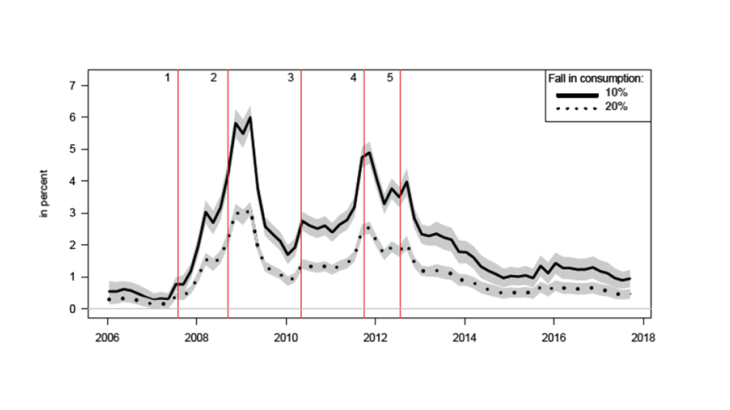

Note: Probabilities that consumption drops by more than 10% (solid line) and 20% (dotted line) in the next year. Shaded areas are 95% confidence bands. (1) European interbank markets seize up; (2) Collapse of Lehman Brothers; (3) Emergency measures to safeguard financial stability; (4) Spain and Italy are hit by a wave of rating downgrades; (5) Draghi’s “whatever it takes”.

“Governments provide support to too-big-to-fail firms in a crisis not out of favoritism […], but because they recognize that the consequences for the broader economy of allowing a disorderly failure greatly outweigh the costs of avoiding the failure in some way.”

-- Ben Bernanke (2010)

The East India Company (EIC) was founded in 1600 to initially pursue international trade in commodities such as spices, silk, tea and opium. By the mid-18th century, the EIC was the largest private firm the world had ever seen – even by today’s standards – accounting for about a fifth of Britain’s exports and half of the world’s trade. In the 1770s, it came close to collapse and was rescued by a bailout of colossal scale. This was the first “too big to fail” firm.

More recently, during the great recession, the harmful effects of the failure of large and interconnected firms on the wider economic system resurfaced. As a response, several policies and regulations (e.g., regulations on Systemically Important Financial Institutions) were put in place to stabilise the financial system and restart economic growth. Interestingly, some of these policies did not only target financial institutions but had a wider scope. For instance, the Troubled Asset Relief Program, which was first launched in the United States in 2008, allocated 20% of its funds to rescuing the US Automobile industry, with General Motors and Chrysler receiving about USD 80 billion.

But what if large firms were to go bust? What would the implications of such a systemic default be for the economy as a whole?

Quantifying the implications of systemic defaults

To address this question, Gourieroux, Monfort, Mouabbi and Renne (2019) build a model which defines a systemic default as one that has a negative effect on the economy and is contagious. In this setup, the negative effect of a systemic default on aggregate consumption − a standard way of quantifying such an effect in the asset-pricing literature − can trigger further defaults, thus, amplifying the initial drop in consumption and allowing for default cascades.

One of the main difficulties in quantifying the macroeconomic implications of systemic defaults is that there are very few observations of such events. However, there exist financial instruments that are exposed to systemic risk. Their prices can therefore be used to inform us about the beliefs of financial markets regarding the implications of such catastrophic events.

The model first establishes the relationship between the payoffs of disaster-exposed assets and the factors that drive consumption. Once this relationship is set, the model predicts, in particular, the size of the credit risk premium investors would require to hold this asset. By anchoring the model to the average default rate and by exploiting asset price fluctuations, the model parameters can then be estimated. This further opens the door to the computation of the market-expected effect of a systemic default on consumption.

Market data with information about catastrophic events

Market prices of far-out-of-the-money put options and senior tranches reflect investors’ expectations about disastrous events and systemic risk

- Far-out-of-the-money put options written on equity indices

Put options allow their buyers to sell the underlying asset (here, an equity index) at a pre-specified price upon maturity. A put option is said to be out-of-the-money when the pre-specified selling price is much lower than the current value of the underlying equity index. Therefore, these assets deliver a payoff when the underlying equity index crashes.

- Tranches of synthetic Collateralised Debt Obligations (CDOs)

CDOs are associated with a reference portfolio (here, an index of firms) and are sliced into tranches, indicating seniority, which allow for a particular exposure to the credit risk of the underlying portfolio. The protection buyer receives payments when the underlying reference portfolio suffers a pre-specified amount of credit losses. Losses are first allocated to the lowest tranche and then sequentially allocated to the remaining tranches, with the most senior tranche suffering losses last. This implies that senior tranches provide payoffs to the protection buyer only once a sufficiently large number of firms in the underlying index experience a credit event (e.g., file for bankruptcy, default).

A systemic default would have recessionary effects

Gourieroux, Monfort, Mouabbi and Renne (2019) deduce estimates of the expected effect of systemic defaults on consumption.

Their empirical analysis is conducted on European data, where systemic entities are proxied by the iTraxx Europe main index. This index is composed of 125 equally-weighted names of the most liquid European entities, with investment grade credit ratings, across several sectors (Autos and Industrials, Consumers, Energy, Telecommunications, Media and Technology and Financials). They document that iTraxx constituents represent a substantial share of European economies: (i) their market capitalisation amounts to EUR 5 trillion, (ii) they employ about 12.5 million employees, and (iii) hold EUR 5.5 trillion of total debt.

Their results suggest that a systemic default is expected to be followed by a 3% decrease in aggregate consumption within two years. To provide an order of magnitude of the severity of this effect, note that during the Great Recession (2007-2009), consumption dropped by 5.4% in the US, relative to the average figures for all other recessions since 1945 of 2.1% (Christiano, 2017). This result takes into account contagion effects, whereby another three systemic defaults occur following the default of one systemic firm within two years.

The analysis also enables the construction of systemic risk indicators: (i) the probability of observing the default of at least 10 systemic firms over a given horizon and (ii) the probability of aggregate consumption experiencing a sharp drop by more than 10% over the next year. Results suggest that the probability of having at least 10 systemic firms defaulting in the next two years peaked after the collapse of Lehman Brothers (reaching about 7%) and at the height of the European debt crisis (reaching about 6%). Similarly, the probability of consumption dropping by more than 10% in the next year reached about 6% and 5% on these respective dates (see Figure 1).

Finally, the recessionary influence of systemic defaults also implies that financial instruments whose payoffs are exposed to such credit events carry substantial credit risk premiums.