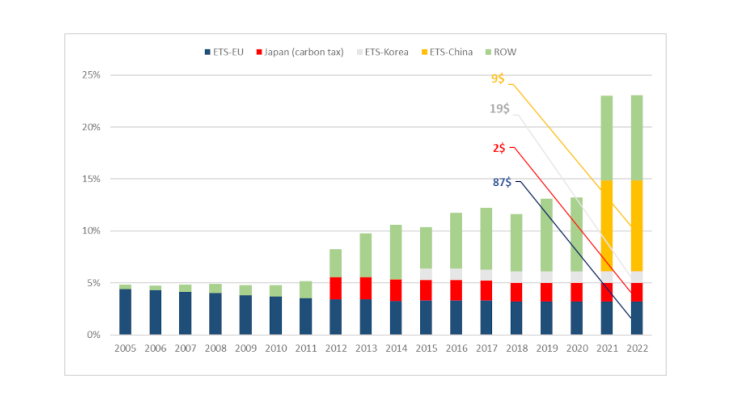

In order to limit global warming to 2°C, the global price of carbon needs to be between USD 50 and USD 100 per tonne of CO2 equivalent (tCO2eq) by 2030 (IMF, 2022). However, more than three-quarters of emissions are not covered by pricing systems and the IMF estimates that the global average price is USD 3 per tonne.

Consequently, discussions are currently underway in multilateral fora (G7, G20) on extending the geographical and sectoral coverage of carbon pricing. An international agreement on a global, uniform carbon tax is highly unlikely, particularly due to the principle of common but differentiated responsibilities (CBDR), which is enshrined in international environmental law conventions and requires advanced countries to make a more significant contribution to the climate effort. The German G7 Presidency championed the idea of a climate club (without penalising non-members as proposed by Nordhaus), which would start with an initial group of countries that shared similar climate ambitions, and would expand over time. The European Union (EU), with its carbon market extending beyond its borders (Norway, for example), is already a sort of climate club.

The IMF has added to these initiatives with its proposal for an international carbon price floor (ICPF). To properly bring all these efforts together, three major issues must be addressed: the effort sharing between advanced and emerging countries; carbon leakage; and the interplay between pricing and non-pricing measures.

Fair effort sharing

The ICPF is a proposal to introduce carbon price floors but it does not stop countries setting higher price floors should they so wish. The prices of these carbon floors vary depending on the level of economic development of the participants, with the floors set at USD 25 tCO2eq for low-income countries, USD 50 tCO2eq for middle-income countries and USD 75 tCO2eq for high-income countries.

This differentiation is designed to bring the measure into line with CBDR and to rally support from emerging countries. This support is vital: action from advanced countries alone is not enough to establish an emissions trajectory that is consistent with the Paris Agreement. According to the Global Carbon Project, the EU accounted for 8% of global territorial emissions linked to fossil fuels in 2021, compared with 30% for China. In addition, countries that do not apply a carbon price floor would reap no economic benefit from non-participation due to negative indirect effects (lower exports to advanced countries with carbon offsetting at the border). India is the only major emerging country for which the benefits of non-participation would outweigh the disadvantages (Bellora and Fontagné, 2022-a).

However, this mechanism has three main difficulties.

- The effort would mainly be borne by emerging countries (China, India, Russia, Saudi Arabia, South Africa, Turkey), whose nationally determined contributions (NDCs) currently equate to an implicit carbon price that falls well short of the envisaged floor price. Conversely, the USD 75 floor price is less than the carbon price implied in the NDCs of the most advanced countries.

- The differences in price floors between countries at varying levels of development would result in carbon leakage at the expense of countries with the most ambitious climate policies.

- As decarbonisation is achievable through carbon pricing, regulations and/or subsidies, the question arises as to how the implicit price of non-pricing measures should be taken into account.

Carbon leakage and adjustment mechanisms

The differentiation of carbon price floors creates a risk of carbon leakage. In particular, industries that are heavy CO2eq emitters and therefore penalised by carbon pricing, tend to relocate to countries where the price (or restrictions on emission) is less stringent. This reduces or cancels out completely the emission reduction efforts agreed at the global level. The EU’s proposal for a Carbon Border Adjustment Mechanism (CBAM) is intended to counter this risk (Cezar, Grieco, 2021).

For the IMF, the disadvantages of a CBAM outweigh its advantages, notably due to uncertainties as to its legal and practical viability and its lack of impact on global greenhouse gas emissions.

However, these concerns should be put into context.

- The European CBAM does not aim to reduce global emissions. Its objective is to limit the very high carbon leakage associated with the scope of the EU’s Fit for 55 legislative package, which itself aims to reduce European emissions.

- The IMF, by suggesting a carbon leakage rate that falls within the lower range proposed in the literature (6.5%), could be underestimating the risk and consequently the utility of the CBAM. This rate greatly depends on the size of the coalition (the risk of carbon leakage increases if the number of countries working together on climate issues declines) and whether or not the different countries comply with their NDCs. In the IMF’s ICPF scenario (Chateau et al., 2022), countries implement a carbon price equivalent to the maximum of the carbon floor price and the carbon price implicit in their NDC commitment as of November 2021. For example, for the EU, if we take into account the impact of Fit for 55, the carbon leakage rate would be at least 31%, assuming that only countries with a nation-wide carbon market will be able to meet their commitments (Fontagné, Bellora, 2022-b).

- Lastly, the IMF does not assess carbon leakage that could arise between ICPF participants as a result of the price floor differentiation. As such, the EU’s CBAM would still be relevant even if the ICPF was applied.

Carbon price equivalence of regulatory measures

The ICPF aggregates the pricing and regulatory components of national transition policies in an overall implicit carbon price. It includes alternative measures to “explicit” pricing, such as regulations, subsidies and climate investments.

These measures are doubly advantageous in that they are more politically acceptable and are complementary: a carbon tax is more effective in terms of CO2 reductions, but its negative effects on growth can be softened by other instruments such as subsidies. Consequently, being able to compare these different policies with regard to cost/advantage/effectiveness is becoming essential, and the OECD and the IMF are working in this direction.

Recent international discussions point towards alternative or complementary solutions.

- While the ICPF targets the economy as a whole, action could shift towards sectoral approaches, as the IMF has envisaged in its minimal cooperative solution scenario, with a carbon price restricted at a minimum to high carbon intensity sectors for emerging countries.

- International cooperation could also focus on results (emission reductions) rather than on the policies put in place to achieve them, even though this approach, which informed the Paris Agreement, has not yet proven itself to be effective.

Furthermore, the question arises as to how to use carbon tax revenues to financially support the efforts of emerging countries, where the marginal efficiency of a one euro investment in decarbonisation is very high. The above policies could be funded by redistributing advanced countries’ carbon tax revenues or CBAM proceeds. More generally, international financial and technological transfers should be encouraged.