Despite the link between short-term finance and the working capital needs, the literature examining the firm level implications of financing frictions has traditionally focused on long-term liabilities. However, given the very specific financial features of SMEs, short-term credit constraints are likely to have significant effects on capital accumulation. Under imperfect capital market assumptions, firms that exhibit the highest agency problems (i.e. SMEs) primarily rely on internal financing capacity and prefer debt to equity if external financing is required. According to this view, firms that are identified as financially constrained also show higher investment-cash flow. In this context, cash-flow uses become of primary interest and working capital needs may compete with fixed investment for the available pool of finance.

In modern corporate finance, working capital accounts for the net position of firms' liquid assets, both real and financial. It is defined as the sum of accounts receivable and inventories minus accounts payable and other non-financial debts due in less than one year. In other words, working capital refers to the funds available and used for daily operations of an enterprise. In this regard, one central motivation of this paper is the specific importance of working capital for SMEs in particular for sectors such as retail, construction or manufacturing where inventory management is a major issue.

To assess the real effects of financial constraints, my empirical analysis hinges on two different approaches which both take advantage of the quarterly French survey on the access to finance for SMEs. Following the ECB’s “Survey on the Access to Finance of Enterprises” (SAFE), the French survey was started in Q1 2012 and aims to provide information on the SMEs' experience in attempting to access finance. Most importantly for my research, the questionnaire is the first to focus on loan maturity distinguishing short-term from long-term loan applications. By summarizing quarterly responses, I am able to construct yearly indicators of investment and cash credit constraints that can be matched with Firms' balance sheet information.

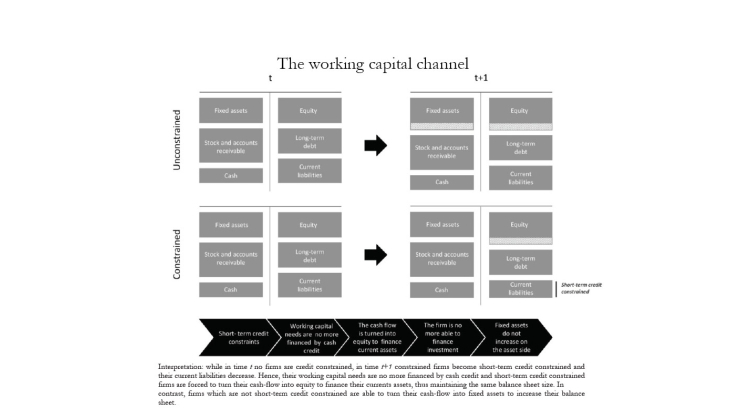

Making use of qualitative survey data on the access to finance of almost 8,000 independent SMEs, I implement both matching estimator techniques and dynamic panel specifications to assess the effect of short-term financial constraints on corporate investment. All in all, I find that short-term credit constraints are at least as important as long-term ones for SMEs' investment decisions. In the presence of cash credit constraints, working capital needs compete with fixed investment to the extent that liquid assets such as accounts receivable and inventories cannot be monetized so easily. Hence, cash credit constraints may force SMEs to forgo investment opportunities in order to finance their working capital needs.

Importantly, the detrimental effect of short-term credit constraints on corporate investment is stronger for firms with higher working capital needs, while the negative relationship between working capital and fixed investment is associated with short-term financial frictions. In the end, only highly liquid firms are able to partially offset the impact of short-term financial constraints on fixed investment by monetizing their current assets.