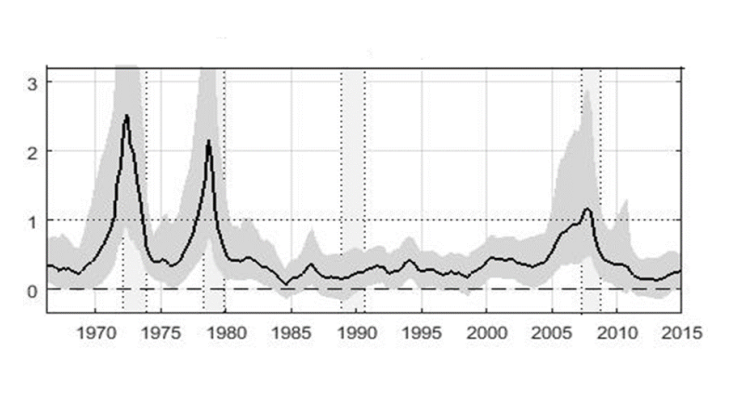

Note : The solid line is the two-year government-spending multiplier for output, defined as the cumulated increase in output in response to a cumulated increase in government spending that amounts to one percent of GDP. Gray shaded area represents the 68 percent error band around the median. The gray vertical bars indicate recession episodes in the UK.

While in theory the effects of fiscal stimulus should be greater at the ZLB, the empirical literature is not conclusive…

The size of the fiscal multiplier is among the most studied issues in economics. Yet, its exact definition varies substantially from one study to another, often making comparisons difficult. In this post, we focus on the government-spending multiplier for output, which represents the increase in GDP generated by an extra unit of government spending (the sum of public consumption and investment). Because government spending is a part of GDP, a multiplier below (equal to) one is considered low because it means that a change in government spending decreases (doesn’t move) other components of GDP, like consumption and investment, or because part of the stimulus leaks abroad through higher imports. Low multipliers can result for instance from households reducing consumption in anticipation of future increases in taxation to repay current government expenditure, from an increase in net imports (as imports generally increase in response to higher domestic output while exports, mainly driven by external demand, vary little), and from monetary policy responses. In fact, in normal times, the effect of a fiscal stimulus is inflationary and monetary policy responds by increasing interest rates. This generates higher savings and a crowding out effect on private consumption, resulting in an output multiplier lower than one. Economic theory however also offers a number of reasons why fiscal multipliers may vary over time and be at times larger than one.

- According to the economic slack hypothesis, multipliers should be larger in recessions because government spending can mobilise idle resources without generating inflationary pressures.

- At the ZLB, fiscal multipliers may be large because central banks are unwilling to respond to inflationary pressures generated by positive fiscal shocks, as they would otherwise.

Note that we will use hereafter the term ZLB although policy rates can be stuck at a negative value (called effective lower bound, ELB) and that ZLB will cover here all situations in which conventional policy might be irresponsive to inflationary pressures (e.g. forward guidance policies).

Understanding whether the economic responses to a fiscal stimulus change in these two states of the world (negative output gap and ZLB) is crucial to provide guidance to policymakers. In particular, since in response to a shock the optimal policy-mix between fiscal and monetary policy depends on the state of the economy, it is important to know in which circumstances it is more effective to use one or the other lever (or both simultaneously).

While the theoretical literature is rather consensual on fiscal effects being stronger at the ZLB than in periods in which conventional monetary policy is unconstrained (e.g. see Christiano, Eichenbaum and Rebelo, 2011), the empirical evidence is rather mixed (e.g. see Klein and Winkler (2018) and Ramey and Zubairy (2018)). Conversely, the vast empirical literature on fiscal multipliers in times of slack, initiated by the influential work of Auerbach and Gorodnichenko (2012), finds few exceptions to the positive correlation between the impact of fiscal stimulus and the degree of slack in the economy.

The size of fiscal multipliers at the ZLB may indeed also depend on other factors at play…

Having policy rates stuck at a low level may not be a sufficient condition per se to have higher fiscal multipliers. Indeed, multipliers can be low, despite the irresponsiveness of conventional monetary policy, when:

These factors should be taken into consideration when trying to evaluate the interaction between monetary and fiscal policy at the ZLB.

In the UK, for instance, hitting the ZLB does not seem to generate per se larger multipliers, while the presence of slack and loose monetary policy do

Glocker, Sestieri and Towbin (2019) explore the time-variation of UK government spending multipliers over the period 1965-2015. Their main finding, shown in Chart 1, is that the UK government-spending multiplier of output varies over time in a cyclical manner, consistently with theories emphasising the role of the economic slack. It is in general:

- above one during recessions

- below one during expansions.

Additionally, analysing possible factors driving the cyclicality of the UK fiscal multiplier and the consequences of the ZLB (between 2009-15 the Bank of England policy rate was kept unchanged at 0.5%), the authors find that economic slack and access to credit (a proxy for financial frictions) are important to explain time-variation. Further, the relationship does not shift during the 2009-15 period, suggesting no specific effect of the ZLB on the size of the multiplier. This is found to be true even though the real policy rate, used as a proxy for the stance of monetary policy, is significant in influencing the fiscal multiplier. UK fiscal multipliers are found to be larger when conventional monetary policy is loose (when unconventional tools are introduced, the real rate is however a less good proxy of the overall stance because real rates may remain unchanged or even increase if inflation falls).

Ceteris paribus, the lessons of economic literature suggest potentially large fiscal multipliers during the post-Covid19 recovery phase

Today, at a time when the policy rates of major advances countries are back at the respective ZLB/ELB, we may ask what to expect in terms of macroeconomic effects from the adoption of fiscal recovery plans in economies hit by the Covid19. Abstracting from other important factors, such as differences in public debt-to-GDP ratios or in debt servicing costs, and in the absence of further lockdown measures, the current coexistence of multiple conditions suggest potential large fiscal multipliers for most countries. Among them, as explained earlier, significant expected economic slack, unconventional monetary measures currently in place keeping medium and long-term interest rates low, and central banks’ forward guidance suggesting that policy rates are likely to remain at the current levels for a long time.