Many efforts have been made previously to identify the main causes of banking crises and the drivers of their cost, especially in the aftermath of the Global Financial Crisis. Surprisingly, the effects of the macroeconomic policy framework are largely ignored.

In general terms, the macroeconomic policy framework refers to all the characteristics that define and restrict the conduct of monetary, fiscal and exchange rate policies. This covers formal arrangements such as fiscal rules, pegged or floating exchange rate regimes, inflation targeting, and the degree of central bank independence. Some further features may be less formal, such as the degree of central bank conservatism.

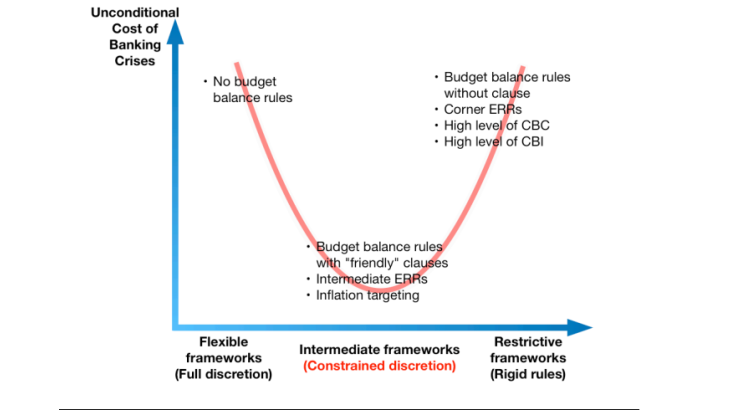

The objective of this paper is consequently to assess empirically how monetary policy, fiscal policy and exchange rate frameworks affect the cost of systemic banking crises. More specifically, in line with the rule versus discretion debate, we focus on how restrictive these policy frameworks are, as stringency may have ambivalent effects on the costs of banking crises. Indeed, in one way, a stringent policy framework is supposed to enhance discipline, improve credibility and enforce greater accountability, and it may give financial room to policymakers. This is conducive to greater economic and banking sector stability. Equally however, restrictive policy frameworks can be counterproductive and pro-cyclical, and while they are not sufficient to prevent banking crises, stringent frameworks lack the flexibility to respond to unforeseeable shocks. This means that tying the hands of policymakers may render banking crises more costly.

The second original contribution of this paper is the focus on the unconditional cost of banking crises. The existing literature concentrates on the cost of banking crises conditional on a banking crisis actually happening, but this produces selection bias. This leads to the factors that may explain why a crisis does or does not occur being neglected, meaning the vulnerabilities that can lead to a banking crisis are ignored. The policy frameworks can have an impact on these financial vulnerabilities, and from this point of view, the absence of a banking crisis is an important piece of information because a given policy framework can be responsible for either a crisis or a non-crisis. In this sense we propose to gauge the global effect of any policy framework on the unconditional output losses related to banking crises, in a similar way to a cost-benefit analysis, for a sample of 146 countries over the period 1970-2013.

Our results reveal that the policy framework as a whole actually matters for explaining the real costs related to banking crises. More precisely, we find a trade-off between stringency and flexibility. The absence of restriction is associated with relatively high expected costs. For instance, the expected losses are around five times higher in countries with no budget balance rules than in those having a fiscal rule with easing clauses. At the other extreme, very restrictive policy features such as corner exchange rate regimes, budget balance rules without easing clauses and a high degree of monetary policy conservatism and independence are conducive to a higher real cost for crises.

In contrast, fiscal rules with easing clauses, intermediate exchange rate regimes and an inflation targeting framework can significantly contain the expected cost of banking crises by combining discipline and flexibility. For example, the expected real losses are around twice as high in countries operating under a corner exchange rate regime as in those operating under an intermediate exchange rate regime. Similarly, pursuing an inflation targeting strategy halves the real costs related to banking crises.

In this way, we provide evidence for the benefits of policy frameworks based on “constrained discretion”. Two decades ago, a seminal paper by Bernanke and Mishkin (1997) asserted that constrained discretion is a desirable compromise for macroeconomic stability, in particular through inflation targeting. In this paper we provide evidence that constrained discretion is also suitable for minimizing the real costs of banking crises.