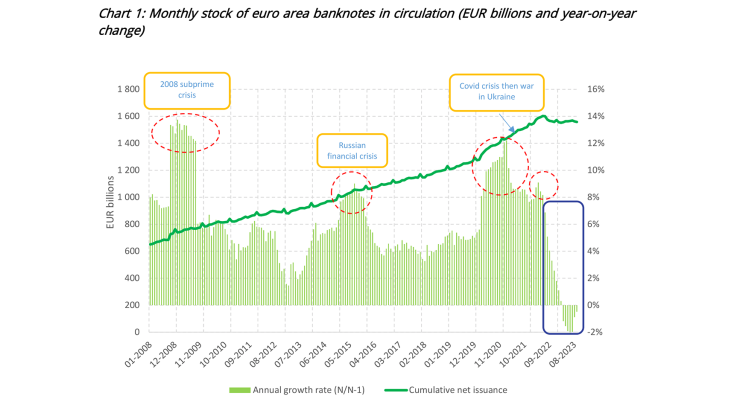

“Cumulative net issuance” of euro area banknotes refers to the stock of banknotes in circulation issued by Eurosystem national central banks (NCBs) since the introduction of the euro. It is the difference between total outflows (withdrawals) and total inflows (lodgements) of banknotes since 2002, i.e. “net issuance”. Cumulative net issuance (CNI), which hence corresponds to the total stock of cash held by the various economic agents (households, commercial banks, firms, non-Eurosystem agents), increased steadily up to mid-2022 (see Chart 1).

From 2008 to mid-2022, CNI of euro banknotes rose at a rate of around 6% per year. There were occasional accelerations, corresponding to periods of strong economic uncertainty: the subprime crisis, the Russian rouble crisis (which mainly affected Germany and eastern euro area countries) and, more recently, the Covid crisis and the outbreak of the war in Ukraine (which had more localised, one-off impacts, e.g. in the Baltic countries). However, from July 2022 onwards, CNI fell each month, and on an unprecedented scale, before stabilising in the winter of 2022/23. This decline means that more banknotes were being returned to NCBs than were being withdrawn, and coincides with the rise in European Central Bank (ECB) key interest rates.

Cash hoarding by households: strong demand for banknotes

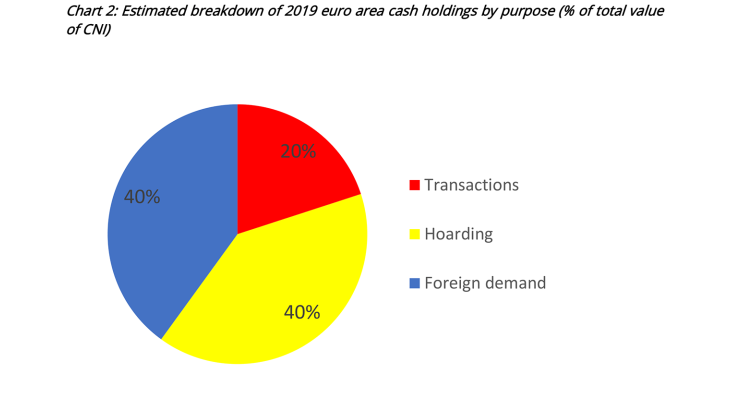

Hoarding is defined here as the accumulation and holding of cash by economic agents, either at home or in safety deposit boxes. It therefore differs from the broader definition, which is the accumulation of wealth with no intention to either spend or invest it. Recent studies have estimated the share of banknotes in circulation that are hoarded by economic agents. In the euro area it stands at around 40% (see Chart 2), while in non-euro area countries the share is also estimated to be 40%. In the euro area, only 20% of these banknotes are thought to be held for use in day-to-day transactions or payments.