The full conclusions of this desktop survey are available on the website of the SEACEN Center.

The desktop survey is based on a review of all the publicly available documents of banks on their website in English. The disclosures made for the year 2023 have been considered for assessment in the survey if there is no later information available (45%). It is acknowledged that the Asian or the European banks in the sample may not be representative of the entire Asian or European Banking system, but the survey is an attempt to highlight some trends for Asian banks that may be discernible looking at a small sample of banks and comparing with European banks. This desktop survey is neither intended to be, nor is it based on, any supervisory exercise.

The sample of the banks is based on the following:

- Jurisdictions covering a significant share of Asian and European 2023’s GDP;

- Profitable Asian and European banks mostly involved in retail and corporate business lines covering a significant share of Asian and European cumulative total assets size.

The Authors have selected more Asian banks (14) than European Banks (6). The legal framework in terms of climate-related financial disclosures is indeed more harmonised in Europe due to the Single Supervisory Mechanism and is already binding and implemented. Asia offers a more diverse panorama which worths to be considered.

The banks have been assessed on their compliance with each table/template of the Basel Committee’s Consultative document on disclosure requirements for climate-related financial risks (CRFR) namely:

- qualitative information related to in terms of governance, strategy and risk management (CRFR-A);

- qualitative information relating to physical, transition and concentration risks (CRFR-B); and

- quantitative information relating to physical and transition risks (CRFR-1 to 5).

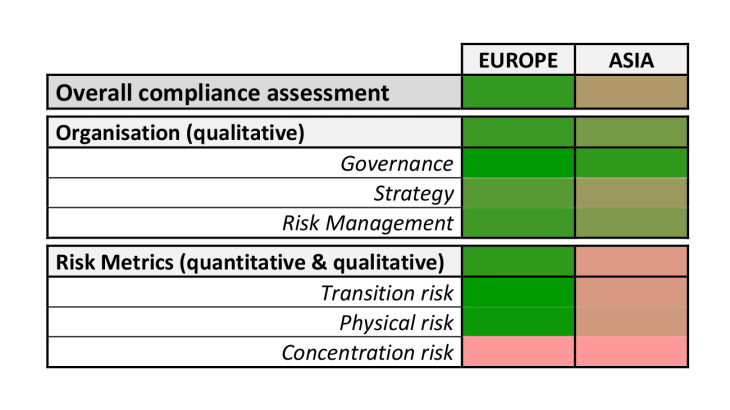

The main key findings of the desktop survey for the Asian banks are the following:

The Asian disclosures are business-oriented and heterogeneous in format

The content of Asian banks’ disclosures is mostly business-oriented i.e. focusing on opportunities whereas the supervisory focus is more on climate-related financial risks. These banks use different templates/formats/reports (e.g., Annual Report, Sustainability Report, Task Force on Climate-Related Financial Disclosures (TCFD) Report, Environmental, Social and Governance (ESG) Framework Policy, etc.) as currently there is no uniform regulatory requirement for banks’ climate-related financial disclosures prescribed by Asian jurisdictions. This makes it challenging to make a comprehensive assessment of the content and quality of these disclosures at a particular point in time.

All Asian banks disclose some elements of qualitative information

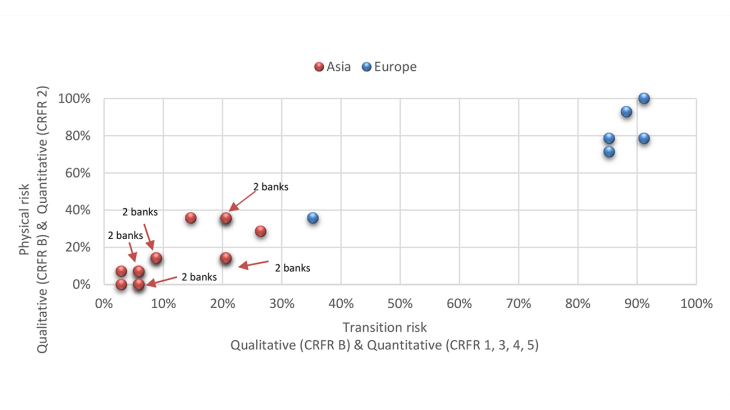

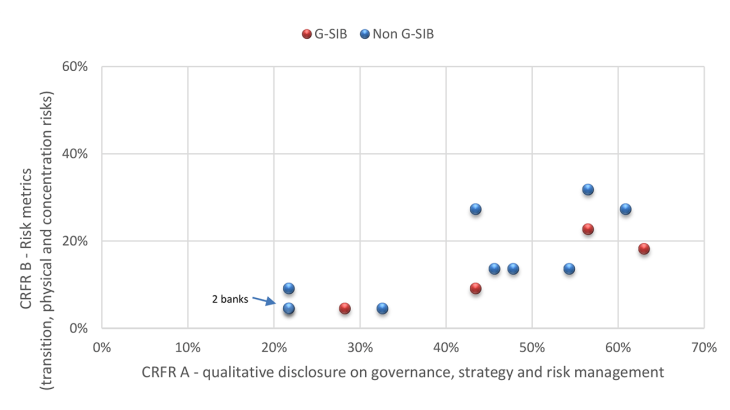

All Asian banks in the sample disclose qualitative information referring to their governance, and to a lesser extent, their strategy and risk management. The degree of compliance to Basel Disclosure Requirements for this category of information is presented in Chart 2. The methodology used to calculate the percentages of compliance of the banks in the sample is available on the website of the SEACEN Center together with the full conclusions of this desktop survey (link at the beginning of this blog). The qualitative disclosures on governance, strategy and risk management reveal a high degree of heterogeneity between the Asian banks in the sample.

Chart 2: Compliance with Qualitative Basel Disclosure Requirements