- Home

- Publications and statistics

- Publications

- The Covid-19 economic crisis: what would...

Post n°161. History remembers Roosevelt for pulling the United States out of the Great Depression. He did it through communication – responding to the concerns of the American people – and by changing economic policy. His goal? To break out of the vicious circle in which pessimism amplifies a recession. Although the crises may differ, this blog looks at the lessons that we can learn from this strategy for the current crisis.

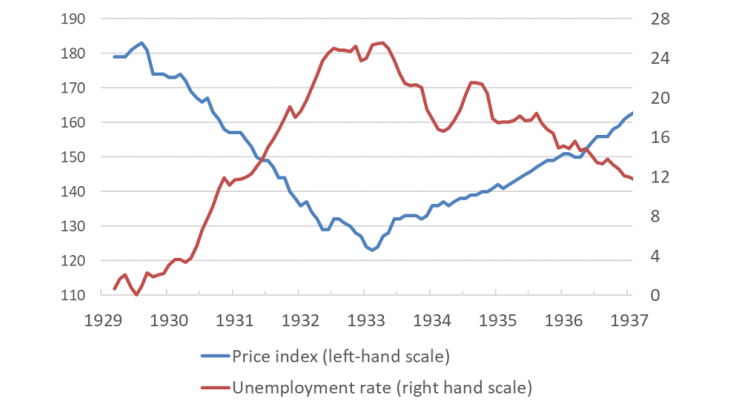

When President Roosevelt took office on 4 March 1933, panic in the banking sector had already been spreading for a month. The United States had been in a depression since 1929, the banking system had been badly shaken by a series of recurrent bank runs and the unemployment rate had hit 25% (see Chart 1). There had been a cascade of bank failures since October 1929 and financing of the economy had come to a standstill. Prices, along with employment and income, were falling by 10% a year, increasing the weight of debt repayment in agents’ revenues.

Roosevelt turned the tide. The recovery was sudden and dynamic. Inflation expectations became better oriented. The unemployment rate fell by a third and inflation returned to positive territory. While all policies prior to 1933 had failed to rectify the situation, Roosevelt’s policies succeeded in a matter of weeks.

Why? What did Roosevelt change? What lessons can we learn for our handling of the current economic crisis?

From recession to the Great Depression

Economics teaches us that a recession turns into a depression when pessimistic expectations become self-sustaining. This mechanism has been well known since Keynes: agents anticipate a fall in prices and everyone consequently responds rationally by delaying spending, thereby sustaining the decline in aggregate demand and forcing prices down further.

History teaches us that depressions do not result from government inaction but from economic policy mistakes and uncertainty with regard to future public policy. Until 1932, there were heated debates and experts were divided as to what to do. President Hoover fought back against falling prices with legislation favouring cartels and combines between producers. However, as Milton Friedman and Anna Schwartz showed for the central bank, everyone was a prisoner of their own beliefs. For example, invoking the Real Bills Doctrine and the perceived need to safeguard the US dollar’s convertibility into gold, the Fed raised its policy rate in autumn 1931. This tightening triggered a further wave of bank failures that reduced the money supply and banks’ supply of credit.

This dual Keynesian and Friedmanian legacy sets out three pitfalls that Roosevelt was able to avoid at the time: (i) doubts about the resilience of the banking sector, which were the primary cause of the recession; (ii) the self-sustaining nature of the depression; and (iii) uncertainty with regard to future economic policies.

The opening months of the Roosevelt presidency: communication and reorienting the policy mix

Roosevelt put forward concrete, credible measures to safeguard bank resilience, began to communicate directly to the people and reoriented the policy mix.

To stop the run on banks, Roosevelt acted quickly. On 6 March 1933, he declared a four-day banking holiday to keep all banks closed. On 9 March, Congress voted through legislation, defining the rules for a gradual reopening and authorising the central bank to provide banks with as much money as they had good quality assets on their balance sheets.

He addressed the American public directly during his “fireside chats”, regular radio broadcasts describing decisions taken in concrete terms and explaining each of his chosen policy stances. During his first fireside chat on 12 March 1933, he justified his decision to close the banks, explaining, “We do not want […] another epidemic of bank failures”. He went on to explain when and how the banks would be gradually reopened. His other broadcasts discussed monetary and fiscal policy.

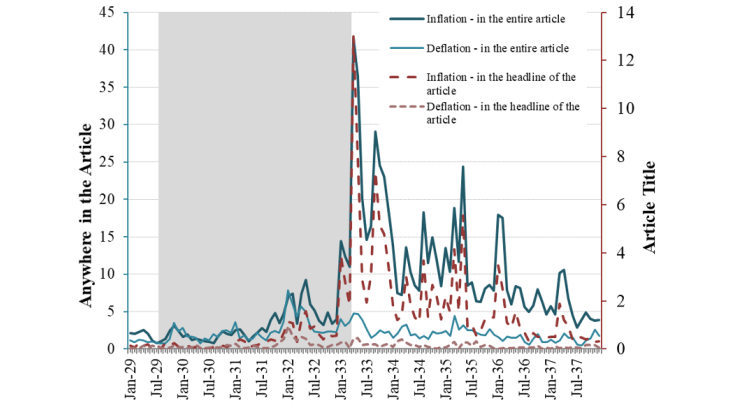

This policy of direct communication addressed the public’s concerns about the state of the banking system. It subsequently gave a forward guidance to economic policy that was likely to pull the economy out of depression and bring inflation back into positive territory. The results were immediate: Jalil and Rua (2016) show that Roosevelt’s communication policy launched the public debate on inflation (see Chart 2) and raised inflation expectations.

Note: The left-hand scale shows the number of times “inflation” and “deflation” appear in the headlines of US newspaper articles and the right-hand scale shows the number of times they appear in the articles themselves. The grey shaded area corresponds to the period of recession as defined by the NBER.

The authorities placed monetary and fiscal policies at the service of one unique objective: economic recovery. Jacobson, Leeper and Preston (2019) refer to this economic policy mix as unbacked fiscal expansion, characterised by:

1. In terms of monetary policy, an accommodative stance to raise inflation:

- To address falling inflation expectations, the United States followed the example of several other countries by devaluing the US dollar against gold by 40%, making imported goods more expensive.

- To combat the contraction of the money supply caused by bank failures and declining deposits, in May 1933 Congress instructed the Fed to purchase government debt securities on the financial markets in addition to its conventional tool of private debt repurchases.

2. In terms of fiscal policy, Roosevelt announced that until the economy had been properly kickstarted the increase in public spending would be financed by debt, which is somewhat akin to a fiscal “forward guidance”. Roosevelt pointed to the exceptional nature of the situation to justify this fiscal expansion: “a war for the survival of democracy”.

According to Jacobson, Leeper and Preston (2019), this mix of economic policies created a nominal wealth effect. Government debt rose more rapidly than future tax increases, boosting the (discounted) nominal wealth of the private sector. This wealth effect drove up aggregate demand, which put an end to the self-sustaining nature of the depression. In the end, the fiscal multiplier was high because public spending was not accompanied by the expectation of a future contraction in business activity caused by a fiscal consolidation. This was made possible by the devaluation in 1933, which meant that the fiscal constraints imposed by the gold standard could be temporarily relaxed.

Two lessons for recovery from the crisis

Of course, a comparison proves nothing. The root causes of the Great Depression and the current recession were very different: the banks in the United States and the epidemic today. We do not have the same institutions, but we can learn from history. And Roosevelt’s handling of the crisis can teach us two lessons.

1. Depression is avoided through credible communication that (i) uses practical and relevant examples to provide reassurance on the authorities’ ability and willingness to act against the root cause of the recession and (ii) reduces uncertainty with regard to future policies.

2. In certain circumstances, if the economy is to recover, fiscal consolidation may have to be delayed until long-term sustainable growth has returned, in order to create a nominal wealth effect.