At the end of April 2020, a third of all employees were working from home (Dares, 2020), although with significant disparities depending on the sector, skill level and therefore geographical region. According to the DARES-ACEMO survey, in April 2020 the share of staff working from home stood at 65% in the IT and communications sector, 54% in finance and insurance, and only 15% in transportation and 4% in catering and accommodation. A number of recent studies have shed light on the transformations that might result from more widespread use of teleworking (Bergeaud and Ray, 2020, Batut, 2020).

A transformation of the labour market?

Teleworking will most likely lead to major changes in the way people work as, in general, employees tend to value being given greater flexibility in the way organise their working time. The majority of employees who work from home say they are on the whole satisfied with their experience (59.3% in France according to a June/July survey conducted by the European Foundation for the Improvement of Living and Working Conditions). Numerous employers also expect teleworking to be used more widely: a study by the Federal Reserve Bank of Atlanta forecasts a threefold rise in teleworking in the near future. The terms of this transformation will need to be negotiated in advance between employees and employers. During these talks, employers will be able to stress the advantages for workers in terms of reduced commuting times, better management of working hours, and greater flexibility and autonomy in managing tasks (although with major legal issues). Conversely, employees will be able to highlight the potential productivity gains for the firm, and above all the transfer of overheads (rents, electricity, heating etc.). However, the question of whether firms will see productivity gains is still the focus of debate (see Cette, 2020, Batut and Tabet, 2020), which could further complicate the negotiations.

Towards less office space?

More widespread use of teleworking, particularly among white-collar workers in the services industry who are the biggest beneficiaries, could lead to major transformations in the commercial real estate market. Demand for office space should fall in densely populated urban centres where prices per square metre are already very high, leading in turn to a decline in prices, and reversing the trend towards urban agglomeration observed since the 1980s, both in France and the United States. A study conducted at the start of the epidemic confirmed that, in the United States, there is a negative correlation between firms’ use of teleworking and their expectations of their future need for office space.

However, a study conducted in the United States in June among a panel of business leaders suggests that demand for office real estate may not necessarily decline once the crisis ends. According to the study, the reduced demand for offices caused by increased teleworking would be offset by the expected rise in activity for those firms that survive the crisis. This optimistic outlook can probably also be attributed to the robust US economic recovery plan, notably at the start of the summer, and the impact this had on business confidence. Therefore, the latter is probably affected by a perception bias, which raises questions as to the validity of the results over time, particularly for other countries.

All these changes will only take place if teleworking continues over the long term and becomes a permanent part of France’s working culture.

An illustration of the geographical heterogeneity of the effects in France

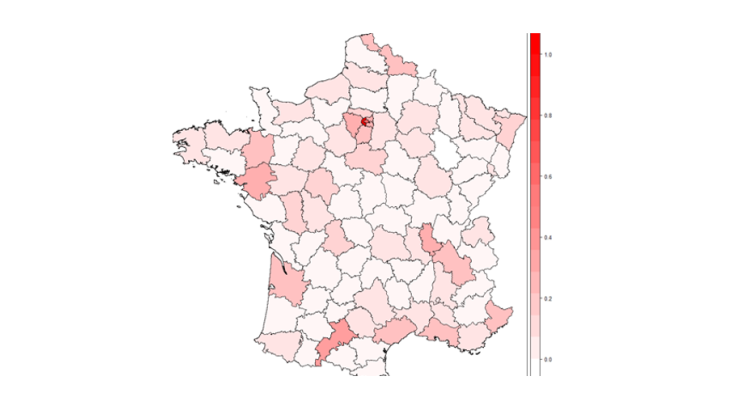

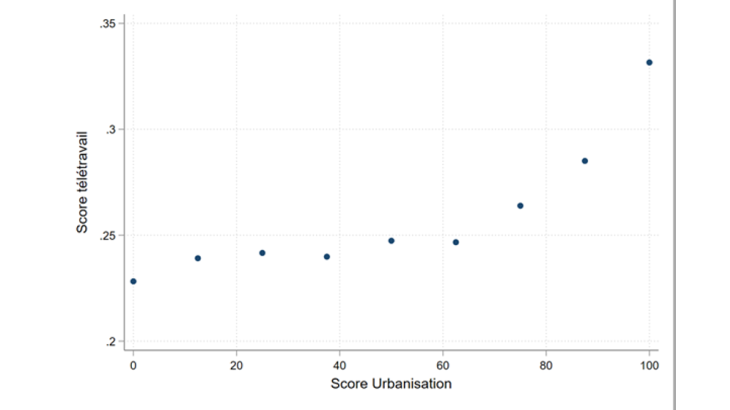

It is possible to replicate the Dingel and Neiman (2020) study for France in order to calculate local exposures to teleworking in each municipality. To do this, we combined social security data (DADS – the annual declaration of social data by INSEE) with information on whether a given job can be done at home, depending on its content, according to sector and socio-professional category. Using this data, we found first that, as might be expected, “teleworkable” jobs are not distributed evenly across the country. The map in Chart 1 shows that departments that are more densely populated have greater exposure to teleworking. Chart 2 goes further by examining the phenomenon at municipality level, and compares levels of urbanisation, as measured by INSEE, with our measure of exposure to teleworking. It shows that exposure is high in those municipalities that are most urbanised, and which traditionally have higher concentrations of white-collar and services jobs.