- Home

- Publications and statistics

- Publications

- The Bank's VSE-SME correspondents during...

Post n°185. During the lockdown, the Banque de France's network of VSE-SME correspondents was greatly called upon to guide entrepreneurs in their requests for financing. Managers' concerns changed during this period.

French public authorities and banks proved very active in helping entrepreneurs

Until the COVID-19 crisis, no company manager could have imagined a total shutdown of his activity. While large companies were able to draw on their available credit lines very rapidly, VSEs and small SMEs were less "armed" to deal with this shock. VSE-SMEs therefore largely turned to the support mechanisms set up by the public authorities and to the Banque de France for personalised support in order to find suitable solutions to overcome this difficult period.

Entrepreneurs' concerns were largely focused on financing

Thus, during the lockdown, more than 6,000 managers made appointments with the Banque de France's local VSE-SME correspondents in metropolitan France and in the overseas territories. This significant number makes it possible to map the changes in VSE-SME managers’ concerns during the lockdown.

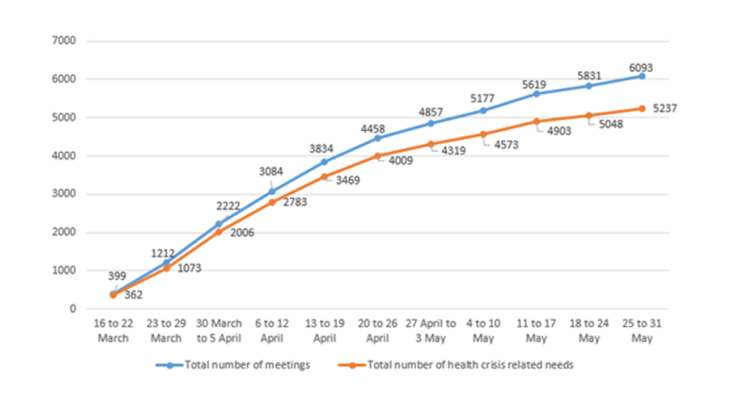

As shown in Chart 1, between 16 March and 31 May, over 6,000 meetings were held, of which 5,237 related to the health crisis. It should be noted that during a meeting, company managers could express one or more needs.

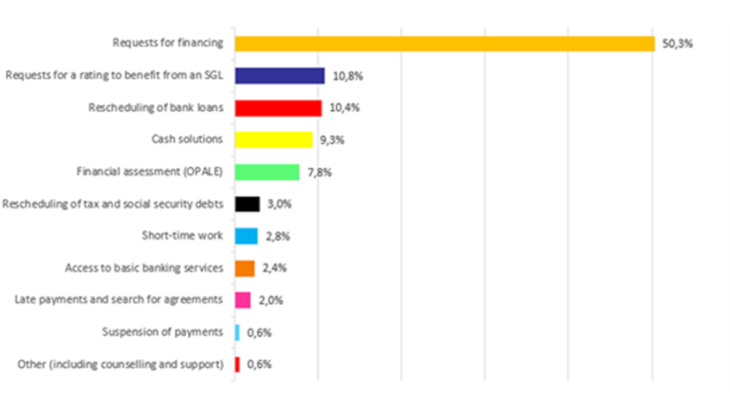

Among these needs, 80.8% are directly or indirectly related to financing (see Chart 2).

The demands made were predominantly requests for all types of loans (59.6%), including State-guaranteed loans (SGL) and rescheduling of bank loans (10.4%). As cash management is one of the main concerns of entrepreneurs impacted by the crisis, some turned to the accelerated rating procedure set up by the Banque de France (10.8%) in order to qualify for SGLs extended by commercial banks. This procedure has thus enabled companies rated up to 5+ to benefit from this scheme.

This chart also shows that close to 16% of company managers got the help of VSE-SME correspondents in applying for rescheduling of tax and social security debts and for short-time work, and in steering their company and negotiating agreements.

Still in terms of support, 2.4% of entrepreneurs were helped to access professional banking services, a task that also falls within the remit of the Banque de France. In the event that a commercial bank refuses to open or close an account, the Banque de France is authorised to appoint a financial institution that will open a bank account to provide the entrepreneur with basic banking services.

These needs changed between 16 March and 31 May 2020

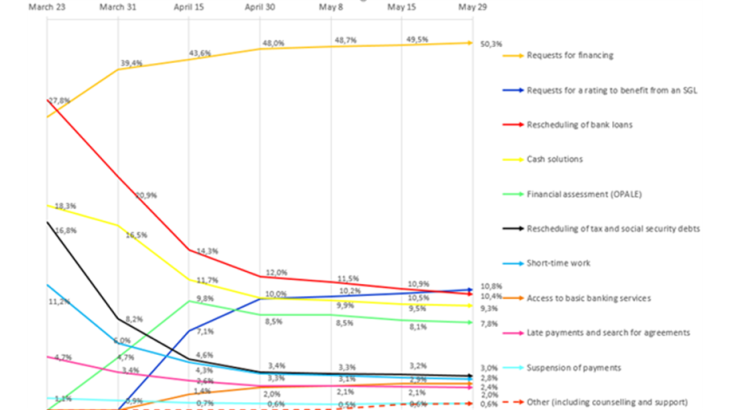

Entrepreneurs’ needs changed during the lockdown. The curves in Chart 3 show the behaviour adopted by companies over time to overcome cash flow difficulties and, as far as possible, to settle their charges.

This snapshot of the changes in entrepreneurs’ needs in terms of financing shows that requests accelerated at the start of the lockdown, then remained at a high level from April 2020.

During the lockdown, entrepreneurs also placed increased requests with the Banque de France in order to rapidly obtain a rating for their company and benefit from an SGL, depending on the quality of their rating (10.8%). In the absence of a rating between 3++ and 5+, the applications were studied on a case-by-case basis by financial institutions. Overall, between 16 March and 31 May, the refusal rate for SGLs was very low, at around 2.4%.

The strong initial interest shown in the measures taken by the government and commercial banks gradually decreased as company managers benefited from this support; a fall in requests was then recorded for the rescheduling of bank loans (from 27.8% to 10.4%), cash solutions (from 18.3% to 9.3%), the rescheduling of tax and social security debts (from 16.8% to 3%) and short-time work (from 11.2% to 2.8%).

Finally, in April and May, requests for management assistance through the Banque de France's OPALE financial assessment tool dropped slightly, falling to 7.8%. The other were relatively stable over time.

... and affected business sectors and regions very differently

Compared to other sectors, the most exposed were trade (30%), business and household services (17%), accommodation and food services (15%), and construction (14%).

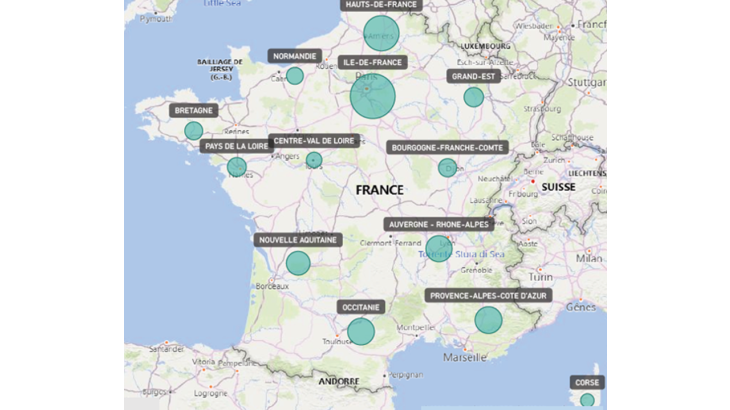

The number of requests made also varied greatly by region. Ile-de-France and Hauts-de-France jointly recorded 36% of requests for support provided by VSE-SME correspondents in metropolitan France during the lockdown, while the three regions Provence-Alpes-Côte d'Azur, Occitanie and Auvergne-Rhône-Alpes accounted for 30% of requests.

The Banque de France's personalised support for VSE-SMEs throughout the country, which was much in demand during the lockdown, will remain just as active during the coming period to help entrepreneurs with their endeavours and enable the economy to return to growth and employment.