- Home

- Publications and statistics

- Publications

- Clear, consistent and inclusive ECB comm...

Post n°244. To ensure public understanding and trust, the ECB has to explain better what it does to all the people it serves. With these goals in mind, the Governing Council modernised its communication in July 2021, to have a stronger influence on interest rates and inflation expectations. The ECB will also listen more to citizens’ economic concerns.

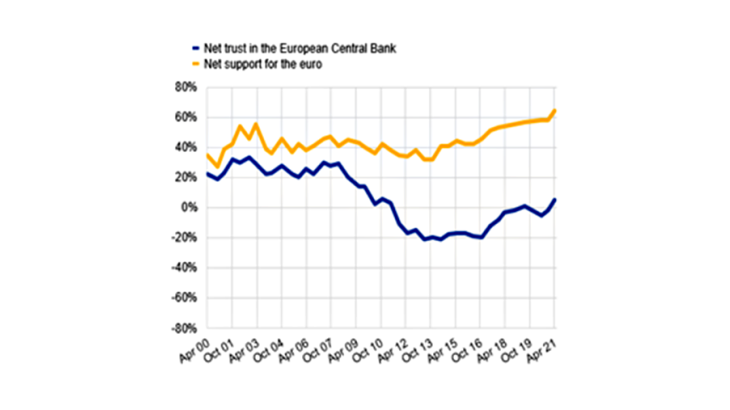

Notes: Net trust = % of those who indicate trust in the ECB minus those who indicate no trust. Net support for the euro = % of those who support the euro minus those who do not support the euro.

Back in 1991, Paul Volcker, the former Chairman of the US Federal Reserve, was asked what his advice to a new central banker would be. His reply was a single word: mystique. In those years, central banks were shrouded in mystery and financial markets had to guess what decisions were taken. Nowadays, central banks announce their policy decisions and the reasons behind them immediately after the meeting. Central banks have realised that to steer interest and inflation expectations more effectively, they need to tell the public what they intend to do, and why. But this is not enough in the current environment, where monetary policy has become more complex, and the communications landscape – think of social media – has changed beyond recognition. For this reason, reviewing the ECB’s communication policy was a key element of the recently concluded strategy review. The case for change towards simpler, clearer and more engaging communication is presented in ECB Occasional Paper No 274.

The ECB is good at talking to financial markets

Communication on monetary policy measures has traditionally focused on financial markets. They have a keen interest in central banking, detailed knowledge, and react instantaneously. Studies show that ECB communication has been largely successful in influencing financial market expectations about the future course of monetary policy. This is especially the case for interest rate forward guidance, where the central bank provides orientation to markets on how it expects interest rates to evolve in the future. For instance, studies show that some forms of calendar or data-dependent forward guidance have been effective in reassuring markets that rates would remain low when the economy is close to the effective lower bound on nominal interest rates (Ehrmann et al., 2019). Forward guidance has also increased the effectiveness of ECB communication on inflation (Goodhead, 2021).

… but less successful in steering expectations of households and firms

By contrast, the ECB has been less successful in influencing the inflation expectations of households and firms to levels consistent with its inflation objective. European consumers perceive that “inflation” is above what official measures report (for example up to 4% higher over the period 2009-16, Duca-Radu et al. 2021). These beliefs are important as changes in expectations matter for economic decisions. For instance, households expecting that prices will increase in the future tend to consume more than those expecting that prices will remain stable (Andrade et al., 2020).

A key challenge for central banks is that households and firms show limited interest in news on monetary policy and inflation (Vellekoop and Wiederholt, 2017). In countries with low and stable inflation, households and firms have little incentive to care much about inflation. Indeed, this is one of the welfare benefits of stable inflation. Households pay even less attention when they lack knowledge about the ECB’s mandate and tasks and how its actions affect their personal lives. Candia et al. (2020) show that to have more influence on firms and households (and move their expectations in the desired direction), central banks should explain how their actions affect other desired economic outcomes, i.e. by explaining the effects of monetary policy on wages and employment. That said, the complexity of “central bank speak” also makes it difficult to “get through” to many people. As Haldane (2017) remarks, “95% of all the words central banks utter are inaccessible to around 95% of the population”.

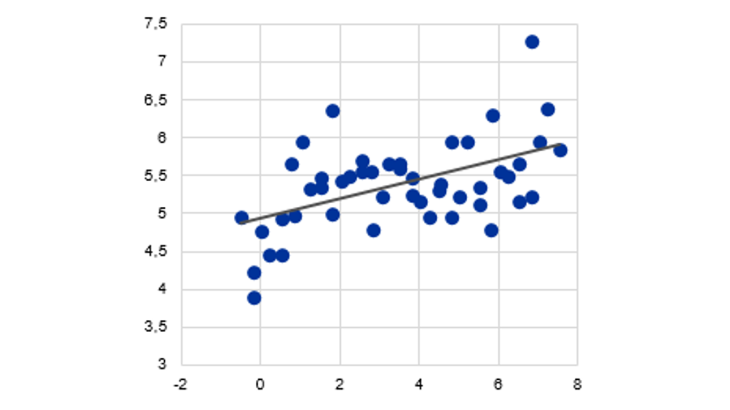

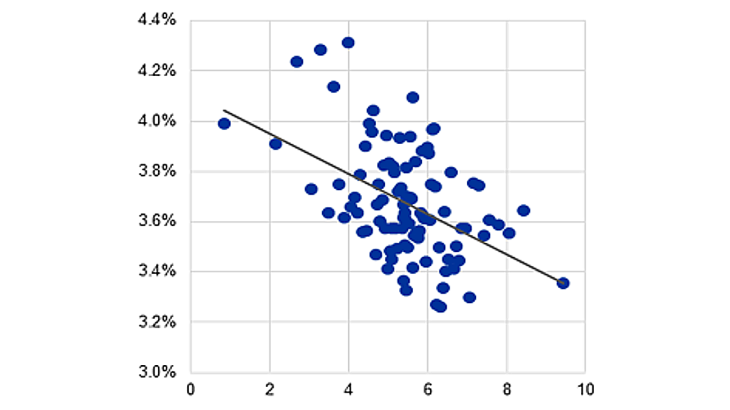

Low levels of trust in the ECB since the financial crisis add to these challenges. As Chart 1 shows, trust in the ECB is still below pre-crisis levels, although support in the euro has kept up well (This is Chart 3, page 45, in Occasional Paper No 274) This matters, as public trust in the ECB is important to better anchor consumers’ inflation expectations at the ECB’s inflation target. Surveys show that the more people know about the ECB, the more likely they are to trust it (Chart 2, left panel). In turn, higher trust in the ECB is generally associated with better-anchored and more accurate, i.e. lower, household inflation expectations (see Chart 2, right panel and Christelis et al. 2020).

Moving towards clear, consistent and engaging communication

With its strategy review, the ECB committed to explain monetary policy in more accessible terms, so that people can understand why decisions are taken and what that means for their lives. In this regard, the ECB has already introduced multi-layered communication, which combines text and visuals to cater to different audiences. For instance, a “first layer” provides an easily digestible overview of the main messages for readers who glance quickly through the content, and a “second layer” caters for those who seek detailed information. The ECB’s communication after each Governing Council monetary policy meeting has also been redesigned with a new Monetary Policy Statement which explains in non-technical terms how and why decisions were taken.

Communication is a two-way street, where the central banks should not only talk, but also listen. To this end, the ECB and Eurosystem will continue with the listening events that they pioneered during the Strategy Review. In this context, during 2021, the Banque de France initiated a dialogue with French citizens to answer the questions they have about monetary policy. The Banque de France à votre écoute events took place all over France and were attended by nearly 260,000 people. Looking forward, the Banque de France has committed to have an annual dialogue with citizens about monetary policy, to be more transparent and clear, and to understand better the expectations of firms and households through new surveys (see LPR 2021). The Banque de France is also developing new tools to monitor household inflation perceptions and expectations through social media.

Finally, as there is evidence that better knowledge about monetary policy can lead to better financial decision making (van der Cruijsen et al., 2020), the Eurosystem will also step up efforts on financial literacy and education. For example, the Banque de France will shortly create a new website to explain monetary policy.

Updated on the 25th of July 2024