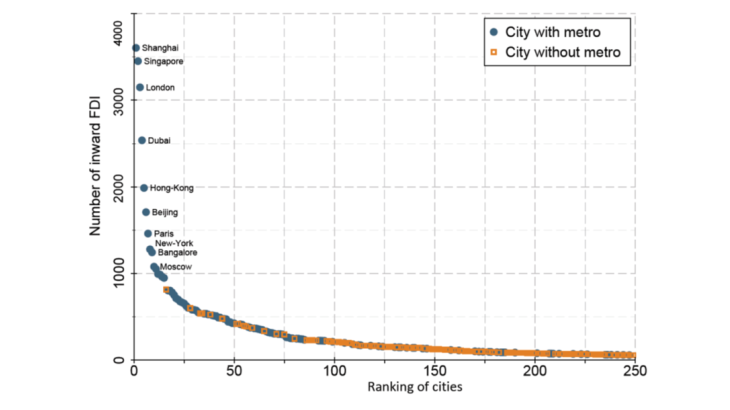

Chart 2 shows the ranking of the 250 most attractive cities in terms of the number of FDI projects received during the 2003-2014 period, taking into account the existence of a subway. Shanghai and Singapore come first and second. Paris is ranked 7th with almost 1,500 projects received, just ahead of New York. Overall, cities with a subway (blue) seem to be at the top of the rankings in terms of FDI projects received, whereas cities without subways are nearer to the bottom, suggesting the existence of a positive link between subways and the international attractiveness of cities.

The econometric analysis, for its part, seeks to isolate the effect of subways from all the other factors that could influence FDI. Indeed, country-level or regional studies show that other determinants, in particular economic ones, affect the location choices of multinational companies (Py and Hatem, 2009). Furthermore, other public transport infrastructures (airports and roads especially) may have an impact on the location and the strength of economic activity (Strauss-Kahn and Vives, 2009; Duranton and Turner, 2012).

In this context, we collected for each city data on: i) their economic size (value added, population, capital), ii) other transport infrastructures (trams, roads, ports and airports), iii) the organisation of major events (Olympic Games, football world cup, Universal Exhibition, etc.). The empirical analysis, based on the location choices of multinationals in almost 3,500 cities worldwide, was carried out controlling for all these factors.

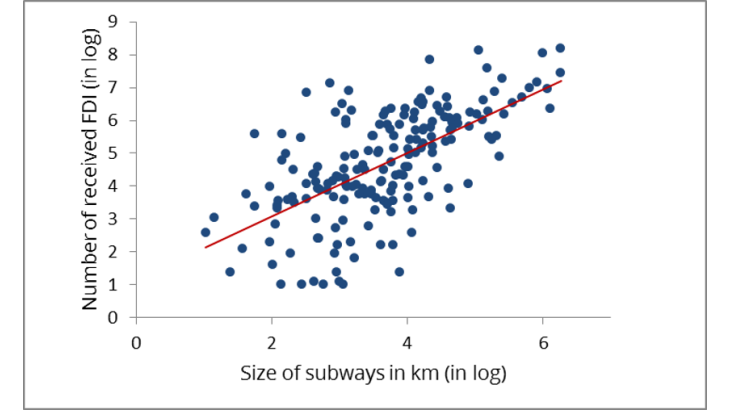

The results show that having a large subway network significantly increases the attractiveness of a city. They are consistent with those of Mayer and Trévien (2017) according to whom the number of multinational companies is higher in the cities connected to the Regional Express Rail (RER) in Île de France.

What effects are to be expected from the Grand Paris Express?

With a total cost that could exceed EUR 35 billion according to the latest estimates by the Société du Grand Paris, the Grand Paris Express project is provoking debate. Given the magnitude of the allocated means, it is important to question its potential effects.

The Grand Paris Express plans to construct 68 new stations and 205 km of new lines, i.e. doubling the size of the Parisian network. According to our results, all things being equal, doubling the size of a metro in a city should attract around 15% of additional FDI projects.

Paris attracted 1,310 projects between 2003 and 2014, i.e. around 110 projects per year, generating, according to fDi Markets data, on average 52 jobs each. Assuming that the projects are carried out (these are announced projects so that actual size may vary) and that these trends continue, the completion of the Grand Paris Express project would make a relatively modest contribution to direct job creations by multinationals, i.e. around one thousand jobs.

However, this calculation must be put into perspective. First, some of the assumptions used for this exercise may be called into question, which would result in significant changes in terms of job creations. Second, in the longer term, the establishment of these multinationals may have significant spillover effects on local economic activity and thus contribute to stimulating employment.

Third, in addition to these effects on the attractiveness of a city for FDI, the development of a subway network may have significant effects on the labour market via its impact, notably, on the housing market (Bono et al. 2017). They may also contribute to reducing pollution (Gendron-Carrier et al. 2018). All these factors must be taken into account in the cost-benefit analysis of such infrastructure investments.