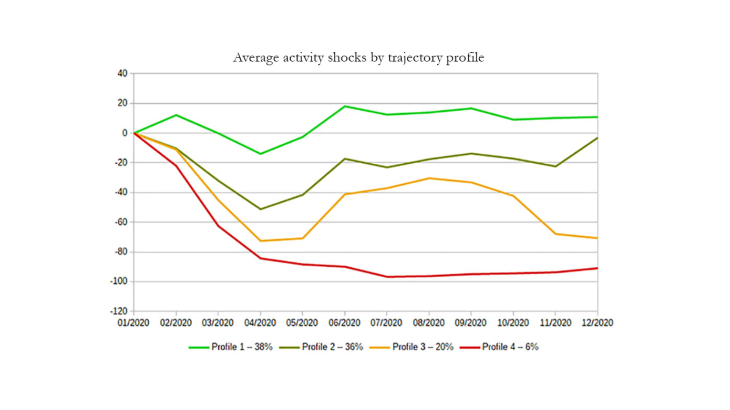

Working Paper Series no. 823. Taking advantage of detailed firm-level data on VAT returns, we estimate the monthly impact of the Covid-19 crisis on the turnover of more than 645,000 French firms. Our approach, based on a micro-simulation model, is innovative in a triple way. Firstly, we quantify the activity loss with respect to a counterfactual situation in which the crisis would not have hit. Secondly, we estimate this shock at the firm level, enabling a thorough analysis of activity loss heterogeneity throughout the crisis. In particular, we shade light on the dispersion of the shock both within and between industries. We show that the industry the firm operates in explains up to 48% of the monthly activity shocks’ variance weighted by employment, a much larger share than in a normal year. Finally, we leverage our monthly firm-level data on sales to show how corporate activity has evolved along four distinct trajectories throughout 2020. The main determinant of belonging to a given profile of activity is the firm industry – defined at a very granular level. Conditional on industry, the activity trajectory is also correlated with the ability to adapt some firms have demonstrated during the crisis in terms of organization and production.

Banque de France - Menu Principal

Press Enter to search. Example: financial stability