What is the ECB balance of risks for price stability and growth?

”The risks surrounding the euro area growth outlook remain tilted to the downside” is the latest assessment on the economic outlook as read by the ECB President Mario Draghi in the press conference on 25 July this year. This form of communication constitutes a balance-of-risks statement indicating the ECB Governing Council’s risk perception on inflation and/or GDP growth over the foreseeable future. The balance of risks is a qualitative judgment of the Governing Council but it relates in the background to the quarterly macroeconomic projections for the euro area made by the ECB and the Eurosystem staff. Staff projections generally report uncertainty or risks around the outlook for growth and inflation. The Governing Council communicates whether it sees these risks as balanced, on the upside or on the downside. The ECB comments on the balance of risks during the Press Conference following monetary policy meetings, in the Introductory Statement read by the ECB President.

The language used by the Governing Council to comment on the balance of risk varies over time. For instance, a statement on risks to price stability sometimes reads as “the main scenario for price developments in the medium term is in line with price stability ” or “upside risks to price stability over the medium term exist ”. With regard to growth, this statement sometimes reads as “The risks to economic growth appear to be broadly balanced over the shorter term or “risks surrounding this outlook for economic growth lie on the downside . The horizon over which risks are assessed may also vary. Risks to price stability are usually assessed over the medium term while risks to growth may differ from short- to medium-term.

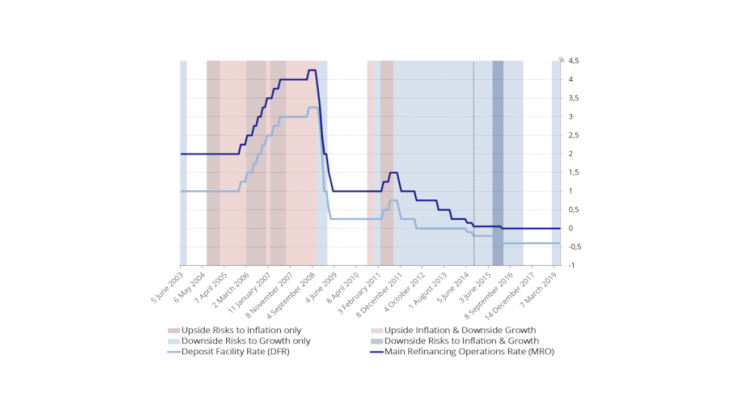

We hand-collected and analysed the qualitative assessments of the ECB balance of risks to price stability and growth from June 2003 to June 2019. Before this period, communication of the balance of risks to growth was less common, while since September 2014, the balance of risks to inflation has not been communicated on a regular basis. We distinguish several cases in Figure 1: periods with upside risks to inflation (red shaded area), periods with downside risks to growth (blue area), periods with upside risks to inflation and downside risks to growth (light red area) and periods with downside risks to both inflation and growth (dark blue area). Periods when risks to both price stability and growth are judged as balanced are left in white. In very few instances, due to ambiguous formulations of the risk assessment, we had to take decisions on how to categorise them. According to our analysis, the ECB has never communicated on upside risks to growth.

The evolution of the balance of risks shows that from mid to late 2000s, the ECB Governing Council judged risks to price stability on the upside (Figure 1). This related mainly to oil price developments and their potential to lead to second-round effects on inflation stemming from wage and price-setting behaviour. During these years, we also observe periods when upside risks to price stability coincide with downside risks to growth. For instance, during 2008, the ECB judges that “the economic outlook is subject to increased downside risks […] upside risks to price stability have diminished somewhat, but they have not disappeared .” From September 2011 onwards, the ECB has communicated downside risks to growth (with a pause from mid-2017 to end of 2018). Concerning risks to price stability, the ECB has stopped commenting on them since September 2014, except for the period between September 2015 and March 2016 when risks to price stability were judged to be on the downside.

How does the balance of risks relate to the ECB key interest rate decisions?

To answer this, we look at the evolution of the balance of risks to price stability and growth in relation to two key ECB interest rates, the main refinancing operations rate (MRO) and the deposit facility rate (DFR), from June 2003 to June 2019. One caveat to this analysis is that we considered only changes in interest rates when linking the ECB balance of risks to monetary policy decisions. For the sake of simplicity, we abstracted from relating it to ECB unconventional monetary policy tools, like forward guidance and the Asset Purchase Programme, which were introduced to address the risks of a too prolonged period of low inflation once policy rates were close to the effective lower bound.

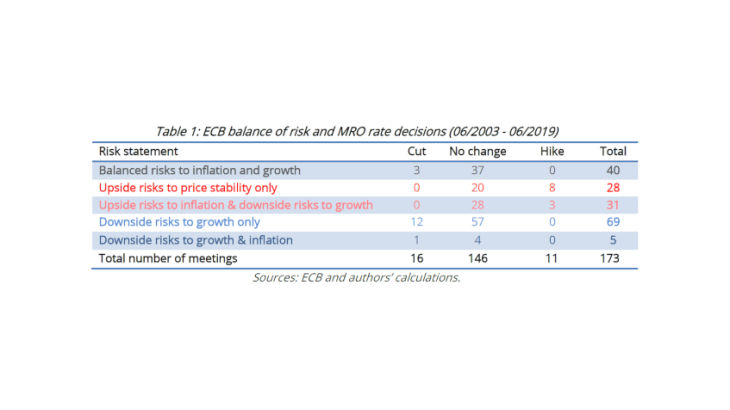

Overall, Figure 1 shows that red shaded areas are associated with interest rate hikes and blue areas with rate cuts. In more detail, Table 1 reports several combinations of the balance of risks to price stability and growth as well as the number of times the ECB decided to cut, to increase or to keep unchanged the MRO rate. We find a few regularities: i) upside risks to inflation are associated with periods of interest rate hikes; ii) downside risks to growth are associated with periods of rate cuts; and iii) when risks to growth and inflation are assessed on the opposite sides (with upside risk to inflation and downside risk to growth) we observe a few rate hikes but never a rate cut.

The latter regularity may be interpreted as concerns over price stability taking priority over growth, consistent with the ECB’s mandate. The Treaty on the Functioning of the European Union sets price stability as the primary objective of the Eurosystem, but also states that "without prejudice to the objective of price stability" the Eurosystem shall also support the general economic policies in the Union, including "full employment" and "balanced economic growth".