- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – Start of Decem...

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

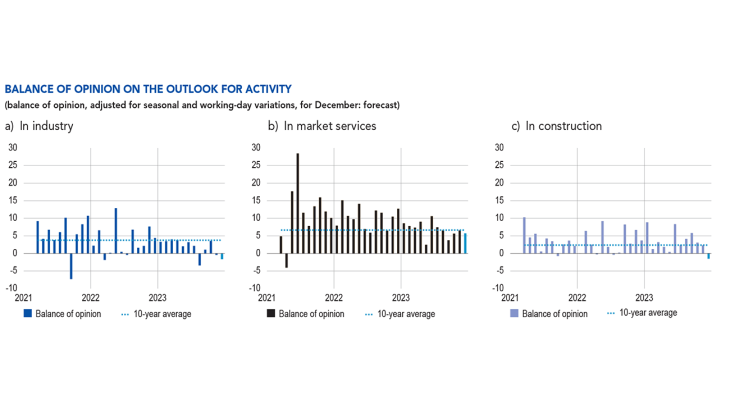

According to the business leaders surveyed (approximately 8,500 companies and establishments between 28 November and 5 December), activity continued to rise in market services and the finishing works of the construction sector, while it was almost stable in industry and declined in structural works. Forecasts for December suggest that activity in the services sector will continue to grow, while it will ease in industry and contract in construction. Order books continued to weaken in industry, and even more so in the structural works sector of the construction industry.

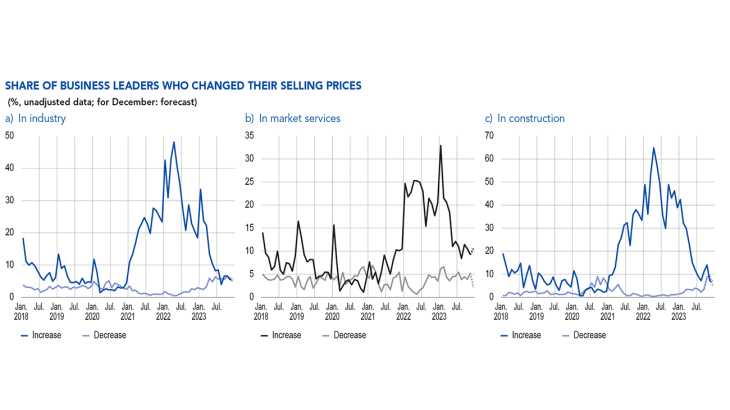

Selling prices continued to moderate. According to business leaders, raw material prices continued to fall, whilefinished goods prices remained virtually unchanged. In all three main sectors, the share of companies that increased their prices over the previous month stabilised at around pre‑Covid levels.

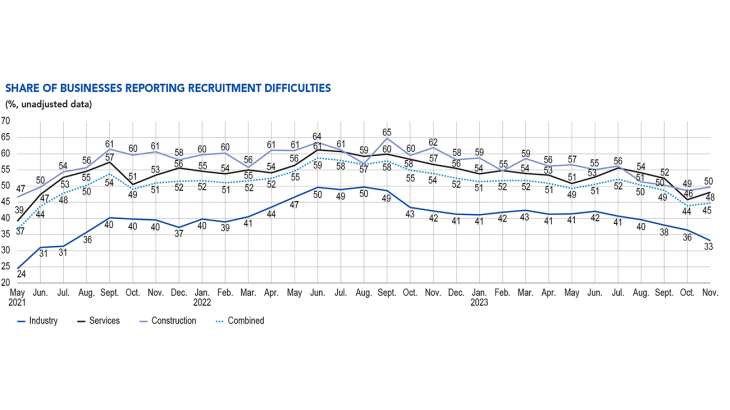

Recruitment difficulties remained almost stable and still affected 45% of companies (down from 44% last month).

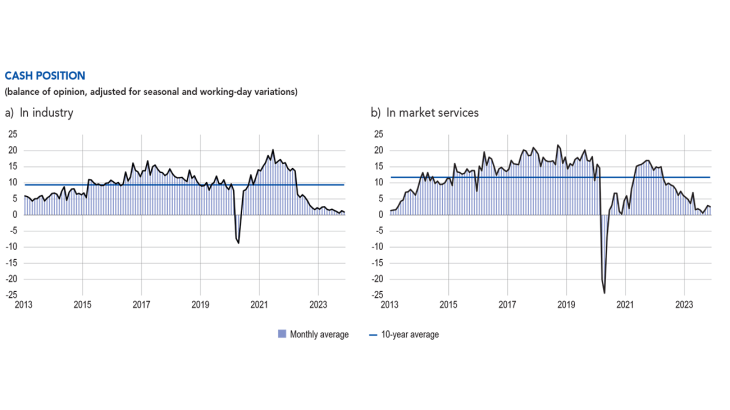

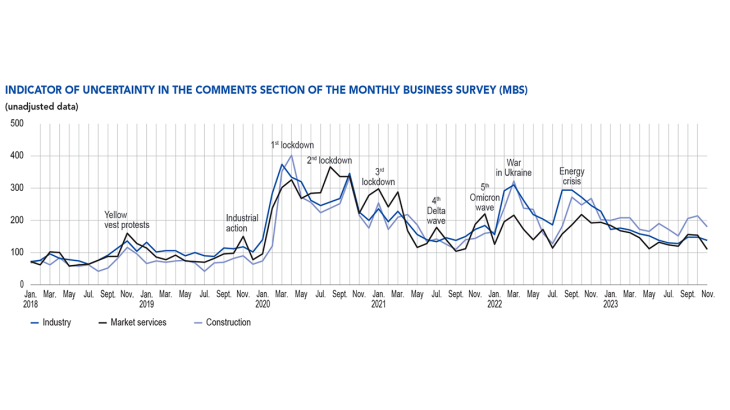

The uncertainty indicator remained above its pre‑Covidlevel in the construction sector. The cash position remained unchanged in industry and services, but was still deemed weak.

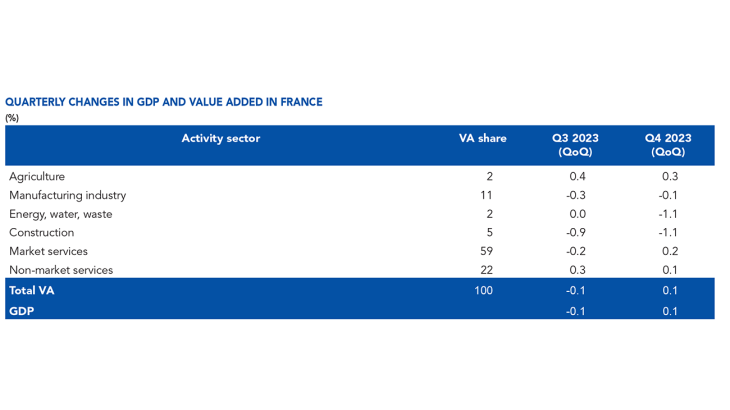

Based on the survey results, together with other indicators, we estimate that GDP should increase slightly by 0.1% in the fourth quarter, after a fall of 0.1% in the third quarter, driven by market services.

1. In November, activity continued to grow in market services and construction, and changed little in industry

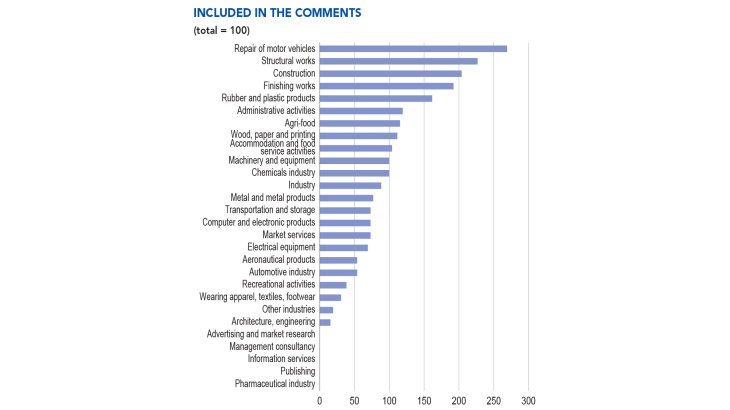

In November, as expected last month by businesses leaders, industrial activity remained more or less stable. The aeronautical, pharmaceutical and electrical equipment sectors were buoyant, while activity fell sharply in the automotive, machinery and equipment, rubber‑plastics and computer, electronic and optical product sectors.

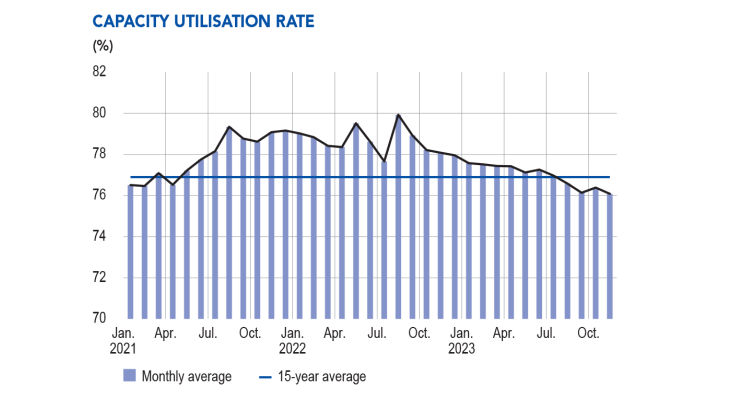

The fall in the capacity utilisation rate (CUR) continued this month, with the indicator dropping to 76.1%, its lowest level for three years and significantly below its 15‑year average (76.9%)

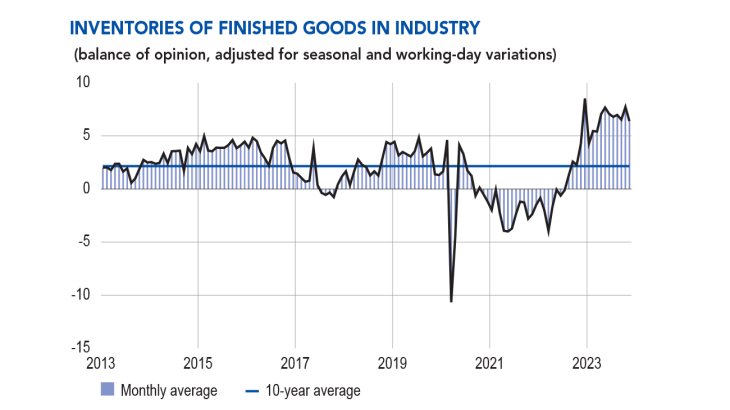

Finished goods inventories, still considered high, nevertheless subsided a little in November. This contraction was particularly pronounced in the automotive and wearing apparel‑textiles‑footwear sectors. Conversely, inventories continued to rise in the electrical equipment and pharmaceutical sectors, to levels well above their long‑term averages.

In market services, activity continued to improve. Among business services, management consultancy, architecture and information services posted the strongest growth, while advertising and temporary employment services contracted. In the personal services sector, leisure activities, personal

services and accommodation performed well. Automotive repairs enjoyed higher demand due to the bad weather (see box). The publishing sector also recorded a strong sales performance for the second month in a row. The food services sector, however, saw a slight decline.

In the construction sector, activity continued to grow slightly in finishing works, but contracted in structural works.

The balance of opinion on the cash position showed little change and remained unfavourable. In industry, it was considered satisfactory in the aeronautical and pharmaceutical sectors, but par ticularly low in the wood‑paper‑printing and wearing apparel‑textile‑footwear sectors, as well as in the rubber‑plastics sector. In market services, the cash position was considered satisfactory in architectural and engineering activities. It was well below its long‑term average in transportation and storage.

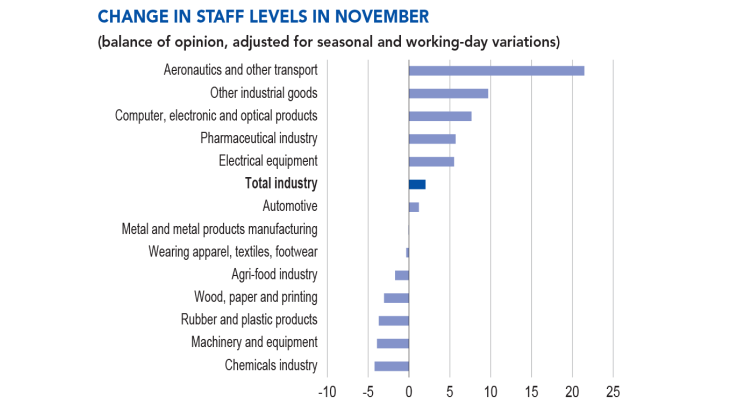

Changes in staff levels partly reflected trends in activity and order books, particularly in industry. While business leaders in the aeronautical sector reported a marked increase in the number of employees, the chemicals, machinery and equipment, and rubber and plastics sectors saw a decline.

2. In December, business leaders expect activity to rise in services but to contract in industry and construction

According to business leaders, activity is set to contract in industry in December. While the aeronautical, agri‑food, pharmaceuticals and other industrial goods sectors are likely to see an increase in production, the machinery and equipment, rubber‑plastics, wearing apparel‑textiles‑footwear and automotive sectors should experience a decline.

In the services sector, activity should strengthen. In personal services, business leaders expect an upturn in activity in the food services and car rental sectors in the run‑up to the festive season. In business services, advertising and temporary employment, a slight rebound in activity is also expected in December.

Lastly, in construction, activity is expected to stabilise in the finishing works sector, and to fall sharply in the structural works sector.

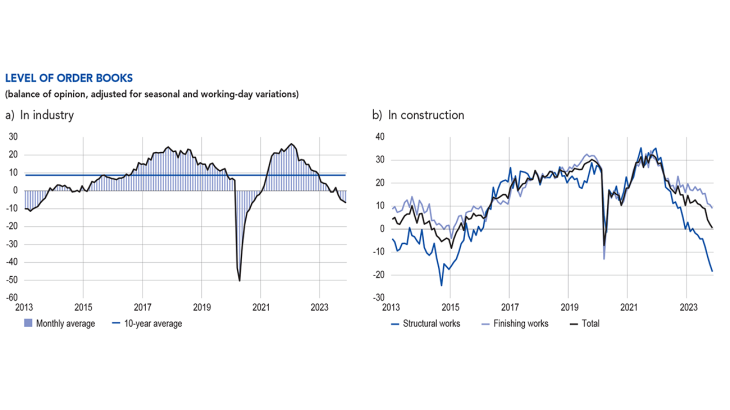

The balance of opinion on order books in industry worsened further in November. The aeronautical and computer, electronic and optical products industries were the only sectors whose order books were deemed to be good or very good.

Order book levels were found to be particularly low in the wood‑paper‑printing, chemicals, rubber‑plastics and agri‑food industries.

In the construction sector, the level of order books continued to decline. In the structural works sector, it reached its lowest level since September 2014. In the finishing works sector, the level of order books fell slightly, further extending the gap with its long‑term average.

Our monthly uncertainty indicator, constructed from a textual analysis of the comments by the companies surveyed, shows a higher level of uncertainty in construction than in services and industry, where the indicator is close to its pre‑Covid level.

3. Selling prices continue to moderate

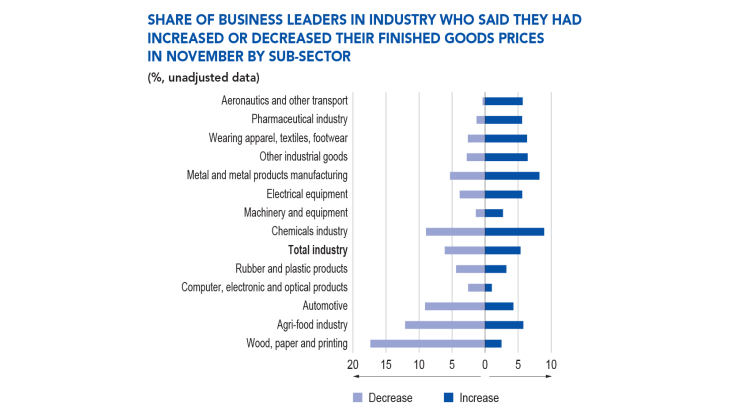

In November, supply difficulties eased further in industry (14% of firms cited such difficulties after 17% in October) but increased somewhat in construction (10% after 7% in September). In industry, business leaders reported a continued decline in raw material prices, whereas finished goods prices were reported to have been almost stable.

More specifically, 5% of business leaders reported that they had raised their selling prices in November 2023, compared with 21% in November 2022. Moreover, 6% of business leaders in industry reported lowering their selling prices in November, compared with 2% in November 2022, reflecting the easing of raw material prices. Decreases in finished goods prices were most common in wood‑paper‑printing (17%) and in agri‑food (12%) and automotive (9%) industries. In all of these sectors, the share of firms that lowered their prices outstripped the share that raised them.

In construction, 7% of companies raised their prices this month (compared with 46% in November 2022), while 9% of companies in the sector lowered their prices. The share was as high as 19% in structural works.

In services, the share of companies reporting a rise in prices was 9%, compared with 18% a year ago. And 5% of firms decreased their prices.

example, 17% of companies in the wood, paper and printing sector reported having lowered

their prices in November whereas 3% of business leaders in this sector reported having raised

their prices over the previous month.

The share of business leaders planning to raise prices in December is close to that seen in November in industry (6%) and construction (7%), but has risen slightly in services (11%).

Business leaders were also asked about their recruitment difficulties, which changed little in November. Across all sectors, 45% of companies surveyed reported such difficulties, after 44% the previous month.

4. Our estimates suggest that activity

will rise slightly in the fourth quarter

At the end of November, INSEE revised the change in GDP for the third quarter downwards to ‑0.1% according to the detailed results of the quarterly national accounts, compared with an initial estimate of 0.1%. This revision mainly relates to market services (in particular transport and storage, information and communication and business services) and construction.

Based on the results of the Banque de France Monthly Business Survey, as well as other available data (INSEE. production indices and high‑frequency data), we estimate that real GDP will increase slightly by 0.1% in the fourth quarter compared with the previous quarter.

Activity is expected to be buoyed this quarter by market services, thanks in particular to accommodation and food services, information and communication and business services. The worsening outlook for output suggests a slight fall in value added in industry this quarter. Value added in the energy and construction sectors is expected to fall sharply, in line with the decline in monthly production indices and the sharp drop in housing starts.

Sources: INSEE data for the third quarter of 2023, Banque de France forecast for the fourth quarter of 2023.

Download the paper

Enquête mensuelle de Décembre 2023

Updated on the 25th of July 2024