A recurrent concern in international policy debate is that policies intended for domestic objectives can adversely affect foreign countries. Looser monetary policy, for example, helps stimulate domestic demand but also lowers the exchange rate making imports more expensive. The lower exchange rate switches demand from foreign to domestic producers.

Foreign central banks respond by either loosening monetary policy themselves or intervening in the foreign exchange market to prevent the appreciation of their own currency, leading to a possible currency war.

This topic has returned to the fore now that the US is tightening monetary policy and starting to run-off its balance sheet. Exiting from exceptionally accommodative monetary policy gives the Federal Reserve potentially two policy instruments, namely the size of the balance sheet and short-term nominal interest rates. Does the possibility of using two instruments heighten the risk of spillovers and do we need international monetary co-ordination along the lines proposed by Mishra and Rajan (2016)?

Governor Brainard on cross-border spillovers of balance sheet normalisation

In July 2017, Governor Lael Brainard of the US Federal Reserve gave a speech on the potential cross-border spillovers of using reductions in the size of the Fed’s balance sheet rather than raising short-term interest rates as a means of removing monetary accommodation. As the Fed runs down its balance sheet, a higher proportion of debt securities will be held by the private sector rather than the central bank causing term premia on longer-term interest rates to rise. Both channels affect market interest rates and domestic demand but she argued that balance sheet adjustment may have less effect on the exchange rate than using short-term interest rates.

Her modelling suggested that if the FOMC were to choose to raise the Fed Funds rate more slowly and reduce the balance sheet more quickly than anticipated, the US dollar would rise at a slower pace vis-à-vis other major currencies. A smaller US dollar appreciation would in turn be less friendly for the euro area, i.e. might make it harder to achieve a sustained adjustment in the path of inflation, the prerequisite for the end of net asset purchases by the Eurosystem.

Mixed evidence on the size of spillovers

There is mixed empirical evidence on whether balance sheet operations affect the exchange rate less than conventional monetary policy in the US and euro area. Some research suggests it might be more sensitive to the path of short-term rates than to balance sheet adjustments – see for example Alon and Swanson (2011); Ferrari et al. (2016); Stavrakeva and Tang (2016). But several other papers find little disparity in the exchange rate sensitivity to short-term compared to long-term interest rates (Glick and Leduc 2015; Swanson 2017; Ammer et al. 2016). Interestingly, the Federal Reserve Board’s own International Financial Division believes the “effects of conventional and unconventional policies on the dollar (…) to be remarkably similar” (Ammer et al. 2016).

Size of spillovers is similar for conventional and unconventional policies

To provide more systematic evidence of the total effect, we estimated very simple Vector Auto-regression equations for the US and euro area economies using 5 quarterly variables: 3-month nominal interest rates, 10-year nominal government bond yields, the nominal exchange rate, real GDP growth and inflation. We impose explicit sign restrictions to identify the shocks in the VAR model, based on economic theory and commonly accepted empirical regularities.

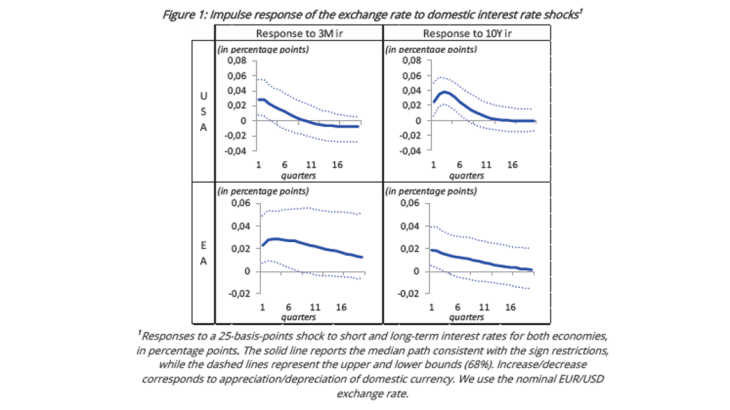

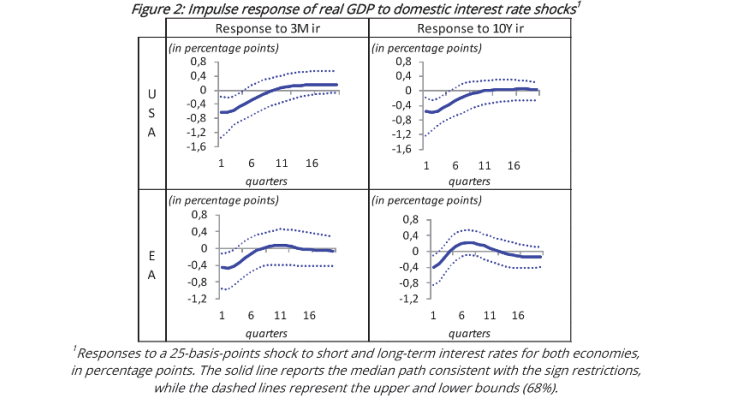

We focus on the domestic impact of short- and long-term interest rate shocks on the US and euro area economies. Figure 1 shows the responses of the nominal exchange rate to a 25 basis point shock to EONIA rate for the euro area and 3-month LIBOR for the US, and 10-year government benchmark bond yields for both economies. These are estimates of conventional and unconventional policies respectively. The conventional monetary policy operates through the short-term policy rate and central bank balance sheet adjustments through the term premia.

The results suggest that there is very little difference between the initial impacts on the exchange rate of the two shocks in each economy. Figure 2 shows the impact of the same short- and long-term interest rate shocks on GDP. Taking both results together, the effects of unconventional monetary policy do not seem to differ quantitatively from conventional policy.