- Home

- Publications and statistics

- Publications

- When the ECB lends in US dollars: Centra...

Post n°170. US dollar funding costs in foreign exchange markets rose sharply in March 2020 when the supply of US dollars in FX swap markets dried up with the onset of the pandemic. Central banks reacted quickly by activating swap lines, which enabled them to provide US dollar liquidity to banks in their jurisdictions.

Notes: The calculations follow the standard approach, i.e. Du et al (2018), and are calculated as the difference between the 3-month Libor rates in USD and EUR plus the log difference of the forward and spot exchange rates (EUR per USD), adjusted for the 3-month maturity.

The US dollar (USD) is widely used in international transactions and is considered a major safe-haven currency. Besides being the currency of choice for many central bank reserves and private sector holdings of external assets, the US dollar is the major currency for trade invoicing (Gopinath, 2015), cross-border banking (Aldasoro and Ehlers, 2018) and international bond issuance (Maggiori et al, 2019). There is therefore a strong overseas demand for US dollars coming from corporates, investors and banks, in order to fund their global activities or FX hedging.

Pandemic-induced USD funding stress

The measures taken by governments around the world to contain the spread of the coronavirus resulted in a flight into safe-haven currencies, in particular USD-denominated assets, and led to an appreciation of the US dollar, especially during the second week of March 2020. The pandemic led to outflows from US money market funds that provide USD to large corporate firms and banks as investors fled to government debt.

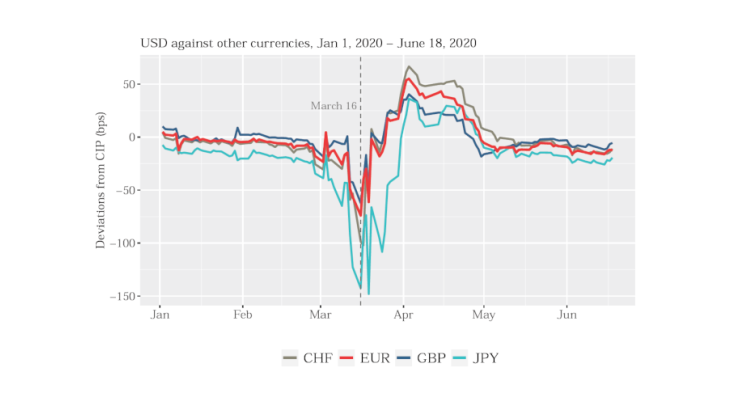

On a global scale, these developments spilled over to other funding markets, in particular by raising the funding costs of non-US global banks, which were cut off from direct USD borrowing in US money markets and had to turn to USD funding via FX swap markets (Avdjiev et al, 2020). These turbulences are well proxied by deviations from covered interest parity (CIP) that emerged with the onset of the Covid-19 pandemic in Asia and Europe (see Chart 1).

What is CIP and why did it break down with the onset of the pandemic?

Banks wishing to fund a USD asset have two broad options: borrow USD either directly in USD funding markets or through FX swaps. In the former, the costs of borrowing 1 USD are equal to the interest rate paid on USD loans, r$ . Borrowing USD via FX swaps, known as synthetic USD funding, consists in borrowing the equivalent amount of 1 USD in a different currency, i.e. EUR, and entering an FX swap contract simultaneously. Via the latter, the borrower receives 1 USD against the amount of s EUR (where s is the spot exchange rate in terms of EUR per USD) at the beginning of the contract and agrees to pay back 1 USD at the end of the contract against the amount of f EUR (where f is the forward rate). The cost of such a synthetic USD loan is the interest rate paid on the EUR loan, r€, as well as the price of the FX swap, which is simply the difference between the spot and forward rates.

Covered interest parity states that both types of funding should be priced equally: 1 + r$ = (1 + r€)s/f . If synthetic USD funding were pricier than direct USD funding, borrowers would simply turn to the latter and ignore the former. However, when investors are weary of counterparty risk and seek safe-haven assets, markets become fragmented and deviations from CIP arise: non-US global banks do not receive direct funding on US money markets and are willing to pay a premium for synthetic USD funding to obtain much needed USD liquidity. Deviations from CIP, defined as the difference between direct and synthetic USD, are shown in Chart 1 for the USD and major currencies. USD-EUR deviations from CIP widened in March 2020 and reached up to -75 bp, indicating that global non-US banks paid a premium for USD liquidity obtained via FX swap markets.

Alleviating USD funding stress through central bank swap lines

Given that they have no stable USD funding in the form of retail deposits, non-US global banks are particularly dependent on US money market funding, be it direct or via FX swaps. Rising USD funding costs and market disruptions pose a particular challenge for non-US banks as they cannot access direct liquidity support that might be provided by the US Federal Reserve to US banks. For this reason, deviations from CIP are a closely watched indicator of USD funding stress for non-US global banks.

Central bank swap lines are established to provide foreign central banks (i.e. the Eurosystem) with foreign currency (i.e. USD) to be lent to banks in their jurisdictions (i.e. the euro area). Central bank swaps work similarly to regular FX swaps with the exception that the spot and forward rates are set at the same level in advance and decided by participating central banks instead of market mechanisms.

USD central bank swap lines were heavily deployed during the 2008-2009 financial crisis. Since 2010, permanent central bank swap lines have been in place between the Fed and the European Central Bank, the Bank of Japan, the Swiss National Bank, the Bank of England and the Bank of Canada respectively.

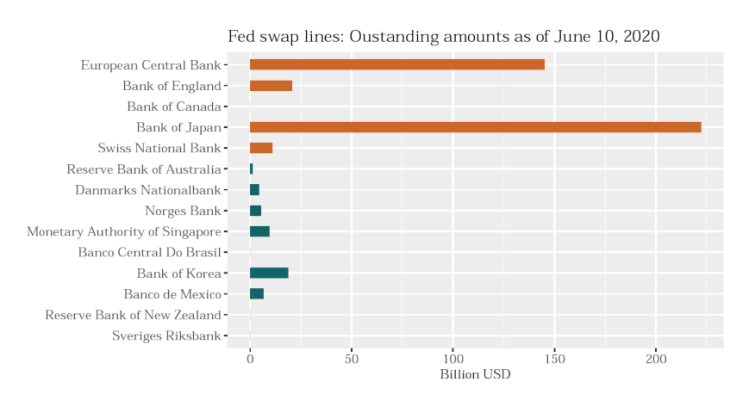

In March 2020, major changes were implemented to address USD funding strains. Taking effect in the week of 16 March, the pricing of these USD loans was lowered to 25 bps over the risk-free overnight rate. In addition to the already available 1-week maturity, USD liquidity support was made available at a much longer maturity of 84 days. The Federal Reserve also established additional temporary swap lines with the central banks of Australia, Brazil, Denmark, Korea, Mexico, New Zealand, Norway, Singapore and Sweden. Japanese and – to a lesser extent – euro area banks were among those taking up the largest amounts of USD liquidity (see Chart 2).

Notes: The chart shows the outstanding amounts of USD liquidity facilities taken up by counterparty central banks. The orange bars indicate the USD swap lines that had already been established since May 2010, while the green bars indicate the newly established swap lines. 10 June corresponds to the maturity of 84 days after the activation of the permanent swap lines (March 19).

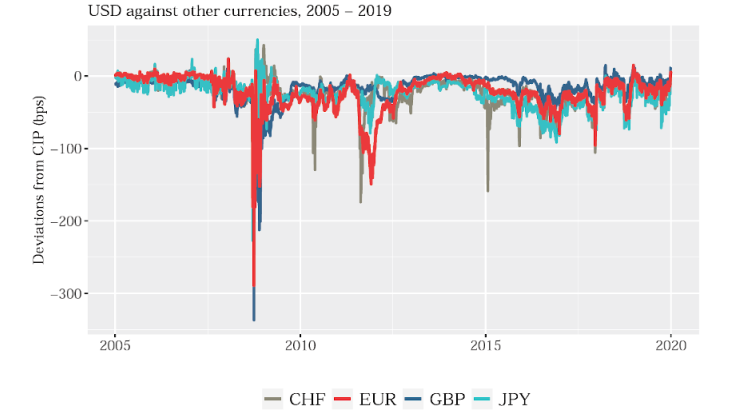

USD funding premia dropped in the second half of March 2020 and deviations from CIP comparable to those reached during the Great Financial Crisis and the European sovereign debt crisis could thus be avoided (see Chart 3). During the month of April, USD-EUR CIP deviations even turned positive, reaching unprecedented levels. During this period, USD central bank swap lines led to cheaper USD funding via FX swaps than in US money markets. Market participants took advantage of these arbitrage opportunities, thus driving down CIP deviations to zero at the beginning of May (Eren et al, 2020).

Notes: The calculations follow the standard approach, i.e. Du et al (2018), and are calculated as the difference between the 3-month Libor rates in USD and EUR plus the log difference of the forward and spot exchange rates (EUR per USD), adjusted for the 3-month maturity.

USD liquidity support was taken up quickly in the euro area: outstanding amounts of more than USD 110 billion (EUR 103 billion) were recorded in the week of 16 March and these amounts stood at more than USD 140 billion (EUR 130 billion) at the beginning of June. As a comparison, liquidity support in EUR to euro area banks in the form of LTROs increased by roughly EUR 410 billion over the same period. Taken together, liquidity support in foreign currency thus made up 25% of overall liquidity measures in the Eurosystem, confirming that international central bank cooperation is paramount in a globalised world where the US dollar is used extensively by the financial and real sectors beyond US borders.