1. Weak consumption momentum weighs on inflation

Since the first oil crisis in 1973, inflation has been lower in Japan than in other advanced countries. This was still the case in 2021 22. With the exception of the most recently reported figures (since spring 2022; 3% in September), inflation has even remained below the Bank of Japan target since the 1990s banking crisis (see Chart 1). The initial demand shock, followed by a debt deflationary spiral (Fisher, 1933), and declining inflation expectations have weighed on consumption since the end of the 1990s (see Chart 2). The “three arrows” of the former Prime Minister Shinzo Abe’s recovery plan, which was launched in 2013 14, temporarily stimulated inflation by increasing household consumption and inflation expectations (Maruyama and Suganuma, 2019). However, the momentum in consumption quickly lost traction due to the absence of wage increases (see Chart 3) and with the rise in VAT. It was also adversely affected by the perception that inflation was structurally higher than it actually was (see Box 1 below).

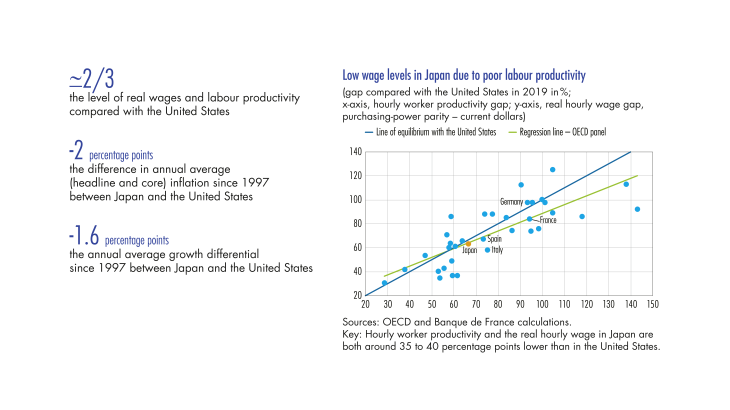

The weak real wage dynamic (see Chart 3) has weighed on consumption since the end of the 1990s. These low wages are due to two simultaneous and interdependent factors:

• distorted income distribution, mainly associated with the loss of workers’ bargaining power and the duality of the labour market between regular and non regular employment (see Appendix 1);

• poor productivity directly linked to chronic corporate underinvestment.

Furthermore, despite high apparent wealth, Japanese households fail to maximise their financial incomes, due either to a lack of knowledge or to “financial repression” (see Appendix 2). The weak financial income gains therefore cannot compensate for the small wage gains.

2. The duality of the labour market and the loss of workers’ bargaining power curtail the wage dynamic

The share of labour compensation in value added is dropping because real wages are not increasing

Since 1995, the share of value added allocated to labour compensation in Japan has declined significantly. This trend had already begun at the beginning of the 1980s (as in France and the United Kingdom) but accelerated sharply in the 2000s, following the same

decline witnessed in the United States. National accounts data can be used to break down the distribution of income from production (real GDP growth) between the two production factors, i.e. capital and labour.

[to read more, please download the article]