- Home

- Publications and statistics

- Publications

- Taking stock, two years after the launch...

Post n°276. Net asset purchases by the Eurosystem under the Pandemic Emergency Purchase Programme (PEPP) were discontinued at the end of March 2022, two years after its launch. This programme successfully prevented the fragmentation of the euro area sovereign debt market in response to the Covid-19 pandemic and will continue to preserve the transmission of monetary policy through flexible reinvestment.

The PEPP, an emergency asset purchase programme in response to the pandemic

In order to address the Covid-19 pandemic and the risks it posed to price stability and monetary policy transmission, the ECB adopted a first set of monetary policy measures on 12 March 2020. These measures included the conduct of additional targeted longer-term refinancing operations, the introduction of more favourable terms for the Targeted Longer-Term Refinancing Operations (TLTRO III) for a limited period of time, and an additional EUR 120 billion temporary envelope under the Asset Purchase Programme (APP).

On 18 March 2020, the ECB announced the launch of the Pandemic Emergency Purchase Programme (PEPP) against the backdrop of a significant increase in credit risk premia in the euro area government bond market. The envelope for this new programme, initially EUR 750 billion, was increased to EUR 1,350 billion on 4 June 2020 and to EUR 1,850 billion on 10 December 2020. All assets already eligible for the Asset Purchase Programme (APP) are also eligible for the PEPP. Some assets that were not eligible for the APP became eligible for the PEPP: a waiver was granted for Greek government bonds. For public sector assets, the minimum remaining maturity of assets was reduced to 70 days (instead of one year under the APP). As regards the private sector, the eligibility of non-financial commercial paper was expanded to include securities with a remaining maturity of at least 28 days. While the benchmark for the allocation of public sector securities purchases across euro area jurisdictions remains the Eurosystem's capital key, purchases can nevertheless be made in a flexible manner by individual Eurosystem national central banks in order to avoid an undesirable tightening of financing conditions.

On 16 December 2021, the Governing Council judged that the progress on economic recovery and towards the medium-term inflation target permitted the discontinuation of net purchases under the PEPP at the end of March 2022. It also extended the full reinvestment of the principal payments from maturing securities until at least the end of 2024.

Taking stock of the PEPP at the end of the net purchase phase

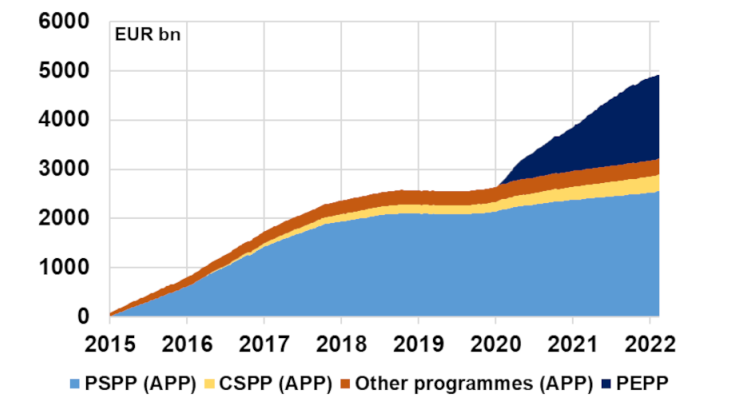

At the end of March 2022, net purchases under the PEPP amounted to more than EUR 1,700 billion, of which 97% were government securities (including supranationals). In total, the outstandings held by the Eurosystem under the APP and the PEPP amounted to almost EUR 5,000 billion at the end of March 2022 (see Chart 2). This result reflects a sharp rise in the share of government bonds held by the Eurosystem in the universe of outstanding bonds from 19% to 30% between 2020 and the end of 2021 (estimated on the basis of purchases for the four largest euro area countries: Germany, France, Italy and Spain (Lane, 2022)).

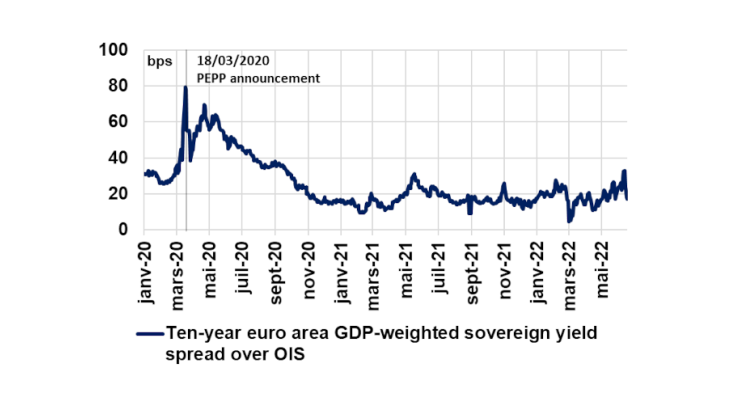

The combination of various monetary support measures helped to stabilise markets and ensure the smooth transmission of monetary policy, but the decisive role of the PEPP was acknowledged by market participants. In particular, the spread of the euro area GDP-weighted yield over the equivalent overnight indexed swap (OIS) rate fell sharply after the announcement of the launch of the PEPP (see Chart 1), to levels below those observed before the pandemic. This is the ECB's preferred market indicator for measuring fragmentation risk (see Hutchinson and Mee (2020) and Lane (2022)).

The flexibility of the PEPP - in terms of asset classes, jurisdictions as well as the timing of purchases - was a strong signal to the markets. Analysts stress the success of this flexibility, which brought down credit risk premia after the peak of market stress in March 2020.

However, this flexibility did not result in major deviations from the ECB's capital key at the end of the programme. While these deviations peaked in the first few weeks following the launch of the PEPP (May 2020), they subsequently narrowed during the implementation of the programme.

The compression of the term premium was also highlighted (see Schnabel, 2021). According to Altavilla et al. (2021), the PEPP (estimated with an envelope of EUR 1,350 billion at the time), coupled with the additional APP envelope of EUR 120 billion, reduced the 10-year sovereign bond term premium by an additional 45 bps compared to the impact of the pre-Covid APP alone.

The discontinuation of net purchases under the PEPP does not mean the end of the Eurosystem's interventions

Since the beginning of the programme, redemptions from maturing securities have been fully reinvested by the Eurosystem, which confirmed on 10 March that these reinvestments would continue until at least the end of 2024. The PEPP portfolio will thus remain stable until then. The Governing Council of the ECB also decided on 15 June 2022 to "apply flexibility in reinvesting redemptions coming due in the PEPP portfolio". Net purchases under the PEPP could also resume, if necessary, in response to negative shocks associated with the pandemic (monetary policy decision of 09 June 2022).

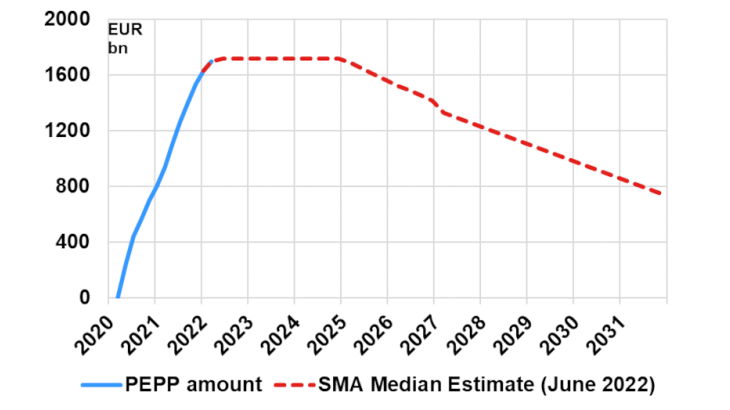

The stock of securities held by the Eurosystem will only decrease gradually. According to respondents to the June 2022 Survey of Monetary Analysts, the stock of bonds should stand at (i) EUR 1,718 billion in Q4 2024 (median of responses) under the PEPP (see Chart 3), while (ii) bonds held under the APP is only expected to decrease gradually as of the end of 2023, with a volume of around EUR 3,438 billion expected in Q4 2024. The stock effect is thus likely to contribute to maintaining favourable financing conditions: various empirical studies highlight the effect on the decline in yields linked to the volumes held (see Arrata, Nguyen (2017), Dalbard, Le Bihan and Vives (2018) and Hubert (Working Paper Banque de France, forthcoming).

Furthermore, following the ad hoc meeting on 15 June and in order to mitigate the resurgence of fragmentation risks, the Governing Council announced in particular that it had decided to flexibly reinvest payments from maturing securities purchased under the PEPP, prioritising countries affected by an unjustified rate spreads.

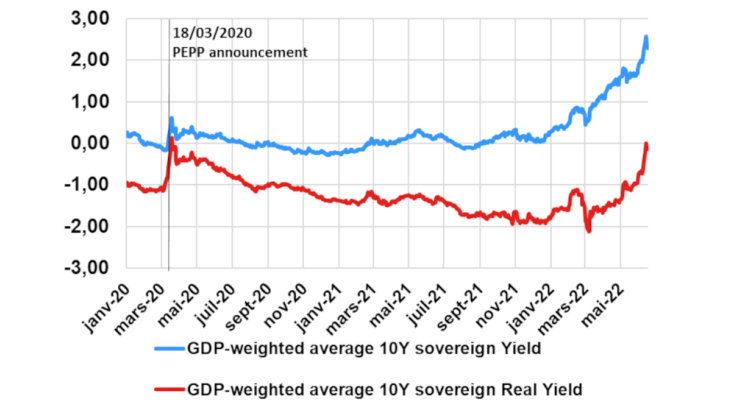

Lastly, despite the rise in nominal yields since the end of 2021, real interest rates in the euro area have been increasing at a somewhat slower pace (see Chart 4).

Source: Bloomberg, authors’ calculations.

Note: The GDP-weighted 10-year euro area yield is the sovereign yield of the 11 largest euro area countries, weighted by the GDP of these countries.

Overall, the PEPP remains an important pillar in the fight against the economic and financial repercussions of the Covid-19 pandemic at European level, alongside the Next Generation EU recovery plan (see Le Quéau, Madeline and Sabalot, 2022. The success of these two programmes highlights the importance of flexibility (Villeroy de Galhau, 2022) and cooperation (Panetta, 2022) in the conduct of European policies.)