From short term interest rates to long term interest rates

In a context of conventional monetary policy, central banks raise (lower) their key rates to curb (stimulate) aggregate demand in order to reach their price stability objective.

However, in practice, aggregate demand is rather sensitive to long-term interest rates since companies and households tend to go into debt over the long term to finance their investment spending. But while central banks only control (very) short-term interest rates, they can indirectly influence interest rates of longer maturities. Indeed, long-term interest rates depend on agents' expectations of what short-term interest rates will be in the months and years ahead.

In order to ensure an effective transmission of monetary policy to all interest rates, it is therefore important for the central bank's strategy to be time-consistent, i.e. always in line with its precommitment. If this is the case, the central bank can be considered as credible (Blinder, 2000), and agents' expectations will coincide with the central bank’s monetary policy stance. In concrete terms, any start of an interest rate hike or cut will be immediately passed on to long term interest rates. The transmission of monetary policy is therefore more effective when the central bank is credible.

A credible central bank is better able to anchor agents’ expectations

To fully understand the importance of credibility for monetary policy transmission, consider a central bank under an inflation-targeting regime, whereby it commits to achieving an announced level of inflation. If this central bank is credible, then agents consider that it will meet its commitment. They deduce that an expected rise (fall) in inflation, above (below) the target, will lead to a rise (cut) in key interest rates. Agents’ expectations and resulting financial trade-offs should move interest rates of all maturities in the direction desired by the central bank. The latter may also rely on public announcements, about the economic outlook and its monetary policy intentions, to influence interest rate expectations. From this point of view, the actions of an entirely credible central bank are perfectly in line with its communication. It does not have to compensate for a lack of credibility by sharp key interest rate movements. On the contrary, key rates are more volatile for less credible central banks.

This is precisely what we show in a recent article that focuses on the credibility of the central banks of the 18 emerging countries that have adopted an inflation-targeting regime (Levieuge, Lucotte & Ringuédé, 2018).

Monetary policy transmission is more effective when the central bank is credible

Our credibility indicator is defined by the gap between private agents’ inflation expectations and the official inflation target of each of the 18 central banks in our sample. The more the inflation expectations are close to the target, the more the central bank is considered as credible.

More precisely, our credibility indicator measures the gap between expectations and the inflation target with respect to the level of the target. For example, a 2 percentage point unanchoring corresponds to a greater loss of credibility for a 2% target than for a 6% target. In addition, our indicator assumes that positive deviations of inflation expectations from the target signal a relatively greater loss of credibility than a negative unanchoring of the same magnitude. Indeed, since the problem faced by emerging countries is to convince agents of their strong willingness to fight against inflation, cases where expected inflation is below the target are hardly considered as situations where the central bank reneged on its price stability commitment.

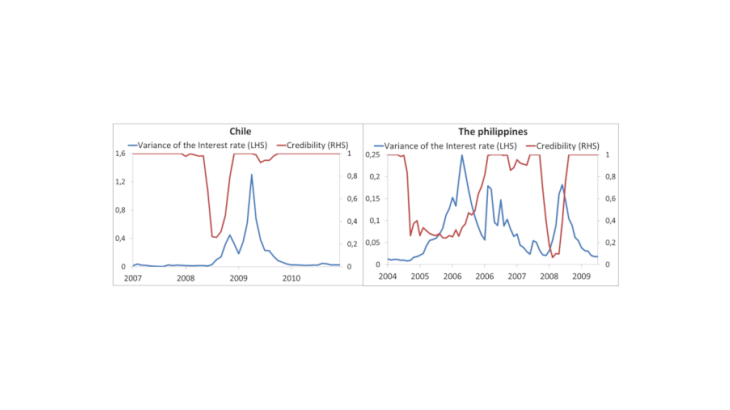

Finally, this indicator makes it possible to empirically study the link between credibility and interest rate volatility, measured by the conditional variance of key interest rates. It appears that the greater the credibility of central banks, the lower the variance of short term interest rates. This means that a credible central bank needs less adjustment of its key rates to achieve its inflation target. For example, Chart 1 shows that the unanchoring of expectations – represented by the fall in the credibility indicator – observed in Chile in 2008 was indeed followed by a spike in interest rate volatility. Similarly, the inverse relationship between credibility and interest rate volatility is clearly apparent in the Philippines between 2004 and 2009. Overall, it is confirmed that credibility enhances the effectiveness of monetary policy transmission in emerging countries that have adopted an inflation targeting regime.

Thus, for the transmission of monetary policy to be effective, agents must believe that the central bank will actually do what it has announced. This means that monetary policy must be as clear, consistent and credible as possible.