Working paper

Debt-Stabilizing Properties of GDP-Linked Securities: A Macro-Finance Perspective

Published on 8 November 2021

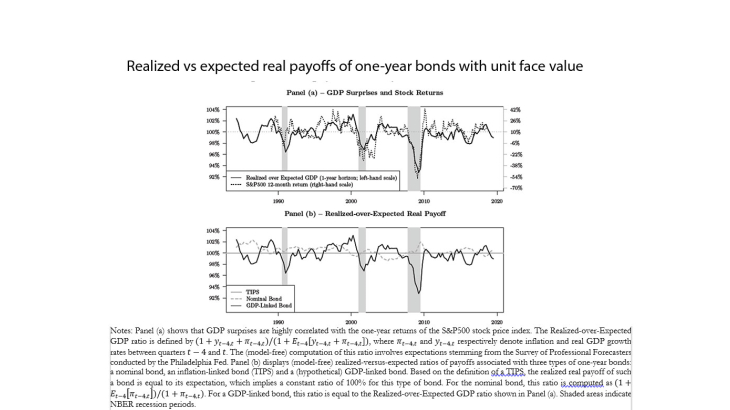

Working Paper Series no. 844. We study the debt-stabilizing properties of indexing debt to GDP using a consumption-based macro-finance model. Three results stand out. First, GDP-linked bond prices would embed sizeable and timevarying risk premiums of about 40 basis points. Second, for a fixed budget surplus, issuing GDP-linked securities does not necessarily imply more beneficial debt-to-GDP ratios in the medium- to long-run. Third, the debt-stabilizing budget surplus is more predictable under such issuances at the expense of being higher on average. Our findings call into question the view that GDP-linked securities tame debt.