD 275 million from FTX in the form of FTT. However, these phenomena did not spread to the traditional financial system due to the modest market size and weak interconnections between traditional financial players and the crypto-asset ecosystem.

Terra’s case illustrates the lack of transparency of players and the interconnections within the market. As an algorithmic stablecoin, Terra was by construction more fragile than stablecoins backed by fiat currency reserves. Nevertheless, the lack of transparency and the absence of auditing of stablecoin reserves leave them open to liquidity risk and a loss of confidence in the purported peg to a fiat currency. Even though the shocks of 2022 did not spread to the rest of the economy, they did confirm the need for an appropriate regulatory framework to protect investors from the potential collapse of market players such as trading platforms. As early as 2013, the Banque de France was alerting investors to the inherent risks of crypto-assets and trading platforms (Banque de France, 2013).

An evolving regulatory framework to protect investors

The current framework is inadequate even though some conduct have already been sanctioned. Several institutions in different jurisdictions are pushing for rules to be implemented to regulate the sector. As of 2019, France required digital asset service providers to register with the AMF (the French financial markets authority) to conduct their business activities. At European Union (EU) level, the Markets in Crypto-Assets (MiCA) regulation, which is scheduled to come into force in 2024, will protect investors by providing a framework for the market which will make platforms responsible for asset losses. Industry participants will have to get an operating licence in order to offer their services in the EU. In September 2022, the United States published a roadmap for future crypto-asset market regulation intended to protect investors and oversee the market and its main players. The Financial Stability Board has concluded that cooperation between jurisdictions is needed to supervise the crypto-asset market and, at the end of 2022, the Basel Committee issued a standard governing banks' crypto-asset exposures (BRI, 2022).

Updated on the 25th of July 2024