- Home

- Publications et statistiques

- Publications

- Conditions for a long-term reduction in ...

Conditions for a long-term reduction in France's public debt ratio

Post n°79. The public debt ratios of France and Germany (as a % of GDP) were similar in the early 2000s. Since 2010, the ratio has fallen sharply in Germany, but has continued to rise in France. Using a simple model, we show that the economic and financial context is now favourable to triggering a lasting reduction in France's public debt, provided that efforts to curb public spending are stepped up.

Sources: Eurostat for the past, BdF calculations for the future

A simple, flexible and illustrative model

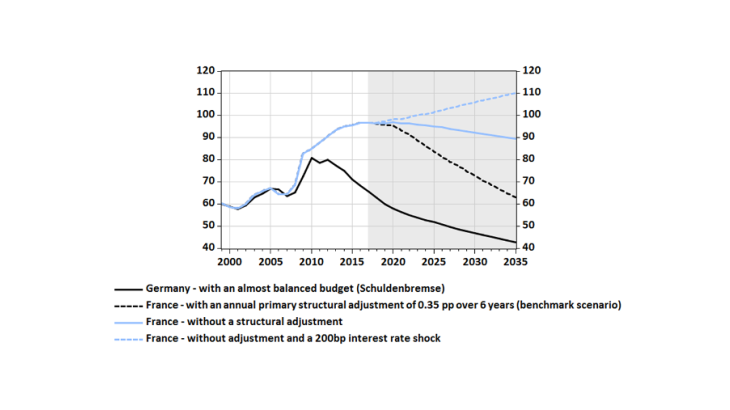

Chart 1 compares the change in public debt as a percentage of GDP in France and Germany since the creation of the euro area. It also shows the impact of different scenarios over the 20 coming years.

We use a simple model for public debt trajectories with four variables directly influencing public debt as a percentage of GDP: (i) an increase in interest rates pushes up debt service costs and therefore the ratio; conversely, all other things being equal, (ii) an improvement in the primary public balance (excluding interest costs), (iii) stronger growth in real GDP or (iv) a rise in inflation reduces the ratio. The variables themselves are determined by stylised macroeconomic relationships. Inflation gradually moves towards its long-term target of approximately 2%. GDP growth in the medium term is anchored to potential growth and impacted in the short-term (via a fiscal multiplier of around 0.5) by fiscal "structural" adjustments. The primary public balance also varies because of fluctuations in economic growth, via its cyclical component.

In this simple approach, the interdependence between interest rates and growth and inflation, as well as public debt, is not modelled. And, in the benchmark scenario, future interest rates are derived from the current market rate curve, with a 10-year yield only a little above 2% until the end of the projection period. However, other interest rate assumptions can be made (see, for example, the 200 bp shock scenario).

In macroeconomic terms, we assume potential growth of 1% to 1.25% only, until 2030, and 1.25% to 1.5% thereafter (in accordance with European Commission estimates). If potential growth proves to be stronger, public debt will decline more sharply.

Furthermore, the average fiscal multiplier can vary depending on the composition of the fiscal structural adjustments. However, this only has an impact at the beginning of the simulations.

Ultimately, as the simple approach chosen for this study can be easily modulated, it is possible to run as many scenarios as may be required. Here, we give some examples.

The case of Germany shows that a reduction in the public debt ratio is possible

In 2010, the public debt ratios of France and Germany as a percentage of GDP were very similar. Their trajectories have since diverged and France's public debt is now around 30 percentage points of GDP higher than the level observed in Germany.

Germany's public debt, which stood at around 60% of GDP in 1999, drifted to some extent in the early 2000s and then increased by around 15 percentage points in the space of a few years after the country was hit hard by the crisis of 2007. However, in 2010, Germany stabilised its public debt and, from 2012 onwards, began rapidly reducing it, by almost 3 percentage points of GDP per year, so that it will soon fall back below 60% of GDP. In Germany, the fiscal consolidations implemented as a preventive measure before the crisis, and then reimplemented quickly after, have been a key factor in the rapid reduction in the public debt ratio since 2010. Thanks to its control over public spending coupled with relatively robust growth that boosted tax revenues, Germany quickly posted a primary surplus again after 2010 and then recorded global fiscal surpluses, including interest costs. In the future, Germany is expected to move to a balanced budget.

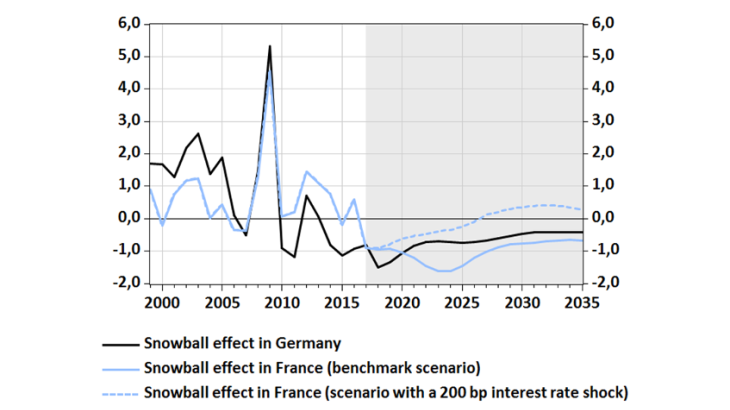

The so-called "snowball effect" (see Chart 2), essentially determined by the difference between the nominal interest rate and the nominal growth rate, has also been favourable in Germany since 2010, as the average interest rate on German public debt has declined while nominal GDP growth has become more robust. This has also contributed to reducing the public debt ratio.

Consequently, Germany has regained substantial leeway in terms of its policy mix.

Sources: Eurostat for the past, BdF calculations for the future

Note: The snowball effect is equal to the difference between the nominal interest rate on public debt and the nominal GDP growth rate, multiplied by the debt level as a percentage of GDP. A negative snowball effect contributes to reducing the public debt ratio.

The current period is favourable to triggering a reduction in France's public debt ratio

France's public debt evolved almost identically to that of Germany from 2000 to 2010 (even though the driving forces behind the changes may have differed). During the crisis, France's fiscal deficit widened in a similar way to that of Germany, but its starting budgetary position was less balanced.

However, since 2010, France's fiscal deficit – both primary and overall – has declined far more slowly and public debt has continued to increase to well beyond 90% of GDP. Today, without fiscal consolidation, there will be no significant reduction in France's public debt ratio (see Chart 1).

An annual structural adjustment of the primary fiscal deficit of around 0.35 percentage point of GDP over a six-year period would put France's public debt ratio on a gradual but marked long-term downward trajectory. At a constant tax-to-GDP ratio, this corresponds to growth in real primary public spending of approximately 0.7 pp less than growth in potential GDP, and therefore amounts to an annual increase slightly below 0.5% per year over the coming years (compared with slightly above 1% for the 2011-17 period and above 2% from 2000 to 2010). Here again, comparisons with Germany could shed light on possible fiscal consolidation options with regard to public spending (see Aouriri and Tournoux, 2017).

In this scenario, with a stable primary structural balance of a little over one percentage point of GDP, the overall fiscal deficit would be broadly balanced in five to six years (around the Medium-Term Budgetary Objective set for France by the European Commission). This condition is essential, under the macro-financial assumptions applied in this study, if France's public debt-to-GDP ratio is to return to around 60% of GDP in the next 20 years or so (see Chart 1).

The current economic and financial context offers a window of opportunity, as the "snowball effect" on France's public debt has also recently become favourable (see Chart 2): long-term interest rates are at a historical low and according to market expectations should remain so, while at the same time nominal GDP growth in France should exceed pre-2017 levels. By the end of 2035, the context could be even more favourable in France than in Germany if its potential growth proves to be stronger than in Germany thanks to a faster population growth rate and provided structural reforms are successful.

The possibility of higher long-term interest rates heightens the need for fiscal consolidation

The context could become less favourable if real long-term interest rates return to levels that more closely resemble their past averages. Chart 1 shows that, in the absence of an improvement in the primary structural balance, an upward interest rate shock (of 200 bp in this example) would lead to a lasting increase in France's public debt ratio, taking it well above 100% of GDP.

This provides further grounds for considering that France's public debt should be reduced as a priority. A lower public debt ratio would provide greater leeway in terms of policy mix in the event of a macroeconomic or financial shock.

Updated on the 25th of July 2024