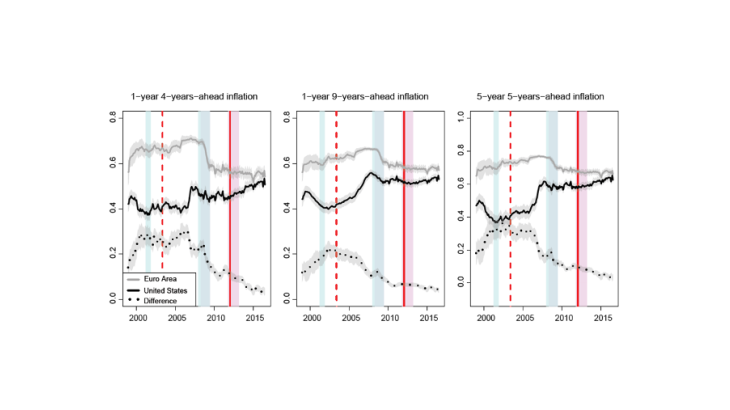

Note: Probabilities of future inflation ranging in the interval [1.5%, 2.5%]. The red dashed (solid) line reports the timing of the ECB’s (Fed’s) inflation-objective clarification in May 2003 (Jan. 2012). Pink (blue) bars report euro-area (US) recessions.

The European Central Bank (ECB) and the Federal Reserve System (Fed) are two of many central banks that have specified their inflation objective, devised to foster economic activity and employment. To meet this objective, both the ECB and the Fed pay close attention to various measures of inflation expectations to assess how stable – or “anchored” – agents’ beliefs about future inflation are.

How can inflation expectations be measured?

There are two sources of inflation expectations: surveys and financial markets.

1. Survey-based inflation expectations

Survey-based data providing information on inflation are extensive and include surveys from polling firms (e.g. Atlanta Fed Business Inflation Expectations), households (e.g. University of Michigan Inflation Expectation) and professional forecasters (e.g. ECB Survey of Professional Forecasters, Philadelphia Fed Survey of Professional Forecasters). Survey-respondents are either asked to provide their point forecast for future inflation or to assign probabilities of future inflation falling in different pre-specified bins.

Professional forecasters’ surveys, in particular, have received considerable attention from policymakers and academic researchers. This notably reflects their documented success in forecasting inflation (see Ang, Bekaert and Wei, 2007). Thus, regular references to inflation expectations stemming from professional forecasters’ surveys are often found in central bank communications – showing their importance for the monetary policy decision-making process.

2. Market-based inflation expectations

Market-based data providing information on inflation are also abundant, and range from inflation-indexed bonds and inflation swaps to inflation derivatives (e.g. inflation caps and floors). These inflation compensation measures are fairly recent – dating back to the early 2000s. Unlike surveys, they are available at a high-frequency and therefore tend to react faster to incoming information about the economy.

A documented problem in the extraction of information about inflation expectations from market-based data is that observed prices are affected by risk premia and liquidity premia. No-arbitrage asset pricing models have extensively been used to purge market-based data from risk premia. Note, however, that estimated risk premia are found to be highly sensitive to the underlying assumptions and specifications of the model (see Joslin, Singleton and Zhu, 2011; Joslin, Priebsch and Singleton, 2014).

… and are these inflation expectations anchored?

The ECB and the Fed both have a mandate to maintain price stability. They therefore strive to ensure inflation expectations remain stable around their target. The two central banks nonetheless formulate their objectives differently: the ECB aims to achieve inflation rates of below, but close to 2 percent over the medium term, while the Fed judges that a 2% inflation target is most consistent over the longer run with its statutory mandate. Therefore, the ECB (resp., the Fed) strives to maintain medium-term (resp., long-term) inflation expectations anchored.

The literature proposes several concepts of anchoring, or stability of inflation expectations. One popular measure is the response of market-based inflation compensation measures to incoming macroeconomic news (see Gürkaynak, Levin, Marder, and Swanson, 2007; Beechey, Johannsen, and Levin, 2011). In this context, inflation expectations are deemed anchored when they do not react to news. Other measures include: the response of changes in long-term inflation expectations to changes in short-term ones, the precision around estimates of the level of inflation, the volatility of shocks to trend inflation, and the closeness of average beliefs to the central bank’s inflation target.

While the above measures are used to define “anchored” expectations, most of them are mainly related to the stability of point forecasts of inflation and discard information on the uncertainty around those forecasts. However, point forecasts can be stable even if uncertainty is relatively high; that is, there can be wide confidence bands around inflation expectations which inherently would not be compatible with the notion of stable beliefs.

A novel measure for the anchoring of inflation expectations

To better capture the uncertainty that underlies the concept of anchoring, Grishchenko, Mouabbi and Renne (2017) propose a novel survey-based measure of the anchoring of inflation expectations that takes into account the possibility that the variance of expectations changes through time. Therefore, rather than focusing on the stability of point estimates, this method computes the probability of future inflation being in a certain range that is consistent with inflation targets.

This anchoring measure accounts for both uncertainty and the distance between inflation expectations and the target. Unlike previous measures, within this set-up, warnings of possible de-anchoring arise when either of the two following scenarios occurs: (i) the event in which inflation expectations display low uncertainty but are far from the target and (ii) the event in which inflation expectations are close to the target but display high uncertainty.

Grishchenko, Mouabbi and Renne (2017) use this framework to assess how anchored inflation expectations are in the euro area and in the United States, over the period 1999-2016. In particular, they compute probabilities of future inflation rates being in the interval [1.5%, 2.5%] (i.e. a symmetric interval around 2%), as illustrated by Figure 1. Comparing these probabilities in the euro area and the United States, they find that:

- The probability of inflation expectations being in the [1.5%, 2.5%] range has been higher in the euro area than in the United States throughout the period 1999-2016, indicating that inflation expectations are better anchored in the euro area.

- This probability in the euro area has declined by up to 10 percent since the end of 2008, and more so for medium horizons than for longer horizons; suggesting a mild de-anchoring of inflation expectations in the euro area during the period 2008-2016.

- US anchoring measures are on average higher during the period 2008-2016 than during the first half of the sample. In particular, the probabilities have steadily increased since the Fed’s quantification of its inflation objective in 2012.

As the doted lines on the three panels of Figure 1 show, the difference in anchoring measures between the two areas has been steadily diminishing since the early 2000s. As of June 2016 (sample end), both areas appear to be equally anchored.