Euro area bank interest rate statistics: November 2024

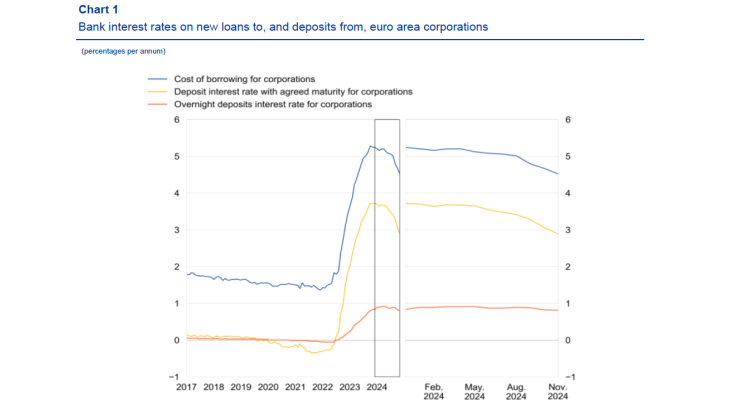

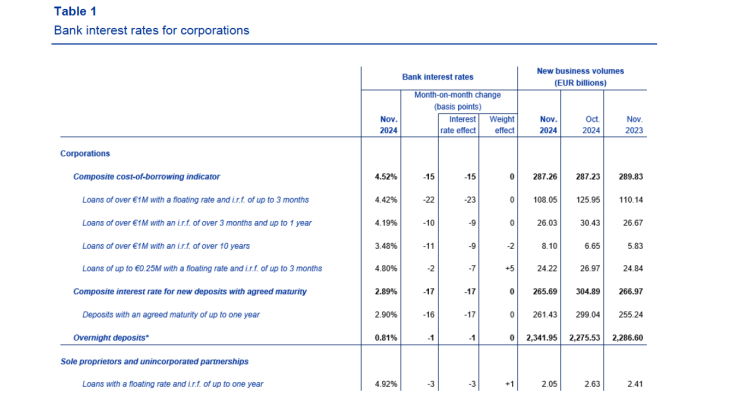

- Composite cost-of-borrowing indicator for new loans to corporations decreased by 15 basis points to 4.52%; indicator for new loans to households for house purchase decreased by 8 basis points to 3.47%

- Composite interest rate for new deposits with agreed maturity from corporations decreased by 17 basis points to 2.89%; interest rate for overnight deposits from corporations broadly unchanged at 0.81%

- Composite interest rate for new deposits with agreed maturity from households decreased by 12 basis points to 2.61%; interest rate for overnight deposits from households broadly unchanged at 0.35%

Published on 7th of January 2025