Although central banks have a special role, they are still banks. They issue financial liabilities and hold financial assets. They are generally owned by their governments and their net profits are regularly transferred to the Treasury through dividends. The consolidated balance sheet of the central banks of the euro zone is published every week by the European Central Bank (ECB).

Central banks issue two important types of liabilities

Central banks issue two important types of liabilities, which comprise the monetary base: bank notes in circulation and deposit and current accounts.

Bank notes – the euro bills in your wallet – are printed by central banks. They are sold to retail banks on demand in exchange for interest-bearing claims so that your bank can give them to you when you make a cash withdrawal.

Bank notes do not earn interest. Since bank notes cost very little to print but are exchanged at face value, central banks make seignorage revenue on the issuance of bank notes because the financial claim yields a return that in general exceeds the zero return on money. There are currently about 1.2 trillion EUR worth of euro bank notes circulating in the world. The value of a bank note comes from its role as legal tender and the public’s faith that its purchasing power will not be eroded by inflation.

Central bank accounts are provided to domestic banks, international financial institutions and governments to facilitate payment flows between them. When you pay for a laptop using a credit card, then the transfer from your bank account to the seller’s bank account ultimately involves a transfer from your bank to their bank across their respective accounts at the central bank. Major central banks pay interest on these deposit accounts or current accounts and it is via these rates that central banks steer other interest rates in the economy and thereby implement monetary policy. The deposit facility rate of the ECB is currently negative, -0.5%, implying that banks are paying to hold their reserves at the central bank.

Backed by a range of assets

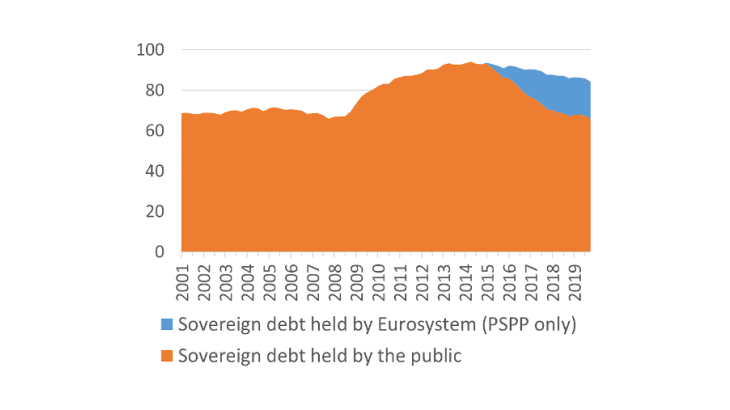

On the asset side, central banks hold gold and foreign exchange reserves, collateralized loans to banks and outright purchases of euro area government and corporate bonds (and a few other things). Historically, the ECB and the national central banks – the “Euro-system” - used collateralized loans to banks (known as repos) to regulate the amount of reserves in the system and influence the interest rate on borrowing between banks. Since 2015, the Euro-system has purchased around 2.8 trillion EUR of bonds under its Asset Purchase Programme (APP) as an additional tool of monetary policy (see Figure 1). On 12 March 2020, this was extended by a further 120 billion EUR and under the Pandemic Emergency Purchase Programme (PEPP) announced on 18 March 2020 the Euro-system will purchase an additional 750 billion EUR of assets by the end of 2020.

Public finances and the limits of central bank money creation

The assets purchased by the Euro-system include government bonds, corporate bonds, asset-backed securities and covered bonds. The purchases are split between the national central banks and the ECB and government bonds are bought more or less in proportion to the fraction of the capital of the ECB held by each member. So French government bonds comprise about 20% of government bonds purchases under the APP and these are mostly purchased by the Banque de France (BdF). The split of purchases across countries is more flexible under the PEPP.

When the BdF buys a French government bond from a French bank, it credits the deposit account of that bank at the BdF. The BdF now earns interest income from this bond and pays interest on the deposit created - both interest rates can be negative. As long as the yield to maturity rate of return on the bond is above the deposit rate, the BdF earns a profit, which it eventually transfers to the French Treasury.

Since the central bank owns government debt and the government owns the central bank, cannot government debt held by the central bank be cancelled leaving the combined balance sheet unchanged? No, not only is annulling sovereign debt illegal in the euro area but the central bank also still owes interest on the deposits created. This is not a problem now since the deposit rate is negative but may become a problem when the deposit rate becomes positive. The central bank will owe money without income to pay for it. The central bank will also record a significant capital loss.

There are mainly two possibilities to resolve this income deficit: either the transfers between the central bank and the government serve to absorb the loss, or the central bank repays by issuing new reserves. In the first case, the government has to accept a lower monetary dividend. In the second, whilst it is true that central banks can always create additional deposits to pay for this shortfall, this risks becoming a pyramid scheme, as the central bank has to issue increasing volumes of deposits to pay interest on its existing reserves. Banks will have more and more central deposits for which there is little prospect of obtaining real value. Inflation is the inevitable consequence when households and firms begin to doubt about the value of this money and begin to spend their money before its purchasing value disappears. This may start an inflationary spiral.

A similar problem would occur with monetary finance - paying for public expenditures through central bank money creation. A central bank can simply credit funds into the account of the government. But when this money is spent, the deposits will transfer from the government’s account to a bank’s account (similar to the laptop example). The central bank will owe interest on this deposit but without any additional asset to pay for it. A similar inflationary spiral can begin.