In recent years, central banks worldwide have faced the challenge of navigating interest rate uncertainty amidst rising inflation. This paper empirically studies the effect of uncertainty about the path of future interest rates on listed firms from the four largest euro area countries.

We measure interest rate uncertainty (IRU) following Istrefi and Mouabbi (2018), which reflects the uncertainty perceived by professional forecasters in the euro area about the future path of important benchmark rates: the 3-month Euribor rate and country-specific 10-year government bond rates. We refer to these measures as short- and long-term IRU, respectively.

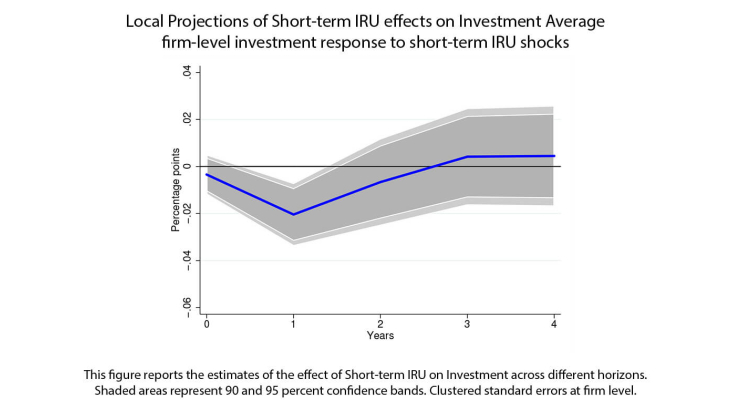

We show that euro area firms reduce their investment in response to interest rate uncertainty, despite the possibility of hedging such a risk. We find that short-term interest rate uncertainty has a stronger negative effect on corporate investment than long-term IRU. This could be due to the high share of floating rate debt in euro area firms' liabilities, which exposes firms to short-term interest rate fluctuations and makes them more vulnerable to IRU.

Beyond this average effect, the sensitivity to IRU varies considerably across firms. Firms with shorter debt maturities and firms whose cash flows are negatively correlated with rising interest rates are thus more sensitive to IRU. In addition, IRU has a disproportionately negative impact on the investment of firms facing real and financial constraints. While hedging against interest rate risk can partially mitigate the negative effects of IRU on investment, especially for financially constrained firms, it does not eliminate it.

In addition to investment, IRU also affects other firm decisions: firms tend to reduce sales, hiring, increase cash holdings, and reduce dividend payouts in response to increased IRU.

Overall, the paper highlights the importance of short-term IRU in influencing firm decisions and points to a broadly negative impact of monetary policy uncertainty on euro area firms. To the extent that uncertainty about short-term interest rates reflects uncertainty about the euro area's common monetary policy, our findings have important policy implications. Policymakers should remain vigilant to the effects of IRU, and the ECB and the Eurosystem can develop policies and operational frameworks aimed at mitigating such uncertainty.