When a firm faces difficulties repaying its debts, whether insolvent or on the verge of insolvency, it can undertake a debt restructuring procedure. Upon emerging from the procedure and after the court’s decision to agree on a debt-restructuring plan, the "restructured" firm must meet its new repayment deadlines to remain in business. One of the decisive factors for success is its access to bank credit. Since restructuring plans last an average of ten years, the incapacity for the firm to borrow or invest could seriously compromise its survival.

In this paper, I analyze the access to bank credit of restructured firms. I question the existence of bank credit constraints associated with the information on firms’ past bankruptcy. Information about past bankruptcies is a public policy issue. It is up to policymakers to decide whether to share or remove information about past bankruptcies from public registries to shape investors’ behavior.

To assess the extent to which policymakers can influence restructured firms’ access to bank credit, I measure the causal impact of removing information about past corporate bankruptcies on SMEs’ access to bank credit.

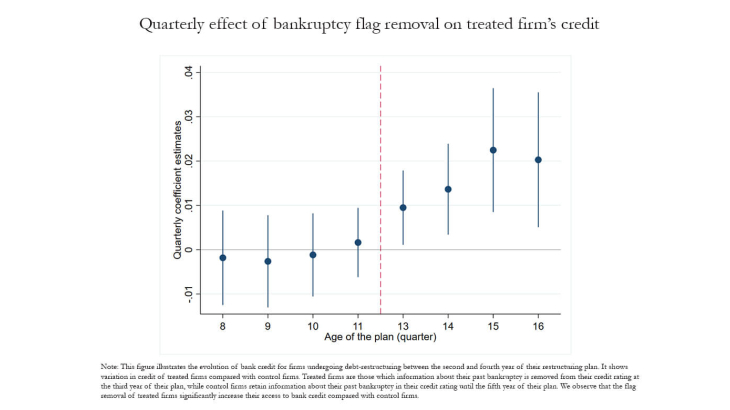

My method takes advantage of the fact that the Banque de France credit rating takes into account information on the firm's past bankruptcy, as long as that information can effectively be used. The purpose of the Banque de France rating is to inform banks about the financial health of a firm and its ability to honor its payment obligations. When a firm emerges from bankruptcy with a restructuring plan, its rating takes into account the information about the past bankruptcy and automatically takes on a 'risky' value. However, three years (for safeguard) to five years (for receivership) after the procedure, the information on the past bankruptcy is, according to regulation, no longer used for the credit rating, which is no longer automatically set as ‘risky’. Using a difference-in-difference method, I show that flag removal allows firms to increase their access to bank credit. Firms with a favorable credit rating obtain credit from their historical banks. For firms whose credit rating becomes 'neutral' and which are therefore more constrained than firms with a good rating, I also observe an increase in bank credit, although smaller, which is partly due to the formation of new banking relationships.

I question why banks react to this change in rating even though information on past bankruptcy remains freely available elsewhere. I argue that the Banque de France's credit rating guides investors’ behavior.

Ultimately, I measure the real economic impact of bankruptcy flag removal. I show that this increase in access to bank credit results in a fall in the use of trade credit and an increase in the investment rate of firms undergoing restructuring. My results are in line with recent policies that aim at reducing the time during which information on past insolvencies is available. This paper emphasizes the importance of supporting firms in their recovery.