Post n°261. A central bank’s inflation objective can be formulated using a point target, a target range or a combination of the two. In this blog, we show the disadvantages of a target range for anchoring inflation expectations and for macroeconomic stabilisation. The analysis thereby underpins the ECB’s adoption of a clear and symmetric 2% inflation point target.

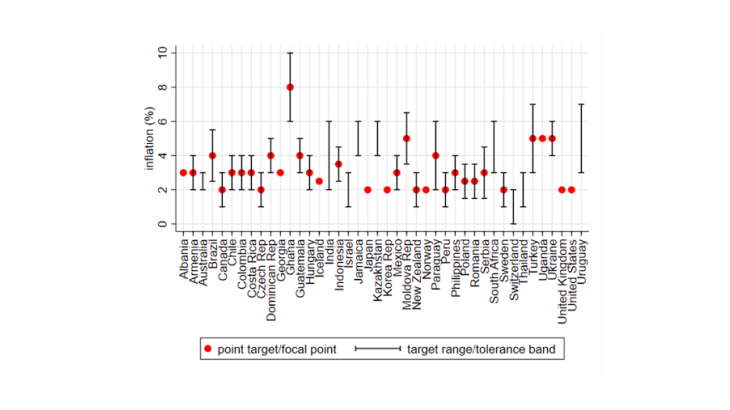

Note: Inflation objectives of central bank inflation targeters and the US. The ECB is not shown as its objective until 2021 did not fall within the proposed categories.

The inflation objective: a great diversity of formulations around the world

The success of the inflation-targeting framework since the early 1990s has rendered the quantitative formulation of a central bank objective for inflation commonplace. While many countries have been operating with a precise numerical definition for many decades, no unique way of formulating the inflation objective has emerged. While some central banks announce a target range for inflation, others have a precise point target. Hybrid versions are also widespread, such as a target range with a focal point, or a point target with an explicit tolerance range. In July 2021, the ECB announced that a 2% inflation target best serves its price stability objective over the medium term. Chart 1 shows target formulations in 40 countries at the beginning of 2020.

The adoption of a tolerance range has also been studied in the context of the Fed and ECB strategic reviews (see in particular Chapter 3 of the Occasional Paper "The ECB's price stability framework: past experience, and current and future challenges"). A range around a point target could seem appealing since it reflects explicitly the uncertainty of short-run inflation rates, which can be affected by monetary policy only with a lag.

While the concept of a point target is easy to understand, a recent taxonomy indicates that there are at least three different interpretations of ranges (Chung et al. 2020). First, explicit ranges can reflect uncertainty about and imperfect control of inflation outcomes in the short run. Second, a range could indicate the indifference of a central bank to inflation outcomes. Third, operational ranges can indicate to what extent a central bank intends to follow secondary objectives in the event that an inflation trade-off arises. In practice, ranges are most often used to signal uncertainty about inflation in the short run, while true indifference ranges are very uncommon.

Empirical assessment: a range reduces the anchoring of inflation expectations

The goal of an inflation objective is to anchor inflation expectations at the desired level by revealing policy intentions. It is not clear theoretically whether ranges are beneficial for this. On the one hand, the central bank could gain credibility by explicitly revealing the uncertainty of inflation in the short run. On the other hand, explicit bands might be misunderstood as true indifference or operational ranges, even if the policy makers’ intention is to signal that fine-tuning of inflation is impossible in the short run. In this case, the long-run inflation expectation might drift within the range, leading to less well-anchored expectations.

In a novel empirical study, Ehrmann (2021) finds that the pass-through of realised inflation to short-run inflation expectations is lower in countries operating with a target range than in those using point or hybrid target formulations. While these results suggest better anchoring of expectations for inflation ranges, the level at which these expectations are anchored remains an open question.

In a complementary empirical analysis, Grosse-Steffen (2021) finds evidence that, compared with target ranges, point targets and hybrid targets are associated with a significantly higher probability that professional forecasters will predict inflation in a close interval around the (midpoint) of the target (range). The impact of an explicit numerical focal point is of similar magnitude for forecast horizons of between two and six years. Furthermore, during periods of persistent deviations of realised inflation from target, there are less frequent extreme or “outlier” forecasts. In fact, point targets attenuate the rise in “outlier” forecasts, contributing to well-anchored expectations even in turbulent times. The empirical findings are consistent with forecasters interpreting ranges, at least to some extent, as zones where monetary policy is less active, either due to indifference about inflation outcomes within the range, or due to higher relative priority being given to subordinate objectives.

A model-based assessment: an inflation range worsens macroeconomic stability

Having discussed the effects of target formulations on expectations formation, what would be the implications for macroeconomic outcomes? A modeling approach that compares an inflation range objective with a point objective can provide insights.

The inflation range objective is represented as the central bank responding less forcefully when inflation lies inside a band around the target than when it lies outside that band. Furthermore, one can vary the degree of asymmetry in how the central bank responds to the inflation gap within and outside the band.

The model then tells us how macroeconomic stability is affected. Overall, Le Bihan et al. (2021) show that inaction ranges – i.e. an excessively low degree of reaction to the inflation gap inside a band – may be destabilising, as they can generate additional macroeconomic fluctuations unrelated to fundamentals (sunspots). This is in line with other recent studies which show that ranges induce worse outcomes for the volatility of inflation and output.

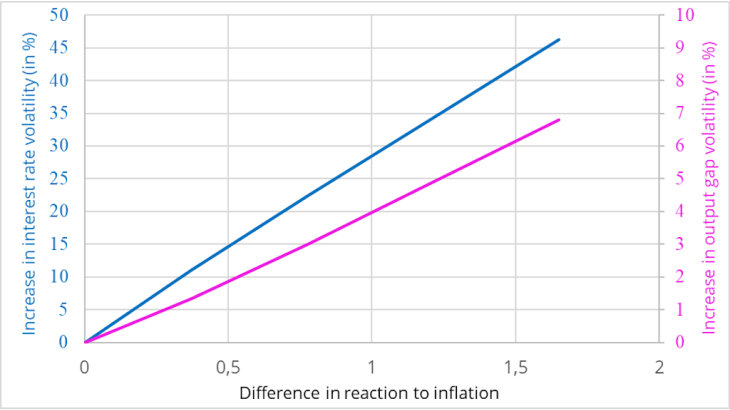

In addition, Le Bihan et al. (2021) point to an unfavourable trade-off between activism within and outside the range: the reaction to inflation outside the band has to be very strong to make up for even a mild decrease in the reaction within the band. Chart 2 illustrates the consequences of this result. The x-axis depicts the differential between activism outside and inside the range: the limit case x=0 (lower left corner) corresponds to a point target while an increase in x represents a higher level of activism outside the band versus inside. The blue line shows the required level of interest rate volatility to ensure a given level of inflation volatility, when we vary the asymmetry of reaction between outside and within the band. This results in an undesired increase in the output gap volatility (in magenta). The conclusion is that inflation ranges are undesirable for macroeconomic stabilisation.

In particular, one conclusion of the Strategic Review was the adoption of a symmetric 2% inflation target over the medium term.

Source: Le Bihan et al. (authors’ computations)

Note: Relative increase in interest rate volatility (%, LHS) and output gap volatility (%, RHS) that ensures a given level of inflation volatility.