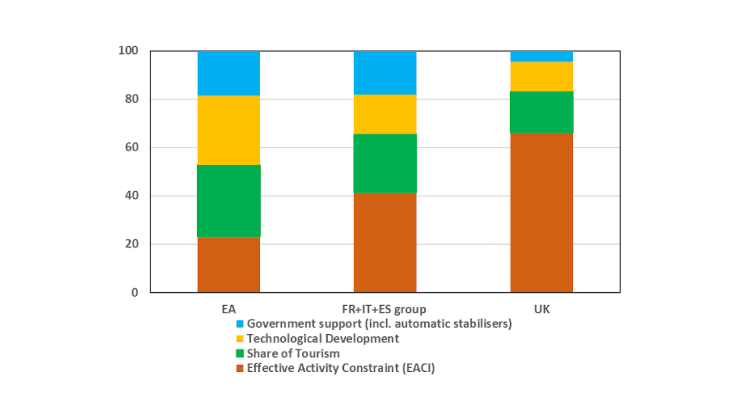

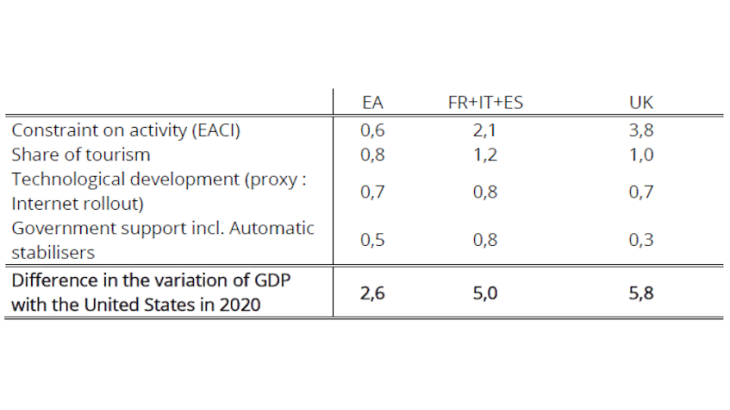

Key: for the three countries France + Italy + Spain, the technological lag explains 0.8 point of the 5% additional drop in GDP compared to the United States.

This factor was amplified by the US economy's lesser dependence on tourism compared to the France/Italy/Spain group (for 20% of the difference, i.e. 1.2pp. in the variation of GDP).

In addition, the United States’ technological lead (share of service sectors where work can be done from home, use of new technologies to rapidly implement teleworking and business-to-business activity via the internet) accounts for about 16% of the divergence with the France/Italy/Spain group. Teleworking is particularly widespread in California (new technologies), New York (finance), Florida (health) and Illinois (insurance).

Lastly, the fiscal stimulus differential in 2020 in favour of the United States explains only 20% of the gap with the FR/IT/ES group, i.e. 1.1 pp. This result is an upper bound, since alternative econometric specifications conclude that it accounts for around 10%. It should be noted that, according to our calculations, the faster reaction of the euro area countries may have reduced the difference in GDP losses but does not cancel out the difference in impact of the lockdown measures.

Two thirds of the additional loss of GDP in the United Kingdom in 2020 can be explained by greater constraints on activity (3.8 pp). Sectoral specialisation (tourism and technological development) accounts for the rest of the gap with the United States; the fiscal stimulus being of relatively similar size.

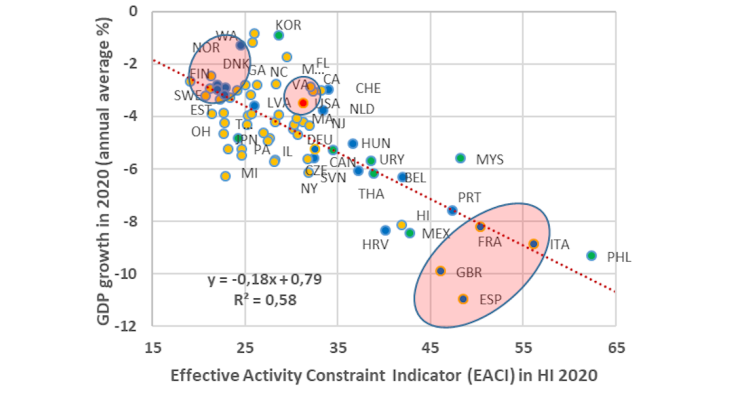

Differences in GDP losses between the United States and the EU but also within these two groups

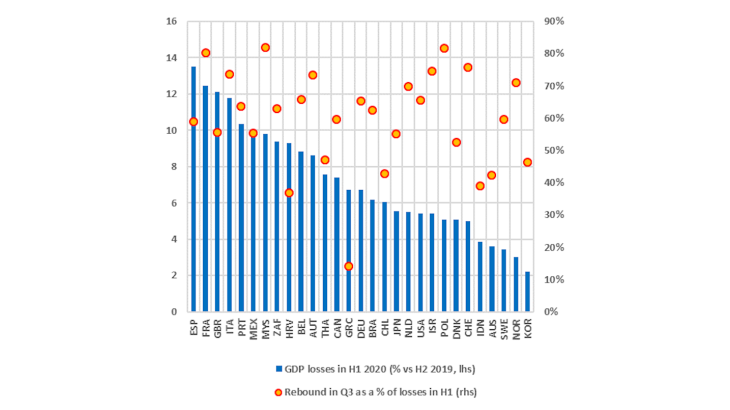

First, it should be noted that the difference in the shock to GDP in 2020 between the United States (-5.6%) and the United Kingdom (-11.4%) or the euro area countries (-8.1%) is essentially due to the loss recorded in the first half of the year, with all the countries experiencing a percentage rebound at least as large as that in the United States in the third quarter. Indeed, the US GDP recovered 70% of the losses, from the first half of the year to the third quarter, which is the average of our panel where most countries recovered between 55% and 80% of the losses (Chart 2).