Banque de France Bulletin

Three years after the beginning of the health crisis, cash is holding its own against other means of payment in France

Published on the 20th of April 2023

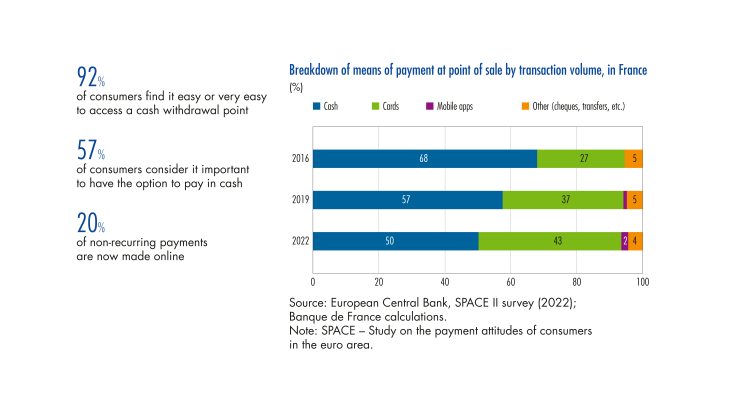

Bulletin n°245, article 5. The European Central Bank has published its latest survey on household payment habits in the euro area, covering the period from October 2021 to June 2022. This is the first such survey on the post Covid period. Although cash is facing an ever wider range of digital means of payment, it remains the most widely used means of payment in France (and in the Eurosystem) at points of sale. Furthermore, households tend to value the option of paying in cash. Levels of acceptability and accessibility of cash are also considered very satisfactory.