In this article, we present a new model aimed at nowcasting the first release of French GDP growth at the end of each month within the quarter in question. This new model is called MF-3PRF (Mixed-Frequency Three-Pass Regression Filter) with reference to the estimation procedure. The estimation method was introduced by Kelly and Pruitt (2015), and provides a strategy for extracting the relevant common factors from a large dataset to forecast a target variable, here GDP growth. Hepenstrick and Marcellino (2019) have extended this approach to cope with mixed-frequency data. This extension allows one to consider a target variable that is sampled quarterly and predictors that are available at a monthly frequency, as it is typically the case in short-run forecasting. To estimate this model, we use a database consisting of 60 monthly indicators. The latter contains survey data (EMC data from the Banque de France), hard data (Industrial Production Index, Services Production Index, construction and employment data), financial data (monetary aggregates, stock and price data), international data (Economic Sentiment Index and IPI in Germany and the euro area), and an index of Economic Policy Uncertainty.

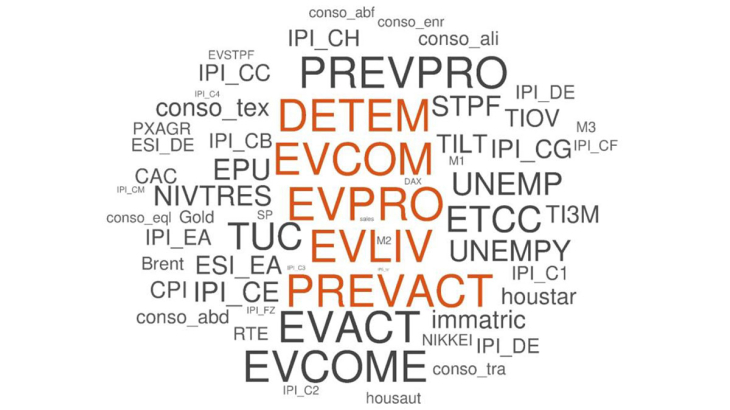

The main findings of this new approach to forecasting French GDP growth are as follows. First, to assess the importance of each variables in the factor building, we compute their weights as the absolute value of their correlation coefficient with GDP growth. As figure N1 shows, the Banque de France survey variables on manufacturing and services are very useful for forecasting French GDP growth in this framework since their weights are prominent in the estimation of the factors. In fact, the top 5 variables in terms of weight come from the Banque de France survey on manufacturing (EVPRO, EVLIV and EVCOM) and services (DETEM and PREVACT). Second, we have derived a formula to calculate the contributions of each predictor in the mixed-frequency context, and it allows us to show that, beyond a positive intercept measuring average growth, all groups of normalized supply and demand variables have contributed negatively to GDP growth since the onset of the COVID-19 pandemic. This is evidence of growth below average since the Covid-19 period. We have also conducted some exercises to assess the ability of the model to produce accurate nowcasts of French GDP growth with respect to several simple benchmarks and existing tools at the Banque de France. In particular, we have compared the performance of our model with that of the MIBA model, which performed very well before the pandemic. We find that our new model exhibits better results than MIBA in the first two months of the nowcast quarter. In the third month, the MF-3PRF model is still useful, as it outperforms MIBA taken alone when the forecasts of the two models are combined with a simple arithmetic mean. Finally, we have also conducted a robustness analysis to challenge our reference specification with several variant specifications.

Keywords: GDP Nowcasting, Factor Model, Mixed-Frequency

JEL classification: C22, E32, E37