Post n°327. Fifteen years after the global financial crisis of 2007-2008, a number of events have highlighted the systemic nature of the non-bank financial intermediation (NBFI) sector, in particular investment funds. These episodes have shed light on the vulnerabilities both for financial stability and the financing of the real economy.

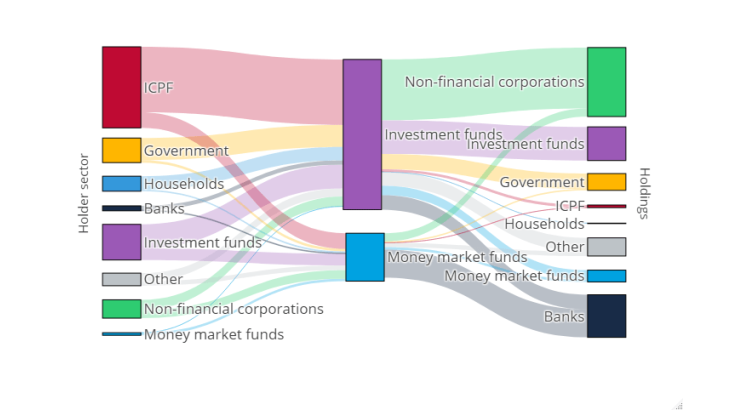

Source: SHS-S. Data as at Q2 2023 for funds domiciled in France, excluding securities held outside the euro area or held by the Eurosystem. The chart shows the holding sectors (left) of investment funds (middle) and the issuing sectors (right) of the securities held by these funds. ICPF = Investment Companies and Pension Funds.

Non-bank finance has become a major sector of the financial system

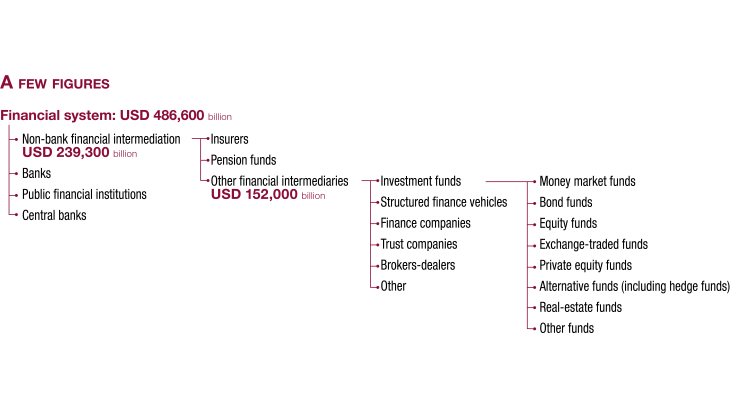

NBFI refers to a system for raising funds and providing funding that involves players outside the traditional banking system. Until 2018, this very diverse set of activities and entities (Chart 2) was known as the shadow banking sector, due to lighter regulation – it should be noted that this term did not cover pension funds and insurers because of their more stringent regulations.

Source: Banque de France (ABC de l’économie), Financial Stability Board (FSB), figures at end-2021. Note: The historical term "shadow banking" did not include insurers and pension funds, unlike NBFI.

The sector has experienced significant growth and now accounts for almost 50% of the world's financial assets, compared with 42% in 2008 (33% for France, FSB 2022 – although the methodology used could give rise to possible double counting, for example on account of pension funds' holdings in investment funds). This trend gained momentum after the tightening of banking regulations following the global financial crisis.

Within NBFI, investment funds contributed the most to the growth of the sector in terms of assets (+199% between 2011 and 2021).

Recent shocks have shed light on the significant vulnerabilities in NBFI

While the global financial crisis of 2007-2008 had already highlighted certain risks, several recent episodes have brought to light the fact that vulnerabilities in NBFI can have major consequences for global financial stability:

- the outbreak of the Covid-19 pandemic, which led to a widespread liquidity shock on bond markets and massive redemption requests made to certain funds;

- the collapse of the family office Archegos in March 2021, which caused more than USD 10 billion in losses spread across several systemic banks following an accumulation of leveraged positions;

- the stress of the UK sovereign debt market in September 2022, which led to forced sales by UK pension funds using leverage and exerted additional downward pressure on debt securities, prompting the Bank of England to intervene.

Liquidity risk contributes to runs and fire sales

The liquidity risk borne by investment funds arises from a liquidity mismatch between their assets and liabilities. It corresponds to the gap between the time it takes to sell assets and the frequency with which investors can redeem their units or shares.

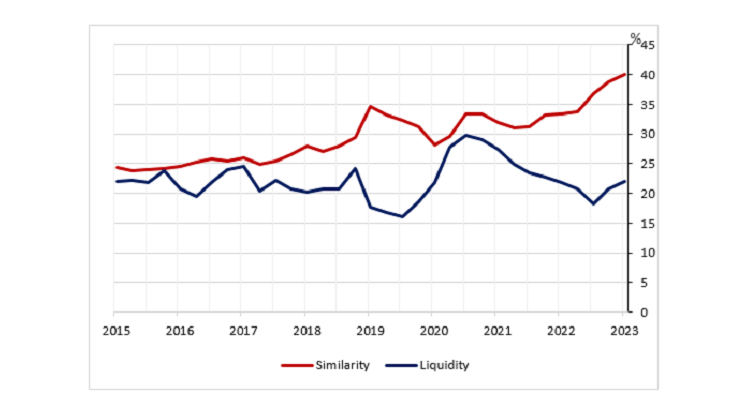

The financial shock caused by the Covid-19 pandemic illustrated this liquidity risk for money market funds: a large number of investors simultaneously requested redemptions ("dash for cash"). To meet these redemptions, a fund can use its available cash and/or sell its assets. In deteriorated market conditions, asset sales can put increased downward pressure on prices (fire sales). The more similar the assets held by the funds, the greater the volume of sales, making them more difficult to sell and driving down prices. These phenomena are exacerbated when the liquidity of securities is limited even in normal times (Chart 3).

Source: Collecte OPC, Centralised Securities Database, Banque de France calculations. Similarity is measured by the similar outstandings (per issuer) between portfolios for each pair of funds (as a % of total outstandings). The level displayed is the average for all pairs of funds, weighted by the assets under management of each pair of funds. Liquidity is the ratio of deposits, loans and money market fund units to total assets.

Liquidity risk can also materialise through peaks in demand for liquidity from margin calls, as highlighted by the case of UK pension funds in September 2022.

Leverage may create or amplify certain vulnerabilities in NBFI

Leverage enables NBFI entities to multiply the exposure of their investments through borrowing and/or derivatives (BDF, 2022). Nonetheless, an adverse price movement may cause a significant loss and force entities to unwind their positions, fuelling a fall in prices and affecting other market participants. The greater the leverage, the smaller the price change that will trigger the unwinding of positions. In the event of a default, their lenders (or counterparties) must be sufficiently resilient to absorb the losses, at the risk of finding themselves in financial distress and spreading the risk more widely through a domino effect.

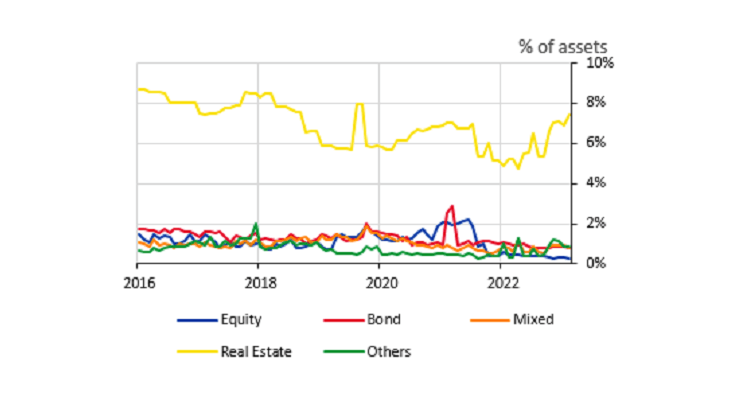

In France, NBFI entities make little use of leverage and use derivatives mainly for risk hedging purposes (Chart 4). However, internationally, some hedge funds display very high levels of leverage (more than x25) and some indicators suggest that leverage in NBFI is on average at a historically high level (FSB, 2023).

Note: Leverage is defined as the ratio of total deposits and loans over assets under management. Synthetic leverage (via derivatives) is therefore not represented here.

Interconnections between NBFI and the rest of the financial system can amplify systemic shocks

NBFI entities are directly and indirectly exposed to the rest of the financial sector through their holdings and investors. For example, insurers hold a large share of French investment funds, which in turn invest in the economy as a whole. Similarly, money market funds play a particularly important role in the short-term funding of banks (Chart 1). The relationship between banks, insurers and other non-bank intermediaries can be a major source of contagion risk, as many NBFI players keep their liquidity reserves in the form of bank deposits and repurchase agreements (repos). Banks' dependence on funding from NBFI (14% of European banks' funding) is a factor amplifying these risks, as these banks play a key role in the distribution of credit to the economy (ECB 2023).

Thus, a shock affecting one sector of NBFI could be passed on to other sectors because of the close financial links between them. Stress testing exercises have highlighted the role of NBFI entities in contagion effects (HSCF 2020, ECB 2021).

These vulnerabilities call for an appropriate and concerted regulatory response at the international level.

The vulnerabilities of NBFI entities are of growing concern to authorities because of the sector's increasing size, complexity and strong interconnections, which are sources of heightened systemic risk.

The vulnerabilities associated with NBFI call for appropriate measures to be implemented in a harmonised way at the international level. In this regard, the Financial Stability Board has just published two reports: the first takes stock of its work on improving the resilience of NBFI, and the second deals with the implications for financial stability of the use of leverage in NBFI. The European Systemic Risk Board has published a note outlining a regulatory approach to dealing with the risks associated with investment funds (real estate and corporate bond funds).

However, the work carried out up until now has focused on microprudential measures, with the activation of certain tools being at the discretion of the funds, and centred on investor protection. A macroprudential approach, which would integrate the risks borne by cohorts of funds and their impact on the financial system as a whole, potentially including tools at the authorities' disposal, has yet to be defined.

Download the PDF version of the publication

Updated on the 25th of July 2024