The Federal Reserve does not have an explicit financial stability objective that extends beyond its supervisory responsibilities. Nonetheless, a narrow interpretation of the dual mandate, i.e. ignoring any interactions between monetary policy and financial stability risks would not be credible (see Kashyap and Siegert, 2020). Indeed, even in the absence of an institutionalised communication strategy, Federal Open Market Committee (FOMC) members do express their views on financial stability risks and policy consequences through informal public remarks.

In a recent study, we assess what Fed speeches reveal about financial stability concerns and whether there is a relationship between higher proportion of time devoted to this topic systematically and the Fed’s monetary policy decisions (Istrefi, Odendahl and Sestieri, 2020). We focused on speeches because they provide a more flexible form of communication compared to standard Fed communication through statements or reports. Moreover, speeches are likely to reflect the debates and opinions expressed in FOMC meetings that have guided policy (Bernanke, 2015).

Fed officials talked more about financial stability around the period of the global financial crisis

We analysed the main topics covered in Fed speeches, and consequently, their relative times in a speech, labelled as “topic proportion”. To extract this information from speeches we employ textual analysis techniques, commonly used to extract information from text data. We looked at around 3,850 public speeches given during the period 1997-2018 by Fed officials, i.e. the Chair of the Federal Reserve, the other members of the Board of Governors and the presidents of the 12 Federal Reserve Banks (FRB).

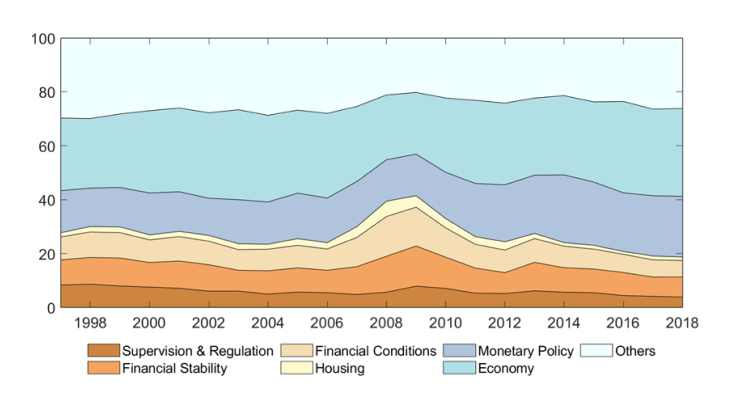

We identify 12 main topics covered in these speeches; for instance, Economy and Monetary Policy and several related to finance, such as Financial Conditions, Financial Stability, and Supervision and Regulation. Chart 1 shows changes in the topic proportions of Fed speeches at an annual frequency. We observe that, while Fed officials speak predominantly about issues related to the Economy and Monetary Policy (about 40-50%), in the period around the global financial crisis they dedicated a higher proportion of speaking time to Financial Stability and other financial-related topics. Financial Stability, the topic at the centre of our analysis, relates mainly to communication about excessive behaviour in financial markets or vulnerabilities in the financial system that are likely to have major impacts on the economy. Thus, in our setup, this topic mainly reflects financial stability concerns.

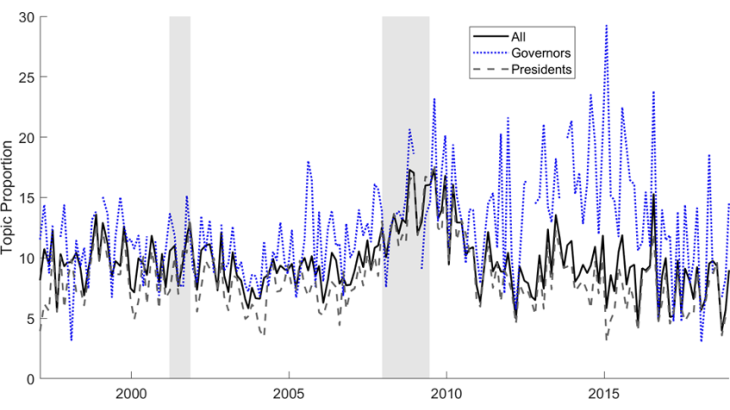

Governors and FRB presidents display differences in the intensity of communication on financial stability

While members of the Board of Governors and FRB presidents cover similar topics in their speeches, the intensity they assign to specific topics differs between them. This is the case for Financial Stability: Governors devote, on average, a higher proportion of their speeches to Financial Stability than FRB presidents, especially after the global financial crisis (GFC). However, during the GFC, FRB presidents also significantly increased their speaking time on this topic (see Chart 2). A similar pattern is observed for other financial-related topics, such as Supervision and Regulation.

These differences appear to reflect the Federal Reserve’s institutional design and the specific roles of these two groups. For instance, Governors and all the FRB presidents participate in the debate and decide on US monetary policy (the latter group is subject to a rotation of voting rights). Unsurprisingly, a large part of their speeches focuses on Economy and Monetary Policy. In addition, the Board of Governors writes regulations and creates supervisory policy for the Federal Reserve System. As part of their duties, Governors are assigned to several Board Committees, among them the Committee on Financial Stability and the Committee on Supervision and Regulation. This job "specialisation" of Governors could explain why in terms of public communication, they have more specialised speeches and therefore a higher average proportion of them in financial-related topics. The particular difference in intensity of speeches on financial stability between Governors and FRB presidents, especially during 2012-2016, corresponds to the implementation of new US banking and supervisory regulation over this period.