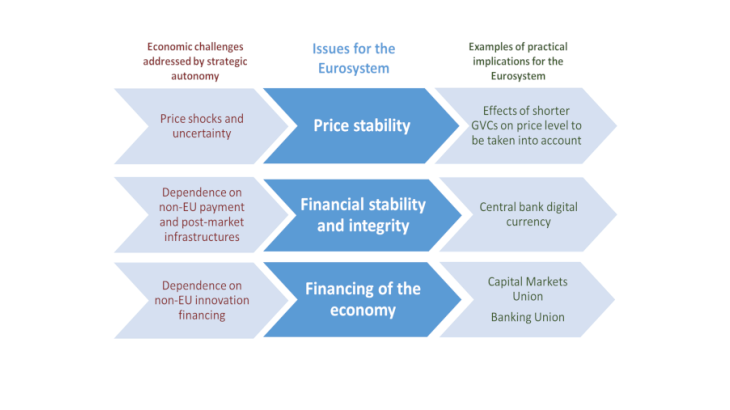

With globalisation under stress, the economic role of European strategic autonomy

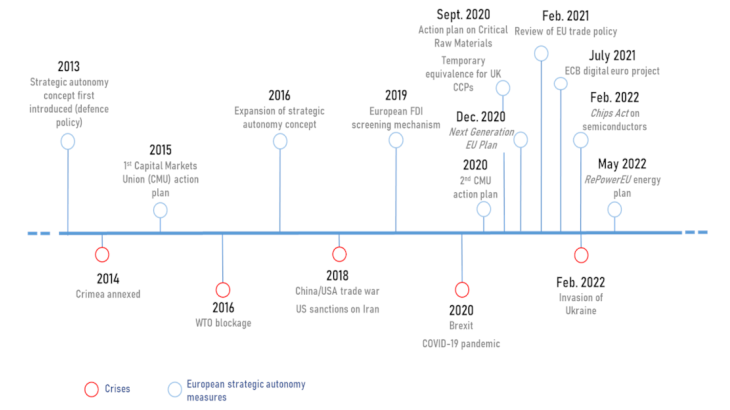

The concept of strategic autonomy – or the “capacity [of the European Union] to act autonomously when and where necessary” (Council conclusions, 2016) – is critically important to the security of the EU's economic and financial relations, and not just for the Union's security and defence policy, which is where the term was used for the first time in 2013 (European Council conclusions).

The concept is a complex one, due to its closeness to the notion of sovereignty. This has spawned differing domestic considerations, setting proponents of economic openness against those who feel that Europe should play a stronger international role (van den Abeele, 2021). The term “open strategic autonomy” (Commission, 2020) therefore represents something of a compromise. The idea is that upholding the Union’s interests and reducing its dependencies can help to preserve security, while not standing in the way of the EU's openness.

Meanwhile, recent events, including strained US/China relations, the Covid-19 pandemic and Russia’s invasion of Ukraine, have exposed areas of vulnerability for the EU in connection with its economic and financial dependencies. This spurred a gradual shift in how Member States perceive the effects of globalisation.

On the trade front, these vulnerabilities stem from reliance on non-European partners in key sectors, such as commodities (particularly energy, where 55% of consumption is met through non-EU sources, ECB, 2023), manufacturing (e.g. intermediate goods such as electronic components, with China accounting for 14% of value added in European imports in 2018) and strategic inputs (China accounts for 13% of value added in imports of basic metals, for example, ECB, 2023).

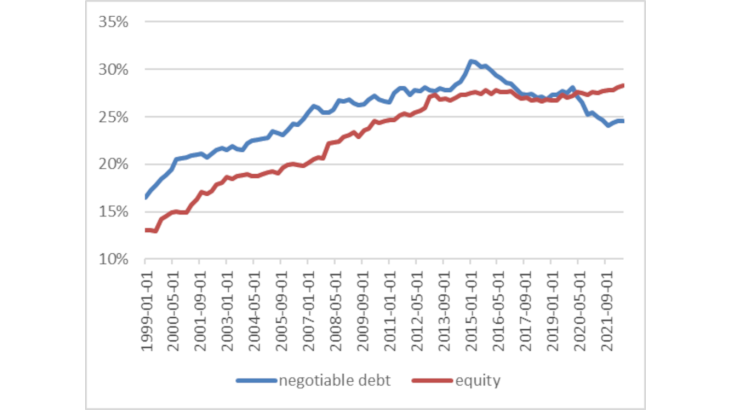

In investments, the EU is primarily interconnected with developed countries. The United States, in particular, is responsible for nearly 30% of mergers and acquisitions in the EU (ECB, 2023). But investments by major emerging countries in the EU have been rising since the mid-2000s, especially in strategic sectors such as energy infrastructure and transportation.

New public policies aimed at fostering strategic autonomy

Against this backdrop, Europe’s “strategic autonomy” concept is designed to ensure that the EU can defend its economic interests on the international stage.

With this in mind, Europe has launched several strategic autonomy initiatives over the last decade, aimed at developing specific industrial and trade policies (Diagram 2). Among the recent measures, the EU Chips Act (2022) seeks to bolster the Union's capacity to produce semiconductors, which are manufactured extensively outside the European Union at present. In investment flows, Europe set up a cooperation mechanism in 2020 to screen inward foreign direct investments in order to prevent non-EU ownership of certain sectors that are sensitive in terms of national security.