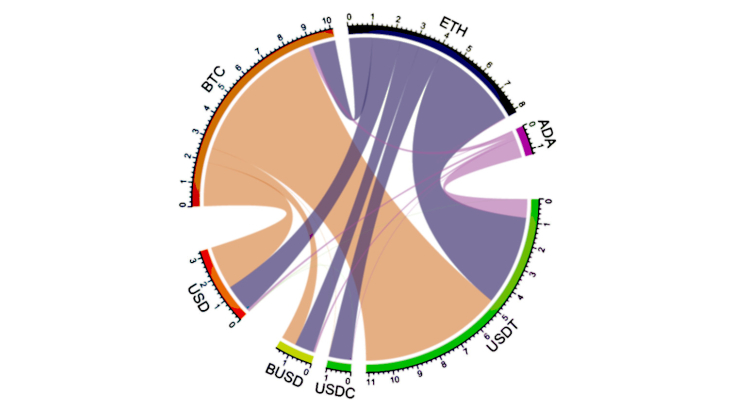

Note: Average daily volume traded between pairs [USD: US dollar, BTC: Bitcoin, ETH: Ethereum, ADA: Cardano, USDT: Tether, USDC: USD Coin, BUSD: Binance USD], over one year (September 2020-September 2021), based on Cryptocompare data, aggregated from 70 exchange platforms. All volumes are converted into US dollars. The thickness of each string reflects the volume traded on a pair, in billions of US dollars. As an example, the average volume of Bitcoins traded daily is USD 10 billion, of which USD 6 billion is traded against Tether and USD 1 billion against Ethereum.

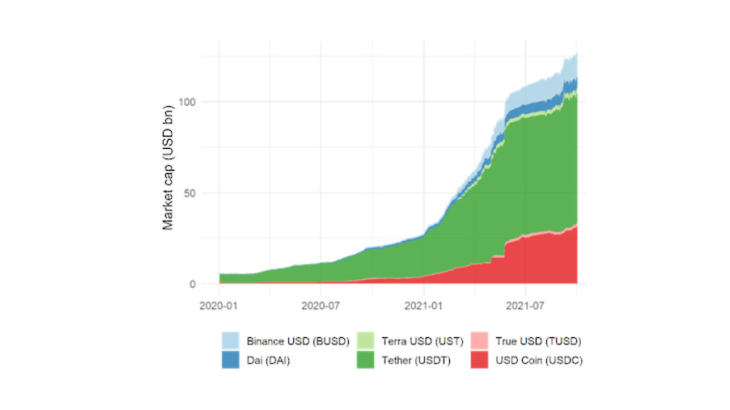

Several strategies have been adopted by stablecoin issuers to ensure stability. In the case of the two largest stablecoins, Tether and USD Coin, which aim at maintaining a stable parity against the US dollar (i.e., 1 Tether = 1 US dollar), the issuer declares that each token is backed by dollar-denominated reserve assets and that it is prepared to convert the tokens at a fixed parity of 1 to 1.

If this is the case, it means that fluctuations in the demand for the main stablecoins - caused, for example, by Bitcoin volatility - lead to variations in the amount of reserve assets held by stablecoin issuers and are likely to abruptly alter the demand for short-term dollar-denominated financial assets, with potentially destabilising effects. A sudden demand for stablecoins to be converted into US dollars would result in reserve asset sales and, all else being equal, an increase in their interest rate.

Stablecoins as an interface with the financial system

Up until very recently, stablecoin issuers offered no transparency about the nature of the assets held as reserves. This summer, Tether (USDT) and Circle (USDC) disclosed the composition of their assets, revealing a large share of commercial paper issued in US dollars by companies and banks (CP). Some issuers of stablecoins are reported to have become among the largest holders of CP in the United States, along with major money market funds (Fitch Ratings, 2021).

Although at this stage the amount of CP outstanding is still much larger than the capitalisation of stablecoins, the US dollar CP market is already linked to the demand for stablecoins. In a recent study, Barthélemy et al. (2021) use econometric analysis to confirm that there exists a statistical link between certain new issues of US dollar CPs and stablecoin capitalisation; they verify that this result cannot be explained by other factors, such as a simple temporal trend, the growth of stock market assets (Nasdaq, etc.) over this period, or the Fed's monetary policy. The analysis also suggests that the rates on some CPs react downward to a growth of stablecoins.

Such a mechanism could become a source of financial instability via the short-term debt market. First, some of the current financing of banks and companies could be sensitive to fluctuations in crypto-asset prices via changes in the reserve assets of stablecoin issuers. Second, the downward pressure exerted on CP rates by the rapidly growing demand for reserve assets by stablecoin issuers is likely to encourage banks and companies to make greater use of this type of short-term financing, thus raising their indirect exposure to movements in crypto-assets.

What framework for stablecoins?

The links between crypto-assets as a whole, stablecoins and the financing of the economy highlight the importance of regulating these markets. For example, economists draw parallels between stablecoin activity and historical experiences that ultimately required the intervention of regulators (Gorton et Zhang, 2021), and helped define, for banks, regulatory requirements such as deposit guarantees, or for money market funds, the very precise disclosure of the composition and valuation of their assets.

In this context, the supervision of crypto-assets is developing in many jurisdictions. At the international level, the regulation of stablecoins according to the "same activity, same risk, same rules" principle vis-à-vis traditional financial intermediaries has been established, with the definition of a harmonised regulatory framework underway (Financial Stability Board, 2020). In the European Union, the draft regulation on markets in crypto-assets (MiCA), which is currently under negotiation, aims to establish a European regulatory framework for crypto-asset issuers and crypto-asset service providers such as trading platforms.

Note: The authors would like to thank Thomas Argente, Adeline Bachellerie, Jean-Bertrand Lesparre, Alexandre Stervinou and Déborah Zribi. The data from Coinmarketcap and Messari are not subject to any regulatory control. The fact that they are used in the context of this post does not mean that the Banque de France acknowledges their reliability.