- Home

- Publications et statistiques

- Publications

- Monthly Business Survey – March 2023

The Banque de France publishes a range of monthly and quarterly economic surveys that provide a snapshot of the French economy in the form of business climate indicators and short-term forecasts.

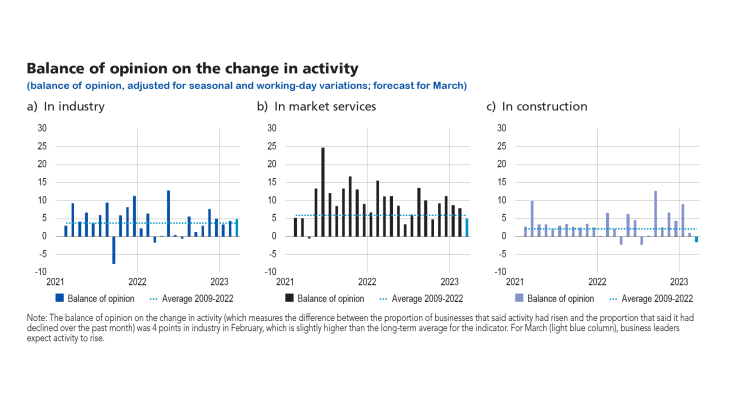

At the beginning of 2023, economic activity continued to show resilience. According to the business leaders surveyed (around 8,500 companies and establishments questioned between 24 February and 3 March), activity increased in February in industry and services; it was relatively stable in construction. For March, business leaders expect activity to rise further in industry and services, and to decrease slightly in construction.

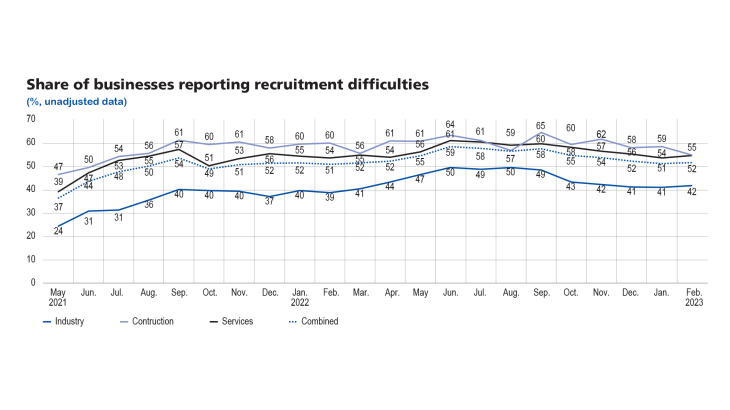

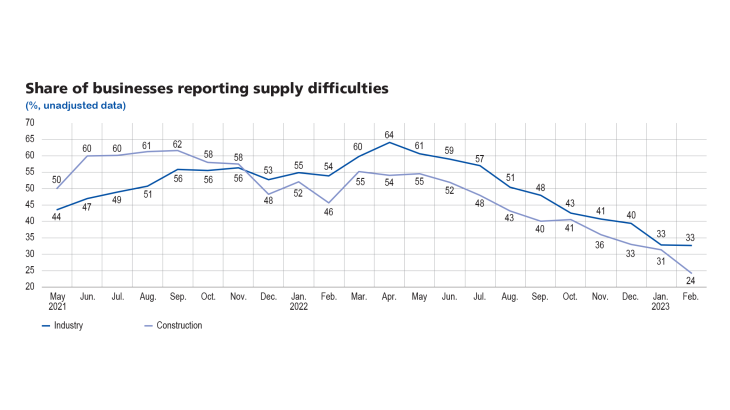

While supply difficulties continued to ease fairly markedly in construction (24% of industrial firms reported difficulties in February, after 31% in January), they stabilised in industry, where 33% of business leaders reported difficulties after the sharp fall observed in January. The balance of opinion on the growth of raw material prices fell significantly in February and is now close to the level observed prior to the Covid crisis. Business leaders also reported – but to a lesser extent – a slowdown in finished goods prices, except in the agri-food industry where price dynamics remained high. After declining over the past four months, recruitment difficulties stabilised and concerned about half of firms (52%, after 51% in January).

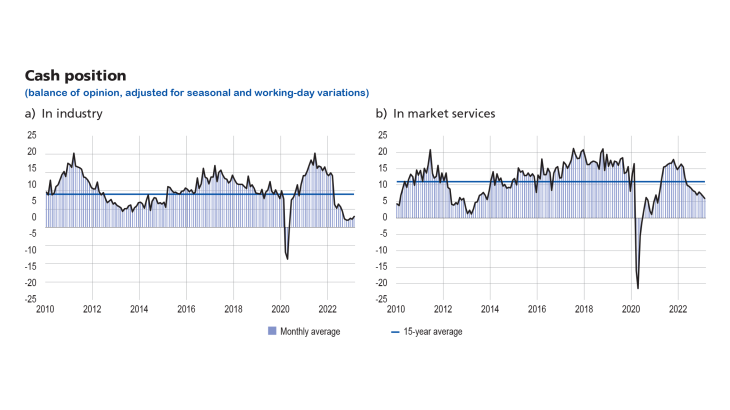

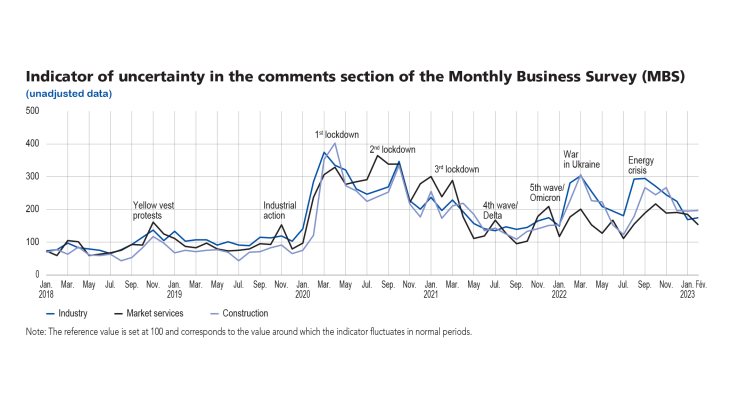

Our uncertainty indicator remained at a high level in industry and construction. In industry, cash positions improved but were still considered weak, and the balance of opinion on order books declined slightly.

Concerning the consequences of the energy situation, business leaders’ opinion improved slightly: fewer said they expected an impact on their activity over the next three months (29%, after 31% in January and 35% in November), particularly in industry.

Based on the survey results, as well as other indicators, we estimate that GDP growth in the first quarter of 2023 will be around +0.1% compared to the previous quarter, which is slightly better than expected in our last macroeconomic projections, published in December.

1. In February, activity increased in industry and services, and hardly changed in construction

In February, activity rose in industry. Balances of opinion on production indicate that activity increased markedly in the automotive, aeronautics, electrical equipment and other industrial products sectors. Conversely, it declined compared to the previous month in chemicals, wood, paper and printing, and rubber and plastic products. These sectors had already posted a fall in January.

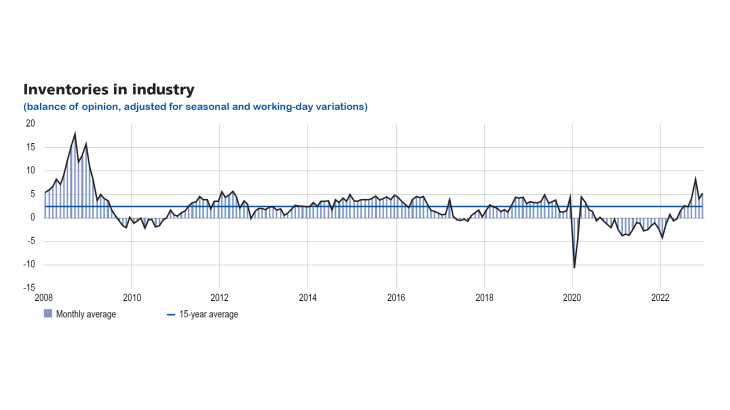

Inventories hardly changed in February. The balance of opinion on inventories remained negative in the agri-food industry due to supply difficulties weighing on production (packaging, bottles, wood for cooperage). In the automotive and electrical equipment sectors, however, it was well above its long-term average, due to a higher production volume than deliveries.

In market services, activity rose markedly, both in personal services (accommodation and food services - which benefited from the return of foreign customers - as well as car repairs) and above all in business services (management consultancy, programming and consultancy). Temporary employment was down for the second month in a row. In this activity, the drop in demand is linked, on the one hand, to the slowdown recorded in various sectors (construction, transport and logistics) and to organisational changes within companies, and, on the other, to a rise in the price of contracts from temporary employment agencies. In addition, some companies are also choosing to integrate temporary workers into their staff.

Activity was stable in construction, with structural works lagging behind finishing works, as in previous months.

Balances of opinion on cash positions improved somewhat in industry, although they were still below their long-term average. This improvement was mainly driven by the automotive, aeronautics and computer, electronic and optical products sectors. They deteriorated again in services in February.

2. In March, business leaders expect activity to rise further in industry and services, and to fall slightly in construction

For March, business leaders in industry expect activity to rise in most sectors, notably in the computer, electronic and optical products, pharmaceuticals and automotive sectors. Conversely, activity is expected to decline in the wearing apparel, textiles and footwear sector.

In services, business leaders were still expecting an increase in activity, albeit a more moderate one than in previous months, with some heterogeneity across sectors: most business services are expected to grow slightly, while transportation and car repairs are expected to dip somewhat.

Lastly, in construction, activity is likely to mark time, driven down by structural works.

Our monthly uncertainty indicator, which is constructed from a textual analysis of comments by the respondent companies, hardly changed in February; it ceased to decrease in industry, while it eased in services.

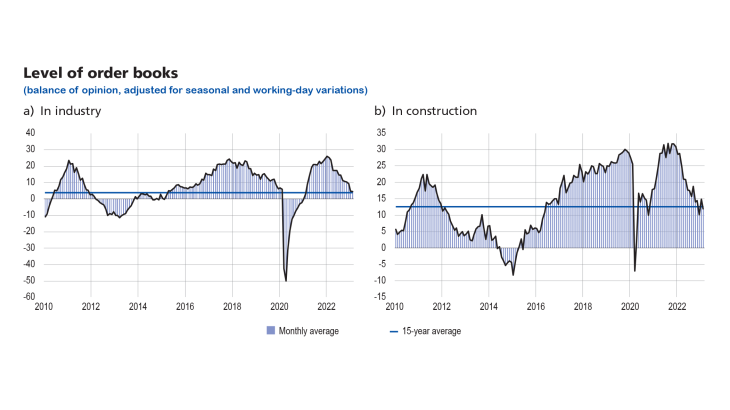

The balance of opinion on order books in industry stabilised close to its 15 year average.

However, order books were still below their long-term average in the agri-food industry, chemicals, rubber and plastic products, wood, paper and printing sectors. Since mid-2022, the deterioration in order books in construction has been exclusively attributable to structural works, which have been hit by the sharp decline in the sale of individual new dwellings; thanks to energy renovation activities, order books in finishing works have remained stable over the past nine months.

3. Supply difficulties – in industry – and recruitment difficulties stabilised; price growth for finished goods slowed in February

In February, supply difficulties stabilised in industry (affecting 33% of businesses) and continued to decline in construction (24% after 31%). However, certain inputs are again mentioned as sources of supply difficulties: wood, glass (agri-food industry), titanium, electronic components (aeronautics), tiles, slate (construction).

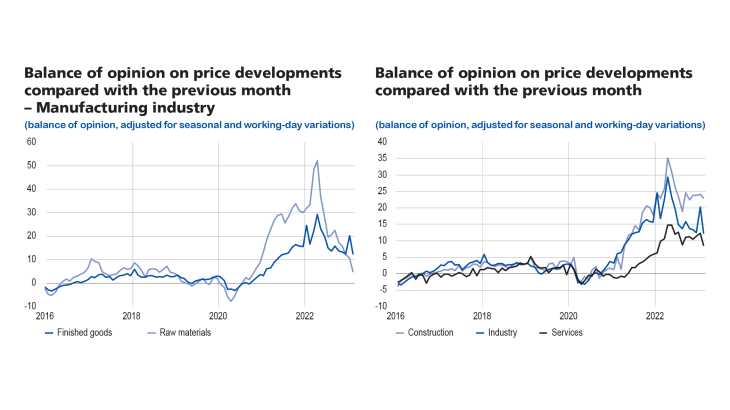

According to business leaders in industry, growth in raw material prices dropped significantly in February, falling back to a level close to that observed prior to the Covid crisis, with different situations across sectors: while input prices started to decrease in certain sectors (chemicals, rubber and plastic products), their growth is still deemed high in the agri-food industry. After the traditional peak observed in January, price growth for finished goods also slowed in industry, construction and market services, but to a lesser degree than raw material prices. This slowdown is expected to continue in March.

More specifically, 24% of business leaders said they had raised their selling prices in industry in February (compared with 32% in February 2022); in construction, this proportion stood at 32% (compared with 36%). In services, the proportion was lower, but close to that observed in February 2022 (20%, compared with 19%). The outlook for March suggests that these proportions will further decline in construction (25%), market services (18%) and industry (21%), with the notable exception of the agri-food industry: in this sector, close to one business out of three said it had raised its prices in February (compared with 30% in February 2022), and this proportion is expected to climb to over 40% in March.

Business leaders were also asked about their recruitment difficulties. After decreasing for several months in a row, they stabilised at around 52% for all sectors.

4. Estimates primarily derived from the survey and supplemented by other indicators point to a slight increase in GDP (+0.1%) in the first quarter of 2023

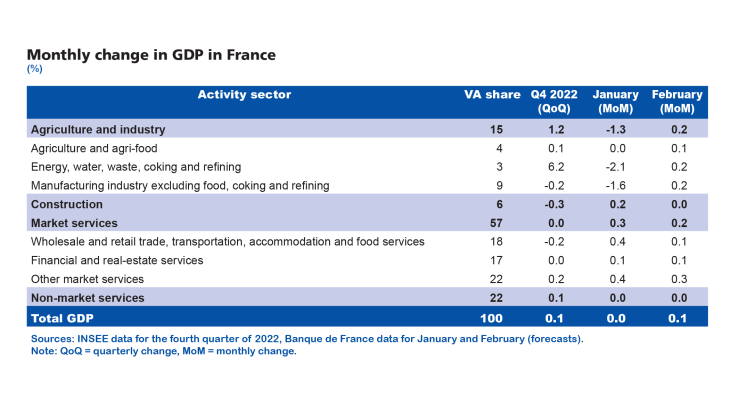

For February, based on granular information from the survey and other available data, we estimate that GDP rose slightly compared with January. This is mainly attributable to the growth of activity in industry, after the fall recorded in January according to INSEE’s industrial production index (IPI), and to the dynamism of market services.

Based on the survey data, value added is projected to have risen slightly in the agri-food and manufacturing industries. After the strong rebound observed at the end of 2022, activity is expected to stabilise in coking and refining, and to inch up in energy (these sectors are not covered by the survey). Value added in those services covered by the survey is predicted to have increased in February, in personal services, accommodation and food services, and business services. After falling at the end of 2022, activity in construction is projected to have stabilised in January and February.

The high frequency data that we monitor in parallel for those services sectors excluded from or only partially covered by the survey point to a slight rise in value added in wholesale and retail trade, and to a slight drop in transportation.

The expectations of surveyed business leaders for March point to a slight increase in GDP compared to February, although again with contrasting outlooks depending on the sector (stability in construction and slight rise in industry and services).

Over the first quarter of 2023, GDP growth should amount to +0.1% compared with the previous quarter, which is slightly better than expected in our last macroeconomic projections published in December. Despite the positive trend for February and March, GDP growth should remain moderate over the quarter due to the downward revision of January’s activity level following the incorporation of most recent data (January IPI, December IPS, Banque de France January survey of retail trade).

Download the PDF version of this article

Updated on the 25th of July 2024