Climate Risk Measurement of Assets Eligible as Collateral for Refinancing Operations – Focus on Asset Backed Securities (ABS)

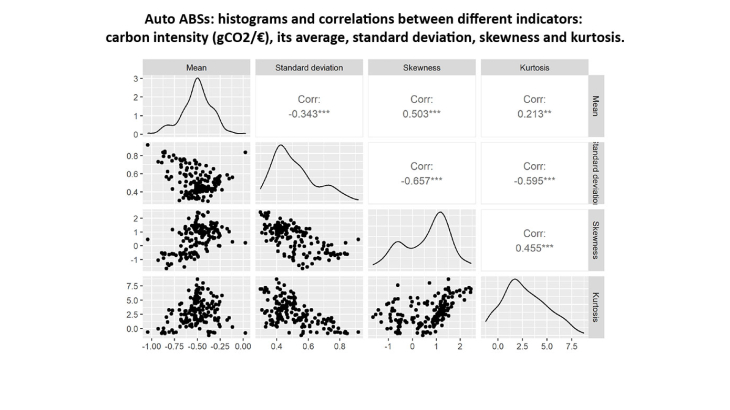

Working Paper Series no. 858. This paper analyses the exposure to climate risk of ABS, an asset class frequently pledged as collateral in the European Central Bank (ECB) refinancing operations. This paper focuses on ABS backed by auto loans or loans granted to Small and Medium Enterprises (SMEs) and explores ways to measure their climate risk based on the characteristics of the underlying loans, using existing loan-level data requirements. The ultimate goal was to come up with an alignment metric, i.e. to judge whether ABS related emissions would meet the Paris Agreements objectives, a task hindered by the lack of data available. Despite these limits, we were able to come up with relevant indicators related to ABS carbon impact, enabling the computation of ABS climate related risk proxies. Without necessarily being able to measure a concrete impact, we carved a series of indicators to serve as a reference. However, we conclude that an improved and harmonized framework for the provision of non-financial information seems essential to achieve an accurate analysis and monitoring of the financial sector's exposure to climate change.