This document presents a set of basic model elasticities (BMEs) of the Banque de France's new macroeconomic model for France (FR-BDF) in its version published in 2019. Readers interested in a detailed description of the model should refer to the specific working paper (Lemoine et alii 2019), while this set of BMEs is mainly intended as a stand-alone supplement for practitioners of forecasting or economic policy analysis on France.

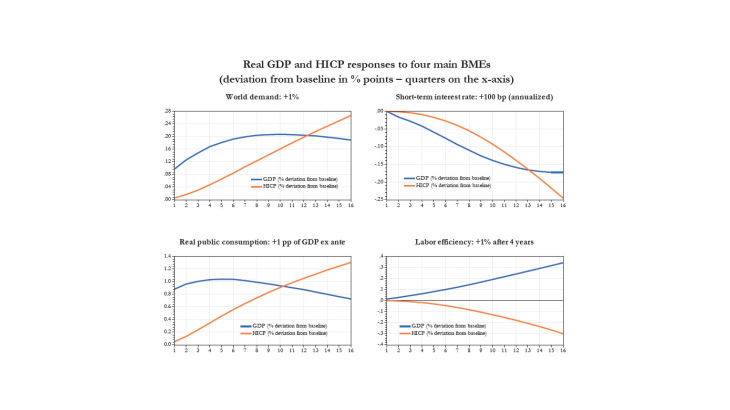

It provides a summary description of the model's response to a number of shocks grouped into four families:

- External shocks (oil price, world demand, competitors' prices) ;

- Monetary and financial shocks (exchange rates, short interest rates, long interest rates, property prices) ;

- Public finance shocks (public consumption, public investment, social benefits, direct taxes, social contributions) ;

- Structural shocks (efficiency, structural unemployment and labour force).

The BMEs presented are constructed on the basis of "pure" shocks in the VAR expectations version of the model - the one used for forecasting. These BMEs are "analytical" in the sense that they give the model's reaction to a specific shock, but are not "realistic" in the sense that, in reality, the economy is affected by a combination of shocks and the various variables concerned interact with each other. For example, in order to describe the total effect of a monetary policy decision, at least a priori one would have to associate the BMEs of short rates, long rates and exchange rates. Moreover, all the BMEs assume that only France is affected by the shock, even when this assumption is inherently unlikely.

However, by combining several BMEs the practitioner can construct these realistic and coherent scenarios, and this booklet of BMEs thus provides the basic building blocks. Finally, it should be noted that the approach here is aggregated and that other tools should be used to examine specific sectoral effects or distributive effects within households.

Reading the different BMEs provides a better understanding of the mechanisms at the heart of the FR-BDF model. A few main ideas can be retained. Monetary and financial shocks spread visibly through the economy. When other interest rates and the exchange rate are assumed to be fixed ("pure" short-rate shock hypothesis), the short rate acts in the model via the channel of expectations, in particular via expected permanent income, unemployment expectations and inflation expectations. Exogenous demand shocks diffuse through the usual channels, notably employment and agents' income. They also affect prices fairly rapidly, which, under the assumption that monetary policy does not react, triggers the main mechanism for rebalancing the economy through price competitiveness. Expectations also play a role in demand shocks, with in particular effects on anticipated unemployment, which plays a role in wages, and on expected inflation, which in particular affects household and business investment via the real cost of capital. Finally, structural shocks highlight the importance of mechanisms for rebalancing supply and demand, particularly via the nominal sphere.