- Home

- Publications and statistics

- Publications

- Monthly business survey – February 2023

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

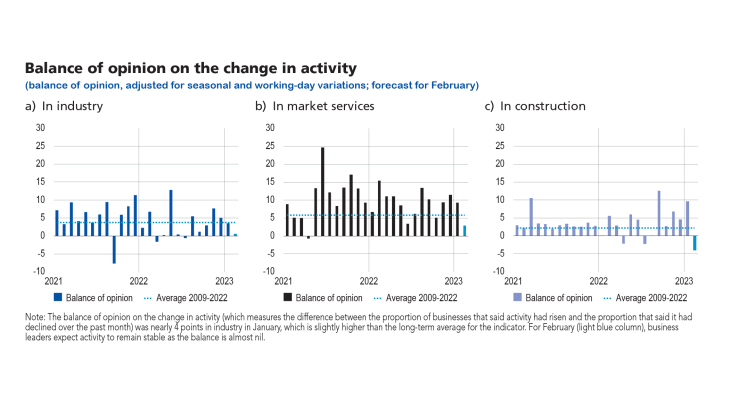

Despite the successive external shocks, economic activity is continuing to show resilience month after month. According to the business leaders surveyed (approximately 8,500 companies and establishments questioned between 27 January and 3 February), activity improved again in January in the three major sectors, and to a greater extent than anticipated the previous month. For February, business leaders expect activity to slow overall, with a slight increase in services, a stabilisation in industry and a decline in construction.

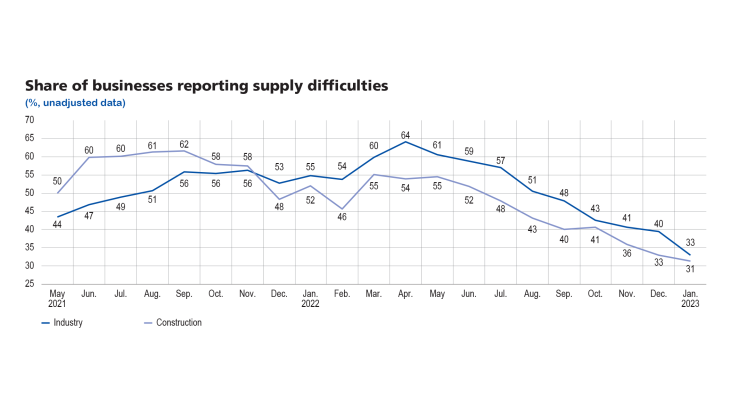

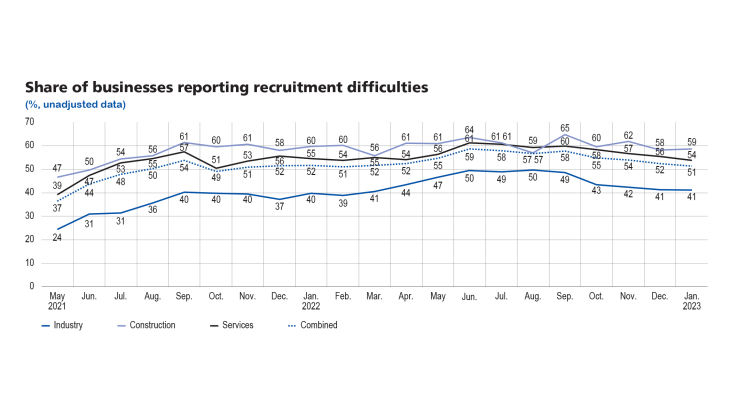

Supply difficulties eased fairly markedly in industry (33% of industrial firms reported difficulties in January after 40% in December) and more moderately in construction (31% after 33%). Despite lower commodity price pressures, finished goods prices rose at a slightly stronger pace over the month, reflecting the usual price revision process that takes place at the start of the year (although in industry, unlike in services, a smaller share of businesses raised their prices than at the start of last year). The outlook for February suggests that price rises will be more limited. Recruitment difficulties abated for the fourth consecutive month, while still remaining strong (cited by 51% of businesses in January).

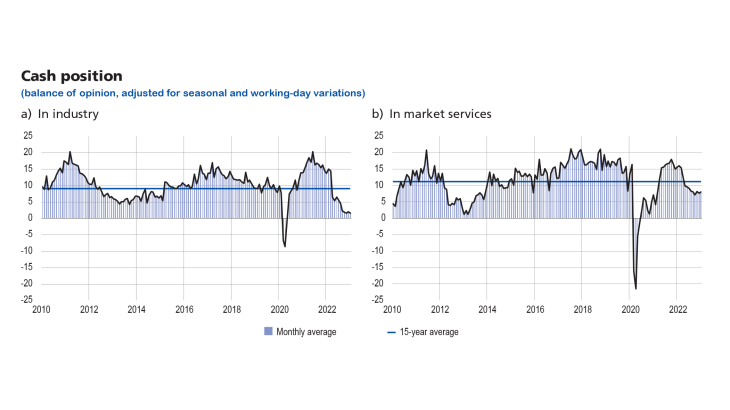

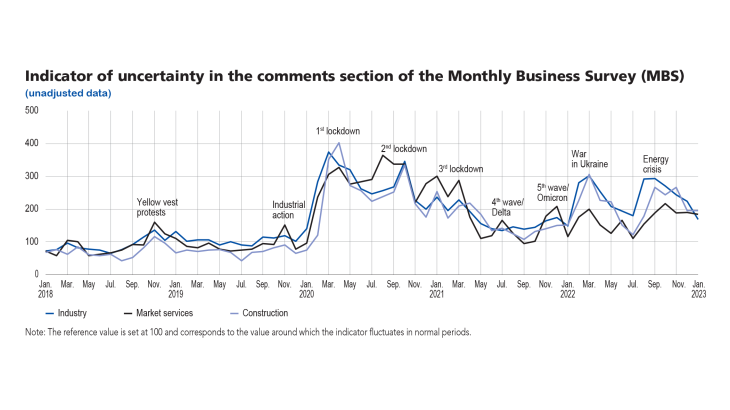

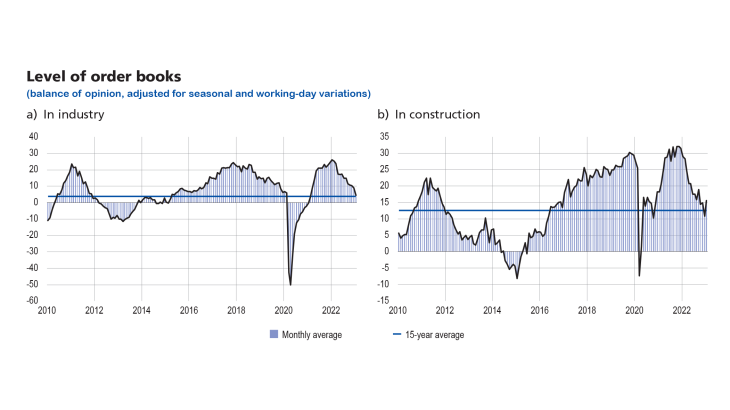

Our uncertainty indicator declined slightly in January, especially in industry, but remained at very high levels. Cash positions remained weak, especially in industry, but were stable compared with the previous month. The steady shrinking of order books in industry over the past year is weighing on the sector’s medium-term outlook.

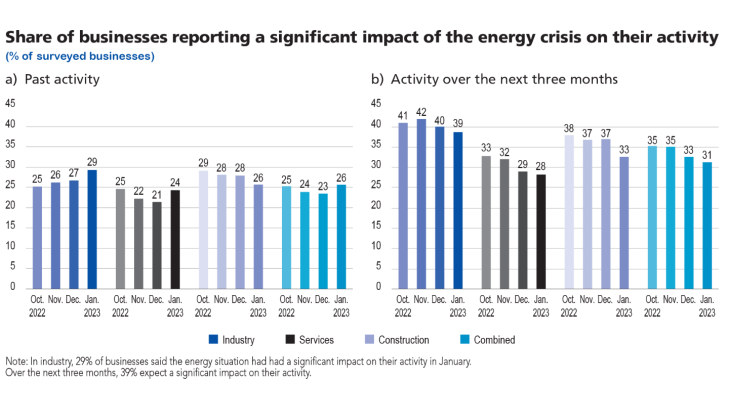

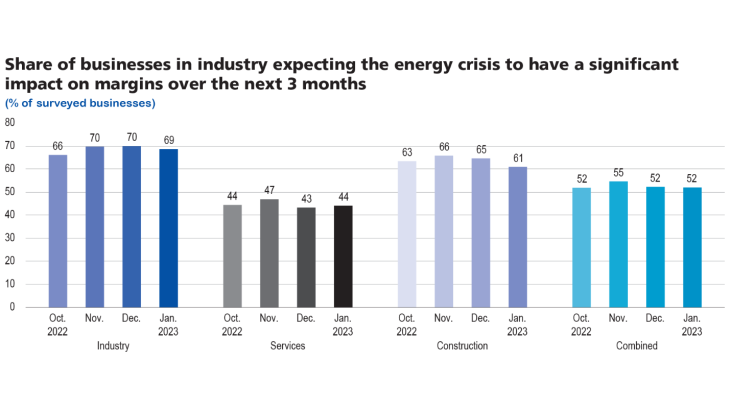

Regarding the consequences of the energy situation, business leaders’ opinions were little-changed in January: while a slightly larger number of businesses said they had felt an impact over the month (26% after 23% in December), especially in industry and services, fewer said they expected an impact over the next three months (31% after 33%). Two out of three construction and manufacturing firms and nearly half of market services firms expect their margins to be affected over the next three months.

Based on the survey results as well as other indicators, we estimate that GDP growth will be slightly positive in the first quarter of 2023 compared with the previous quarter.

1. In January, activity increased in industry, market services and construction

In January, activity rose in industry, in line with business leaders’ expectations the previous month.

Balances of opinion on production indicate that activity increased markedly in pharmaceuticals, electrical equipment and other industrial products. However, it declined compared with the previous month in chemicals, wood, paper and printing, and rubber and plastic products; the latter sector has seen a continuous fall in activity since the summer of 2022 and is particularly exposed to the energy difficulties seen at the end of 2022.

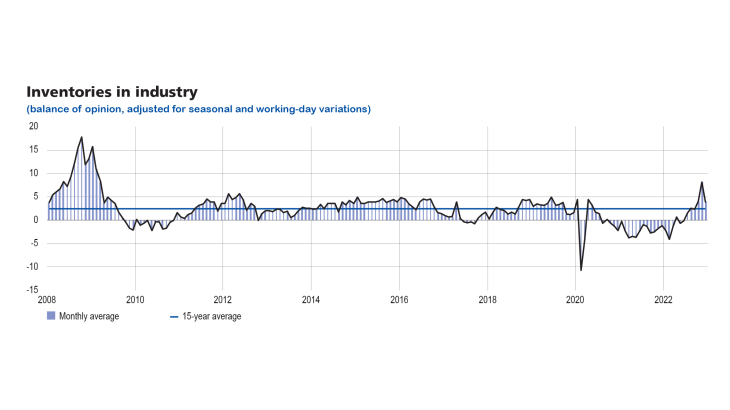

After rising markedly in previous months, inventories fell in January in the majority of sectors. In the agri-food industry and rubber and plastic products, the balance of opinion on inventories is now negative, due to lower production linked to supply difficulties (rise in the cost of packaging and bottles) or to expectations of a drop in demand (competition from China in the manufacture of plastic products). In the other sectors, balances of opinion on inventories fell markedly in January, while remaining slightly above their long-term average. The drop could be linked to the easing of concerns over power cuts, which had led certain firms to build up precautionary stocks.

In market services, activity rose sharply – and at a faster pace than anticipated by business leaders the previous month – in personal services (accommodation and food services) and especially in business services (management consultancy, architectural and engineering activities, technical testing and analysis, computer programming and consultancy). Temporary employment saw a marked drop in activity over the month.

Activity increased again in construction, especially in finishing works. The rise was driven largely by energy renovation activities, and was thus mainly concentrated in the second hand dwelling market.

Balances of opinion on cash positions remained almost stable in January, albeit at very low levels compared with the past 15 years, especially in industry. In nearly all industrial sectors, current cash levels are well below their long-term average, especially in electrical equipment, chemicals, and computer, electronic and optical products, where the gap is over 20 points.

2. In February, business leaders expect activity to rise slightly in services, remain stable in industry and decline in construction

For February, surveyed business leaders expect activity to remain stable overall in industry, although with significant disparities across sectors. Some are expected to see a drop in activity, for example rubber and plastic products, and wearing apparel, textiles and footwear. Conversely, activity is projected to rise in pharmaceuticals and in computer, electronic and optical products.

In services, business leaders forecast slight growth in activity in the majority of sectors.

In construction, activity is seen falling in both structural and finishing works.

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by the respondent companies, eased further in January in industry. However, it still remains well above normal levels, which is linked in part to the energy situation. The uncertainty indicator remained stable in market services and construction.

The balance of opinion on order books declined again in industry and rebounded in construction; in both sectors it is now close to its long-term average. Order books shrank in nearly all industrial sectors in January, but especially in chemicals. Compared with the high reached in March 2022, orders have declined sharply in wood, paper and printing, chemicals, and rubber and plastic products, which are all being hit by a drop in demand or by foreign competition. The two latter sectors are also being badly affected by the energy crisis.

3. A further easing of supply and recruitment difficulties, and a sharper rise in finished goods prices in industry, services and construction

Supply difficulties declined markedly in industry in January (affecting 33% of businesses after 40% in December) and more moderately in construction (31% after 33%). In certain sectors, the easing seen since April 2022 is partly linked to falling demand, especially in chemicals, and in wood, paper and printing.

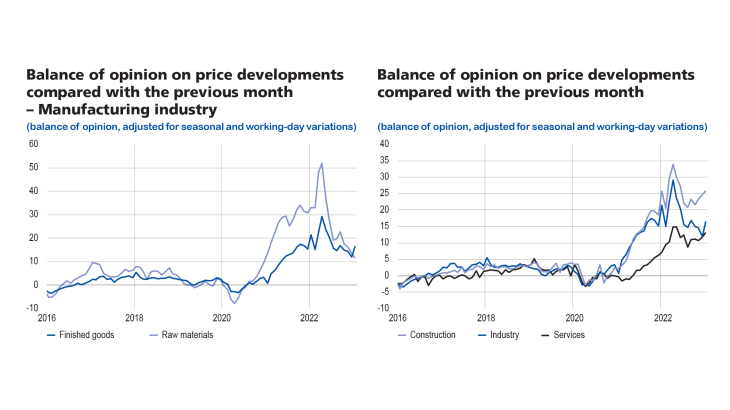

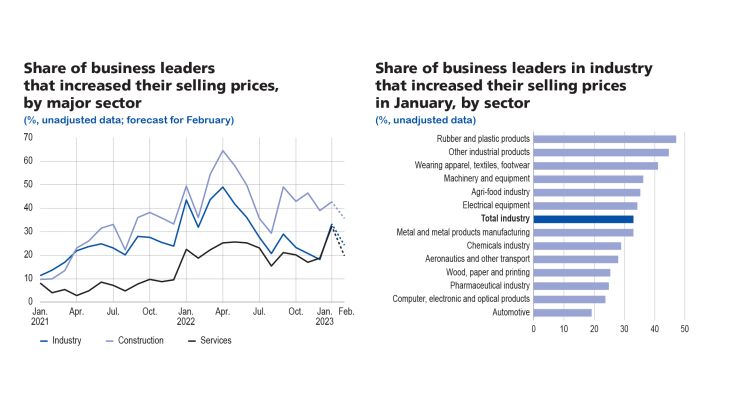

According to business leaders in industry, growth in raw material prices continued to slow in January, while still remaining strong. However, in industry, construction and market services, there was no slowdown in price growth for finished goods. This in part reflects the traditional price rises observed in January each year – although, as in 2022, these were larger than in previous years – which were largely anticipated by business leaders in last month’s survey. For February, balances of opinion on prices have fallen and are back to the levels seen at the end of 2022.

More specifically, compared with January 2022, a smaller share of business leaders said they had raised their selling prices in industry (33% compared with 44% in January 2022) and in construction (43% compared with 49%); in services, however, the proportion was higher (32% compared with 22%), reflecting the pass-through of goods inflation to services. The outlook for February suggests that these proportions will return to more moderate levels in industry (24%), construction (36%) and market services (20%).

Business leaders were also asked about their recruitment difficulties. These remain significant, affecting 51% of businesses across all sectors, but they are nonetheless receding gradually from their peak in September 2022.

The impact of the energy situation on activity and margins

Since the start of November, the survey has included three specific questions on the prices and availability of energy: the impact on business activity over the past month, the expected impact on business activity over the next three months, and the expected impact on business margins over the next three months (with, in each case, three possible answers: no impact, weak impact, strong impact). These questions will be included in the survey for as long as these issues continue to have a significant impact on businesses.

Impact sur l'activité

10% of industrial firms said the energy crisis had had a strong impact on their activity in January. The proportion was lower in construction (6%) and in services (5%).

The proportion who thought the energy crisis had had a significant impact (weak or strong) was 26%, up slightly on December’s level of 23%. The impact was stronger in industry (29%), and January’s rise was mainly driven by chemicals, rubber and plastic products, and other industrial products.

Regarding the next three months, the proportions are higher, especially in industry: close to 15% of industrial firms expect the energy crisis to have a strong impact on their activity, compared with 8% in construction and 7% in market services. Overall, the share of businesses who said they thought the crisis would have a significant impact (weak or strong) on their activity over the next three months was down slightly at 31% compared with 33% last month.

Impact on margins

In industry, 26% of businesses said they thought the energy crisis would have a strong impact on their margins over the next three months. More broadly, the share of businesses who said it would have a significant impact (weak or strong) on margins over the next three months was stable at 52%.

Ainsi, comme les mois précédents, une plus forte proportion d’entreprises estime que la situation énergétique aura, au cours des trois prochains mois, un impact sur leurs marges plutôt que sur leur activité. Cet écart est particulièrement visible dans l’industrie ou le bâtiment.

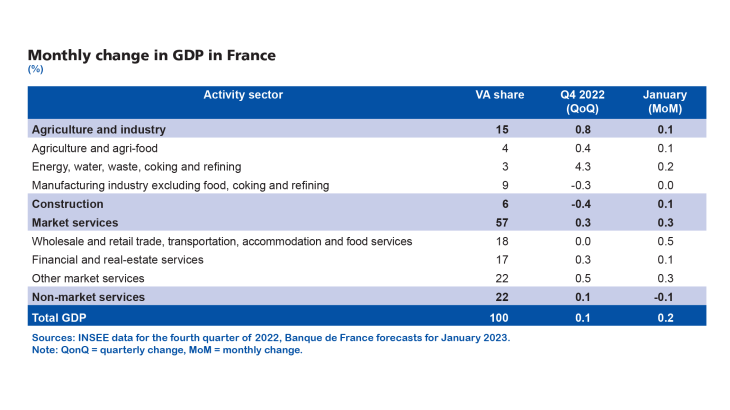

4. Estimates primarily derived from the survey and supplemented by other indicators point to a modest rise in GDP in January compared with December

In our previous business survey, published on 11 January 2023, we correctly forecast the change in activity in the fourth quarter, as the quarterly accounts published by INSEE at the end of January showed that GDP expanded by 0.1%. Despite a downturn in construction, activity remained resilient over the last quarter, with the energy component driving growth in the industrial sector, and market services also posting a rise.

For January, based on granular information from the survey and other available data, we estimate that GDP rose compared with December. This is mainly attributable to the strength of activity in market services. Value added in manufacturing and construction is also estimated to have risen, albeit to a lesser extent.

Based on the survey data, value added is projected to have grown slightly in the agri-food and manufacturing industries. After the strong impact of October’s refinery strikes and the rebound observed at the end of 2022, activity is expected to have normalised in coking and refining in January, as well as in energy (these sectors are not covered by the survey). Value added in those services covered by the survey is predicted to have risen in January, with personal services, accommodation and food services, and business services all posting growth.

The high frequency data that we monitor in parallel for those services sectors excluded from or only partially covered by the survey point to a slight rise in value added in wholesale and retail trade, as well as in transportation.

The expectations of surveyed business leaders point to weak GDP growth in February versus January, although again with contrasting outlooks depending on the sector (slightly negative growth in construction and slight rise in industry and services).

Over the first quarter of 2023, GDP growth should be marginally positive compared with the previous quarter. Despite the positive trend for January, GDP growth should remain modest over the quarter due to the downward revision of December’s activity level following the incorporation of recent data (quarterly national accounts, IPI, IPS, survey of retail trade).

Download the paper

Updated on the 25th of July 2024